Many of the biggest moves in any given year in market start with big earnings surprise or big earnings miss.

We are currently in the earnings season and it is good time to look at stocks with big earnings surprises. They are likely to be future leaders in the market.

Everyday hundreds of stocks release news before and after hours. These news releases can lead to stock making big move for the day. What you have to look for is extreme surprise or growth.

A massive earnings surprise on a stock with multi month base can lead to big rallies lasting weeks or months.

Focusing on "massive Earnings acceleration " will help you find 5 to 20 big ideas in a year that can make 50% to 1000% move.

In order to find such massive acceleration you need a structured approach to track after hours earnings news.

It should be efficient process which should only take 15 minutes...

How many of you would want to spend daily 15 minutes to find potential 50% to 100% move????

In order to do this successfully you need very streamlined process. If you just tracked these handful of links you should be able to find big winners periodically.

- Zacks Earnings : https://goo.gl/CsJviq

- Seeking alpha earnings news https://goo.gl/zkAKiB

- Earnings whisper calendar https://www.earningswhispers.com/calendar

- Earnings Whisper email summary : you need to sign up for this . it is free

- WSJ post market winners https://goo.gl/9ZYmW7

A blowout earnings stock will not be missed if you do this daily.

Besides earnings news other news can also move stocks , but earnings will give you most bang for bucks for your 15 minutes.

When big earnings news is released either it is already discounted by the market or the market is surprised by it. The stocks can either go up or go down.

A heavily shorted stock on good news can lead to short squeeze. A heavily favorite of fund stock similarly on surprisingly bad news can tumble.

Announcement related to earnings in either as guidance or actual earnings have potential for starting or ending multi month moves.

This phenomenon is called PEAD or Post Earnings Announcement drift. It is considered a market anomaly.

In a perfectly efficient market a news should get discounted immediately and there would be no way to profit from it.

So let us say a stock releases significantly better earnings. If such earnings is going to lead to doubling of the stock, then at open it should gap up to the double price and there would be no way to profit from the new information.

But markets are not efficient. What happens is the new surprise gets priced in over time. This is what the PEAD phenomenon is about.

When companies announce earnings, if the earnings are significantly better or worse than market/analyst expectations then the company stock goes up or goes down for next couple of months.

Post Earnings Announcement Drift or Pead is 40 year old discovery. Ball and Brown in 1968 first documented the PEAD anomaly in their ground breaking study that challenged efficient market hypothesis.

What does the study show. it shows that if you form 10 portfolios of stocks ranked by their earnings surprize then the portfolio of stocks that are in top 10% by earnings surprise outperforms the 9 other portfolio and similarly the bottom decile portfolio under performs the nine other deciles.

This is the most researched topic in financial field. Every year at least 50 new papers are published on PEAD and is persistence.

Stocks react vigorously to earnings acceleration.

After a few quarters of earnings acceleration, every one notices it and the reaction is more muted as the earnings get discounted.

While there is a vast effort by many speculators to anticipate such earnings acceleration and take positions in anticipation, even if you react to earnings and enter after the earnings announcement, you still can catch bulk of the move.

Typically first earnings acceleration is followed by more earnings acceleration or the improved earnings continues.

The structural factors which contribute to earnings acceleration do not disappear in one quarter. That is why earnings trends persist and price trends persist.

PEAD phenomenon is more pronounced in thinly traded stocks.

PEAD phenomenon is more pronounced in stocks with no analyst coverage.

PEAD returns persist even after one quarter.

PEAD is more pronounced on stocks with revenue surprise in addition to earnings surprise

While day traders look for one day moves on earnings day, for position traders or swing traders the PEAD phenomenon can offer longer duration picks.

After the day trading frenzy is over in these stocks , in many cases, they pullback and setup and go up after a breakout.

PEAD was relatively unknown phenomenon among retail traders around 6 to 7 years ago . Now everyone is aware of it and as a result many PEAD stocks tend to move big on earnings day often going up 20- 40% and then spend several weeks pulling back .

Buying after earnings is less risky as the news risk is out. However companies use the good news to time secondaries and this can lead to stocks with good earnings dropping aster few days of rally after earnings.

Secondaries for growing stocks are not a big problem as long as the money is used for expansion. Secondaries where the owners sell aggressively can be rally killer for a stock with excellent growth.

Buying after earnings is good strategy for position traders.

In a market driven by growth , you will find small companies offer best PEAD opportunities. In inefficiencies are greater on them.

When looking at earnings news, you also need to look at guidance. If the guidance is not in line with expectations, stocks can drop on earnings even if earnings are good.

Same way a stock with bad earnings will make big move if the guidance is good.

Larger companies are masters at manipulating investors earnings expectations through forward guidance and pre announcements. Genuine surprises on large caps tend to be rare. But when they happen they can signal significant shift in underlying business dynamics.

Best opportunity related to earnings is in small unknown company that suddenly starts growing rapidly.

When a small company with say below 50 million revenue starts growing suddenly in increments of 250 millions per quarter then you get explosive situation. This kind of growth happens in new segments or consumer products.

For a consumer product company with hot product , it is easy to grow rapidly as US has 300 million plus hungry consumers and if a product becomes hot must have product , it is easy for the companies to just plug in the product in existing distribution channel. Besides that most consumer products tend to have high margin.

For position traders finding such extreme growth situations should be top priority. A hot growth company if it takes off can make very explosive moves.

While such moves are not common in this market, there are market periods when such stocks dominate the market. This happens when new industry is being created.

Become an extremist

Look for extreme earnings growth (just starting out to grow)

Look for extreme sales growth (just starting out and of magnitude likely to make the company a billion dollar company)

Look for extreme price strength ( just starting young trend with explosive first leg)

Look for extreme neglect (multi year , low float, low volume

Look for stocks that breakout on 10 million plus volume on earnings on earnings days. That indicates big funds buying . Make a watchlist of such stocks.

One easy way to do this is to scan for big moves in last 40 days on 9 million plus volume

sincetrue(c > 3 and c/c1 >= 1.08 and v >= 9000000, 40) >= 0

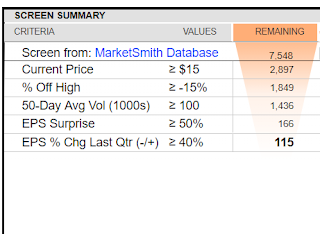

This scan will give you stocks that were up 8% or more on 9 million volume in last 40 days. After you run the scan you have to isolate stocks that had big earnings surprise.

For example ETSY out of this had very good earnings last season and then has been going up.

Similarly you can find bearish candidates by scanning for big moves.

sincetrue(c >10 and c/c1<= .92 and v >= 9000000,40) >= 0 and c>15

Will give you stocks that were down big in last 40 days. The scan looks for stock priced above 15 as shorts on higher priced stocks are better.

Again once you run the scans you need to isolate big misses and create watchlist.

If you are really serious about finding big winners and making money in the stock market keep a close eye on earnings surprises. Those stocks can make 300% to 30000% moves.

Related posts :