1 Meat Products

2 Broadcasting Radio

3 Edu and training services

4 Hospitals

5 Gen Entertainment

1/31/2006

Top Sectors

1 Steel and iron

2 Silver

3 Heavy construction

4 Building Material wholesale

5 Oil and gas equip and services

2 Silver

3 Heavy construction

4 Building Material wholesale

5 Oil and gas equip and services

1/30/2006

Bottom Sector

1 Confectioners

2 Personal Computer

3 Education and Training Sevrices

4 Meat Products

5 Broadcasting radio

2 Personal Computer

3 Education and Training Sevrices

4 Meat Products

5 Broadcasting radio

1/27/2006

Top Sectors Top Stocks

1 Semi Memory Chips- RMBS, MIPS

2 Steel and Iron- IIIN, ATI

3 Building material Wholesale- BECN BXC

4 Silver- HL SLW

5 Gold- GRZ TRE

2 Steel and Iron- IIIN, ATI

3 Building material Wholesale- BECN BXC

4 Silver- HL SLW

5 Gold- GRZ TRE

1/26/2006

Bottom Sector

1 Confectioners

2 Hospitals

3 Education and Training Sevrices

4 Meat Products

5 Broadcasting radio

2 Hospitals

3 Education and Training Sevrices

4 Meat Products

5 Broadcasting radio

The Commodities Bull market

Jim Rogers says the bull market in commodities might last for another 10 years.

Other than historical precedent, why do you see the bull market in commodities lasting about 18 years?

This is not a prediction. If history is any guide, the shortest bull market I found lasted 15 years, and the longest lasted 23 years. The average has been 18 years. If history is any guide, this bull market will last until sometime between 2014 and 2022.

Other than historical precedent, why do you see the bull market in commodities lasting about 18 years?

This is not a prediction. If history is any guide, the shortest bull market I found lasted 15 years, and the longest lasted 23 years. The average has been 18 years. If history is any guide, this bull market will last until sometime between 2014 and 2022.

1/25/2006

Bottom Sector

Sec Software and services

Meat Products

Hospitals

Education & training services

Broadcasting Radio

Meat Products

Hospitals

Education & training services

Broadcasting Radio

Reversal Watch

I am expecting a market reversal this week. The month end is always a good time to watch for trend change. The reversal would catch many with surprise as most see good break outs. The tone has become bullish all over. Stocks are opening with gaps. So time to wait for the right opportunity.

Wall Street Bonuses Match Afghanistan's GDP

This blog has some interesting inside info on wall street.

Another intersting blog from Henry Blodget

Roger Nusbaum has a new blog focusing on Retirement Planning

Another intersting blog from Henry Blodget

Roger Nusbaum has a new blog focusing on Retirement Planning

1/23/2006

Weekend reading

I spent the weekend reading the entertaining book Hedgehogging by Barton Biggs.

by Barton Biggs.

The book deals with the authors experience of starting a hedge fund. It takes you behind the scene and gives a good glimpse of the funds of funds, large investors and their decision making, the people who run hedge funds and their lifestyle, strategies used by them and many other glimpses in to the inner working of hedge funds.

The writer has excellent sense of humor. I highly recommend Hedgehogging to anyone associated with trading.

to anyone associated with trading.

The book deals with the authors experience of starting a hedge fund. It takes you behind the scene and gives a good glimpse of the funds of funds, large investors and their decision making, the people who run hedge funds and their lifestyle, strategies used by them and many other glimpses in to the inner working of hedge funds.

The writer has excellent sense of humor. I highly recommend Hedgehogging

Stockwatch

Google had all time high volume on Friday. So what happens next. Backtesting all time high volume on stocks can show you very interesting results and system with an edge.

There were also some sector Spiders showing all time high volume:

XLF- FIN ETF

RKH- REG BANK ETF

XLP- CONSUMER STAPLES ETF

IYK-CONSUMER GOODS SECTOR

1/20/2006

1/18/2006

Stock Watch

TS, NX, CRED, CORS, PTR, MSB, BRNC, FPB, RTK, MIDD

There is mini panic in the market pre open today. One thing I have learned over the years is panic is good buying opportunity.

One of the best book on how to use panic to profit is Practical Speculation by Victor Niederhoffer, Laurel Kenner. Let me be upfront this book is not easy read, it is poorly written. But it has some good valid ideas.

Update

Victor Niederhoffer often quotes Henry Clews when it comes to market panic:

Henry Clews wrote in Twenty-Eight Years in Wall Street (1887):

“But few gain sufficient experience in Wall Street to command success until they reach that period of life in which they have one foot in the grave. When this time comes, these old veterans of the Street usually spend long intervals of repose at their comfortable homes, and in times of panic, which recur sometimes oftener than once a year, these old fellows will be seen in Wall Street, hobbling down on their canes to their brokers’ offices.

