I have got number of emails about my

previous posts about mental models, asking for details.

Much of my interest in mental modeling started when I spent 6 years in advertising industry. Advertising industry is possibly the largest and the most shrewed user of every psychological technique known to mankind. All successful persuasion involves either reinforcing or challenging existing mental models.

One of the first research I was involved with was on cigarettes, for the launch of a new cigarette. Now cigarette as a product is conspicuous consumption product. What you smoke tells a lot about what you are as a person or what you want to project to the world. When we researched cigarette buyers, they had different mental models and their brand choices were determined by their mental models.

So in focus groups people would explain their brand choice by their life philosophy, beliefs, assumptions, images, etc. You could clearly see people with different mental models had different career choices, different earnings capabilities, different levels of success in life. All their choices and behavior flowed form those mental models. One of the very popular brand of cigarette in India at that time was Red and White. It was primarily targeted at lower middle class. It had a very popular advertisement running at that time in Hindi, "Red and White pine walo ki baat hi kuch alag hain"( There is something special about a Red and White smoker). People in focus groups or in interviews would sum up their life philosophy by using that line.

One of the task we were assigned was to identify different mental models and I spent considerable time going through various studies in mental modeling and coming out with hypothetical mental models and testing them with actual people. So I got deeply involved in to researching mental models. The central role of effective advertising is to change or reinforce consumers existing mental models through communication.

Subsequently I spent 6-7 years in service industry where again the quality of service at individual level is a function of front line workers mental models. So service industries create an idealized profile of excellent service worker and recruit people with similar mental models ( in USA this is bit tricky because this is called profiling). Internally service companies create a organizational culture which encourages and actively recruits people with certain mental models and punishes or do not hire people with different mental model. I did lot of work in creating such "profiles" of mental model when I worked in service industry, as that is the key to good service quality where personal interaction is involved.

While doing this I was teaching MBA courses as a guest lecturer. I did this for many years and interacted with lot of young people and started studying their mental models in order to shape and change them. I also spent some time formally researching and interviewing people who were successful in managerial roles in senior management roles or in other fields like journalism, sports, academics, etc. Much of my understanding of mental modeling has evolved out of those studies and experience.

Mental models are deeply held mental images, beliefs, and assumptions. The mental models play a very important role in dealing with world around us. We interpret the world according to our mental models. Two people with different mental models react and interpret same data and same situations differently. Mental models include what a person thinks is true but not necessarily what is actually true.

What I observed is that successful people had very different mental models. They did, not just few things differently, but they did 100 things differently. Their world view and assumption about world and people was very different from those who were not very successful. One of the central difference was in their self belief and self motivation. Which to large extent reflected in how they looked at same set of data and acted on it differently. Motivation and discipline were not the problem for most of them, while the others had these issues frequently.

From a more practical perspective based on my experience of long years of working with my students on trying to change mental models, I have found if you are looking for dramatic changes or "orbital changes" then you need to change your mental model significantly.

"Orbital changes" are changes which push you in to next level of orbit in terms of success or competency. These are very significant changes, requiring changing major set of beliefs and assumptions and freezing that new change and belief. I have seen such changes in many cases when the person was ready and motivated enough to make the change in mental models. I have seen some of the students changing their mental models dramatically , so much so that it surprised even their parents, people associated with them, their classmates and best friends. They just lifted themselves in to new orbit.

My home in India was a laboratory and I spent all my free time working with my students on mental modeling.I have been in touch with most of them over the years and seen how their life and career progressed since then. Changing mental models is easier for young people, as you get older you become more set in your belief and assumptions about world and life or your mental models get hard coded. Also once young people get convinced they can be very obedient. Mentoring relationships require certain degree of obedience for them to work. Hence commercial mentoring arrangements seldom work. It is not impossible, but more difficult process for older people plus culturally obedience is difficult thing to understand in American society. Sometime when people go through major life changes like death of close relative or friend, war, divorce, loss of job or any such event, such orbital changes in mental models happen.

Armies have structured programs to change mental models. Recently I was watching on Fit TV a program about elite

Navy Seal

training and it was all about changing mental models. While it was physically very challenging and rigorous, the overall emphasis was on mental modeling. The side interviews with those conducting the training again and again talked about the mental aspect of it. Those who completed it were interviewed in that program immediately after the training and after many months and they kept saying what that program did was to change their mind.

Cosmetic changes are easier and involve simple psychological intervention and much of the commonly used techniques like coaching, biofeedback, affirmation, counsellings,training etc. But dramatic changes require different approach.

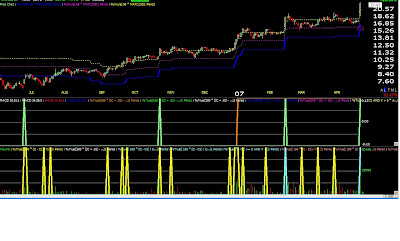

It is my belief and observation after interacting with many different types of traders, that same mental modeling thing comes in to play in trading. Successful traders simply have different mental models. When you interact with them you become instantly aware of it. This week I interacted with a trader who sent an email based on what that person read here, now the moment I read the first email, I knew this person gets it, this person has a different mental model. Subsequently I had more interaction with the same person and it reaffirmed my earlier observation.

So if you are struggling with trading, you may need an orbital change in your mental model.