“Then they always buy good stocks to the extent of their bank balances, which they have been permitted to accumulate for just such an emergency. The panic usually rages until enough of these cash purchases of stock is made to afford a big “rake in.” When the panic has spent its force, these old fellows, who have been resting judiciously on their oars in expectation of the inevitable event, which usually returns with the regularity of the seasons, quickly realize, deposit their profits with their bankers, or the overplus thereof, after purchasing more real estate that is on the up grade, for permanent investment, and retire for another season to the quietude of their splendid homes and the bosoms of their happy families.”

There is mini panic in the market pre open today. One thing I have learned over the years is panic is good buying opportunity.

One of the best book on how to use panic to profit is Practical Speculation by Victor Niederhoffer, Laurel Kenner. Let me be upfront this book is not easy read, it is poorly written. But it has some good valid ideas.

Update

Victor Niederhoffer often quotes Henry Clews when it comes to market panic:

Henry Clews wrote in Twenty-Eight Years in Wall Street (1887):

“But few gain sufficient experience in Wall Street to command success until they reach that period of life in which they have one foot in the grave. When this time comes, these old veterans of the Street usually spend long intervals of repose at their comfortable homes, and in times of panic, which recur sometimes oftener than once a year, these old fellows will be seen in Wall Street, hobbling down on their canes to their brokers’ offices.

“Then they always buy good stocks to the extent of their bank balances, which they have been permitted to accumulate for just such an emergency. The panic usually rages until enough of these cash purchases of stock is made to afford a big “rake in.” When the panic has spent its force, these old fellows, who have been resting judiciously on their oars in expectation of the inevitable event, which usually returns with the regularity of the seasons, quickly realize, deposit their profits with their bankers, or the overplus thereof, after purchasing more real estate that is on the up grade, for permanent investment, and retire for another season to the quietude of their splendid homes and the bosoms of their happy families.”

1/17/2006

Should you buy All Time High

Last week I received this unsolicited study on trend following. Essentially it says if you buy all the breakout to All Time High you will outperform the market.

The idea of buying All Time High has been around for long time. The logic being there is no overhead resistance at all time high.The Market Wizard, Ed Seykota has also bee n often sited for his observation - take note when the market makes all time high. William O'Neill has also been an advocate of this method.

So should you buy All Time High? The problem is on a given day there are more than 100 All Time Highs. More than that this concept of overhead resistance is unsubstantiated assertion. If a stock has to go up it will go up no matter what. If you take the top 100 yearly performers for last 25 years you will find stocks have made substantial gain even though they had significant overhead resistance.

There is a way to make the All Time High breakout system more profitable and workable. The clue to that is in Jesse Livermore book.

Note: Here is the Livermore Book I was refering to.

As mentioned in my earlier post, Jesse Livermore offers a better way to play the All Time High signal.

"For instance, let us say that a new stock has been listed in the last two or three years and its high was 20, or any other figure, and that such a price was made two or three years ago. If something favorable happens in connection with the company, and the stock starts upward, usually it is safe play to buy the minute it touches a brand new high."

The idea of buying All Time High has been around for long time. The logic being there is no overhead resistance at all time high.The Market Wizard, Ed Seykota has also bee n often sited for his observation - take note when the market makes all time high. William O'Neill has also been an advocate of this method.

So should you buy All Time High? The problem is on a given day there are more than 100 All Time Highs. More than that this concept of overhead resistance is unsubstantiated assertion. If a stock has to go up it will go up no matter what. If you take the top 100 yearly performers for last 25 years you will find stocks have made substantial gain even though they had significant overhead resistance.

There is a way to make the All Time High breakout system more profitable and workable. The clue to that is in Jesse Livermore book.

Note: Here is the Livermore Book I was refering to.

As mentioned in my earlier post, Jesse Livermore offers a better way to play the All Time High signal.

"For instance, let us say that a new stock has been listed in the last two or three years and its high was 20, or any other figure, and that such a price was made two or three years ago. If something favorable happens in connection with the company, and the stock starts upward, usually it is safe play to buy the minute it touches a brand new high."

Weekend Reading

This week end I was re reading this classic- How Charts Can Help You in the Stock Market by William L. Jiler. Unlike many books on chart patterns, this one is simple and concise. The book talks about key patterns and variations of them. I am not a chartist but I find some useful ideas in this book.

1/16/2006

Economist Covers

1/11/2006

1/10/2006

1/09/2006

China related stocks are taking off after a long pause.

IYT had all time high volume on Friday. The railroads (NSC and BNI ) had someone making a huge trade last week.

If stock market start rallying strongly, what will happen to bonds.

Gold is flying, I am watching SA.

IYT had all time high volume on Friday. The railroads (NSC and BNI ) had someone making a huge trade last week.

If stock market start rallying strongly, what will happen to bonds.

Gold is flying, I am watching SA.

1/06/2006

High Volume Movers

1/05/2006

When Things go wrong in retail

Bull Stampede

Last two days look like buying panic. So many breakouts to play with. I am expecting a shakeout of some kind in next couple of days. Some stocks on my watchlist are:

ASEI, RAIL, RTI, LCC, SF, ATI, PDLI, TU, OXPS, LDSH, ZRAN, TEC, PDRT, ASYT,

ASEI, RAIL, RTI, LCC, SF, ATI, PDLI, TU, OXPS, LDSH, ZRAN, TEC, PDRT, ASYT,

1/04/2006

Earning picture for 2006

Zacks has the latest update on earning picture for 2006 and things at this stage look bright.

Measured either by total net income growth, or by the growth rate of the median firm, the S&P 500 is expected to post double-digit growth for both 2005 and 2006. However, on a median basis, earnings growth is expected to decelerate from 13.4% in 2005 to 12.5% in 2006, while on a total net income basis, growth is expected to rise to 13.4% from 10.6% in 2005. The differences between these measures indicates a somewhat better performance for mid- to large-cap companies in 2005, but a better relative earnings performance expected in 2006 for mega-cap companies. For 2005 earnings growth has largely been about the energy sector, which accounts for 42.6% of the overall earnings growth, with only two other sectors pitching in double-digit contributions to the total growth (Industrials 15.2%, and Financials 13.5%). For 2006, the growth is expected to be much more balanced with five sectors making double-digit contributions to the total incremental earnings pie and the incremental earnings more closely matching the total 2005 earnings.

Measured either by total net income growth, or by the growth rate of the median firm, the S&P 500 is expected to post double-digit growth for both 2005 and 2006. However, on a median basis, earnings growth is expected to decelerate from 13.4% in 2005 to 12.5% in 2006, while on a total net income basis, growth is expected to rise to 13.4% from 10.6% in 2005. The differences between these measures indicates a somewhat better performance for mid- to large-cap companies in 2005, but a better relative earnings performance expected in 2006 for mega-cap companies. For 2005 earnings growth has largely been about the energy sector, which accounts for 42.6% of the overall earnings growth, with only two other sectors pitching in double-digit contributions to the total growth (Industrials 15.2%, and Financials 13.5%). For 2006, the growth is expected to be much more balanced with five sectors making double-digit contributions to the total incremental earnings pie and the incremental earnings more closely matching the total 2005 earnings.

10 Day reprieve for market

Yesterdays action sets up the market for next two weeks. Market tends to sell off and then thicken up again. The earning season will start in earnest soon, so the market is setting itself up for that.

Yesterdays action has over 25 stocks on my scan list signaling entries. Some good shorts are also setting up over next 10 days.

Here are some stocks on my radar for next two weeks

1/03/2006

Emerging theme

In the early going Energy and Metals appear to be the developing theme. The implications of that for broader market will be bearish, as we saw last year. But it is early in the year and picture will be clearer in a week.

The morning action was a good lesson for all those who got excited with the up open.

The morning action was a good lesson for all those who got excited with the up open.

New Year Brings New Trends

Does the start of the new year herald new trend in the market. Lot of asset allocation decisions are made on yearly basis by the big institution and investors and policy changes also are linked to new year, so some very good long term trends start at beginning of year.

Last year the biggest trend for the year which caught everyone on the wrong side, the USD reversal started at beginning of the year. The oil price trend which dominated bulk of this year again started in January.

So lets see what happens this year. I am mostly on the sidelines for last few weeks.

Last year the biggest trend for the year which caught everyone on the wrong side, the USD reversal started at beginning of the year. The oil price trend which dominated bulk of this year again started in January.

So lets see what happens this year. I am mostly on the sidelines for last few weeks.

1/02/2006

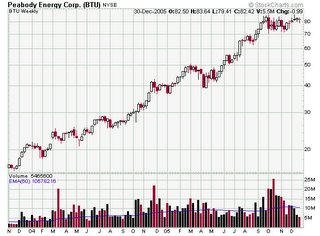

Perfect Stock 2005

These are some of the stocks I have traded in 2005. These charts are to keep references of these. There are stocks on short side which I would be posting some time this week.

Most of the time I am looking for a stock with high probability of making a linear, smooth move.

Most of the time I am looking for a stock with high probability of making a linear, smooth move.

Subscribe to:

Posts (Atom)