Thomas N. Bulkowski has studied data from 1990 to 2008 on stocks that doubled . He found two key things:

● Stocks that double substantially outperform the following year 53% of the time.

● Stocks that drop 50% or more outperform the following year 68% of the time

The Half Trouble approach that I use is focused on stocks that drop 50% or more in a year. They are stock in deep trouble , but if suitable catalyst comes in they can go up several fold quickly.

I start looking at these stocks once they drop 40% from 52 week high. In next one year or so some of those stocks go on to make explosive 300% plus moves.

JCP which we bought in in Working People Portfolio sometime back is a example of this kind of stock. As you can see in chart below, it was beaten down stock and down more than 50% from 52 week high. Everyone had a very low expectations for this stock.

It was heavily shorted. A recent earnings news lead to the start of this move and stock is already up 90% from low. If the turnaround sticks, you are looking at further gains.

By systematically and daily tracking them and proactively looking for a possible catalyst we will be ready when the stock is ready to explode.

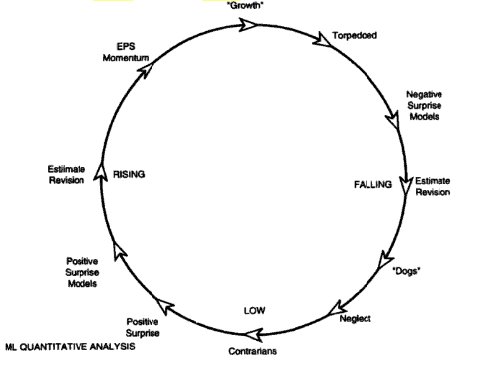

Stock go through expectation cycle. For low expectation or negative expectations they move to extremely high expectation or darling status.

At low expectations level they are neglected and at high expectations level everyone wants to buy them. They become market darlings.

But the romance does not last and ultimately there are heart breaks and negative surprises. If you are looking for good short candidates do reverse of this and track stocks up say 500% plus.

Sooner or later in next one year they will become good short candidates as the old darlings are dumped for the next young and pretty thing.

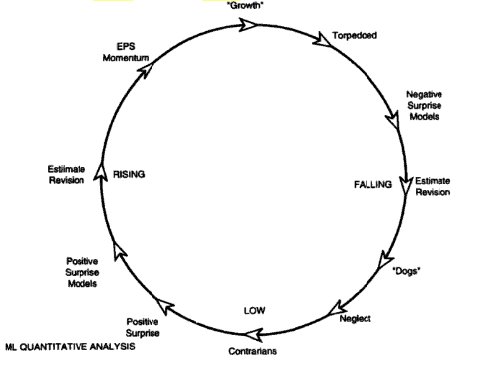

One of the biggest winner for last year for me was FB, it was also found using similar watch list. It got dumped more than 40% from IPO high and subsequently took off after earnings surprise.

FB from neglect to market darling

This approach is more suitable for research based speculators with longer holding timeframe.

The first starting point in the Half trouble approach is to look at scan candidates and find out why they are down and is it because of secular reason or temporary reason. The secular trends will require long time to play out. The temporary variety are low hanging fruit.

Temporary setbacks get fixed easily and stock bounces back. While that kind of situation is good , it seldom leads to explosive multi month move. The big explosive multi year turnaround happens on the most neglected and stocks with big problem and negative outlook that manage to turnaround.

Stocks often bounce back once they get cut down in to 40% level, so in addition to scan you need to maintain a database . For example NUAN is now marginally up but it was a HT candidate few weeks ago and should still be tracked as that. You should be willing to track these candidates for more than 2 to 3 years. The one that spent long time getting cut are the most attractive candidates when surprise arrives.

One of the temptation will be to buy early. If you do that you will have portfolio full of duds that might get cut in half multiple times. You have to wait for catalyst to show up or buy just ahead of catalyst.

In addition to the stocks adding ETF that are down 40% plus from high will allow you to find ETF near their trend start.

I have a combined list of ETF and Half Trouble scan candidates I monitor daily:

Symbols from Half Trouble Universe I monitor

OXF

YANG

GFI

HMY

ARCO

ERY

EDZ

TZA

SRTY

OFIX

DGAZ

JCP

UVXY

CPL

HXM

FBP

ELP

ARO

ELNK

TVIX

TWM

MPO

MIDZ

FIO

SBS

DRD

UGLD

SPXU

SOXS

SPXS

XCO

FAZ

LBTYA

ASPS

KOLD

RSH

VXX

MHG

KOF

VIXY

VIIX

SQQQ

NUGT

EIG

EC

SDOW

PULS

EBR

CVOL

BIS

CALX

SKF

QID

CIG

TECS

OIBR

TFM

LBTYK

FSYS

AGI

BVN

RDNT

DSLV

UTIW

NEM

BWP

CVRR

USLV

PBR.A

GSEH

BXC

INTX

EMITF

AT

LDK

SGI

AGQ

ANFI

UNTD

DMD

QUAD

NTE

AEPI

CZZ ( largest sugar producer)

CLNE

JAKK

ZNH

EZPW

LFL

FRAN

GFA

ALDW

XNY

SFY

ADT

LULU

CDE

OSTK

NVTL

INWK

BSBR

KGC

BBY

HERO

WTSL

IAG

CCCL

SQM

GMAN

CLUB

PBR

CALI

YZC

RT

AVP

RCII

DUST

ACW

NBG

IOC

AAWW

RNDY

NTLS

AVNW

DRV

SHOS

NIHD

BIOS

TWGP

WTW

TUR

WAC

GOL

CVI

CETV

ICA

PBF

FST

XIN

CNCO

EROC

RNF

BIOF

RIOM

MLNX

MTL

DLLR

YRCW

MX

NUS

NSM

SODA

LF

RDEN

HGG

BTH

BBRY

END

VRS

TITN

RLOC

XXIA

USU

TC

JRCC

BGFV

ZA

SOL

RAX

DRL

LRN

EDMC

ANR

CONN

YINN

SID

HK

TECUA

HSOL

RUSL (keep an eye, this can bounce back 30 to 50% quickly)

CWTR

WLT

LINC

CSUN

APP

IO

CRRS

FFHL

ALSK

GSS

COCO

BONT

NES

Why are these stocks showing up in this scan? Can you classify them into groups. like below.

Some of the common reason for a big drop are:

1. excessive bullishness driving stock to unsustainable level resulting in subsequent drop

2. loss of earnings power

3. high cost

4. high debt

5. management changes

6. outdated technology

7. faulty business model

8. industry structure change

9. fashion or craze product loses appeal

10. overall economic slowdown

11. replacement product at lower price

12. mergers gone wrong

13. product recalls

14. natural disaster

15. regulatory action

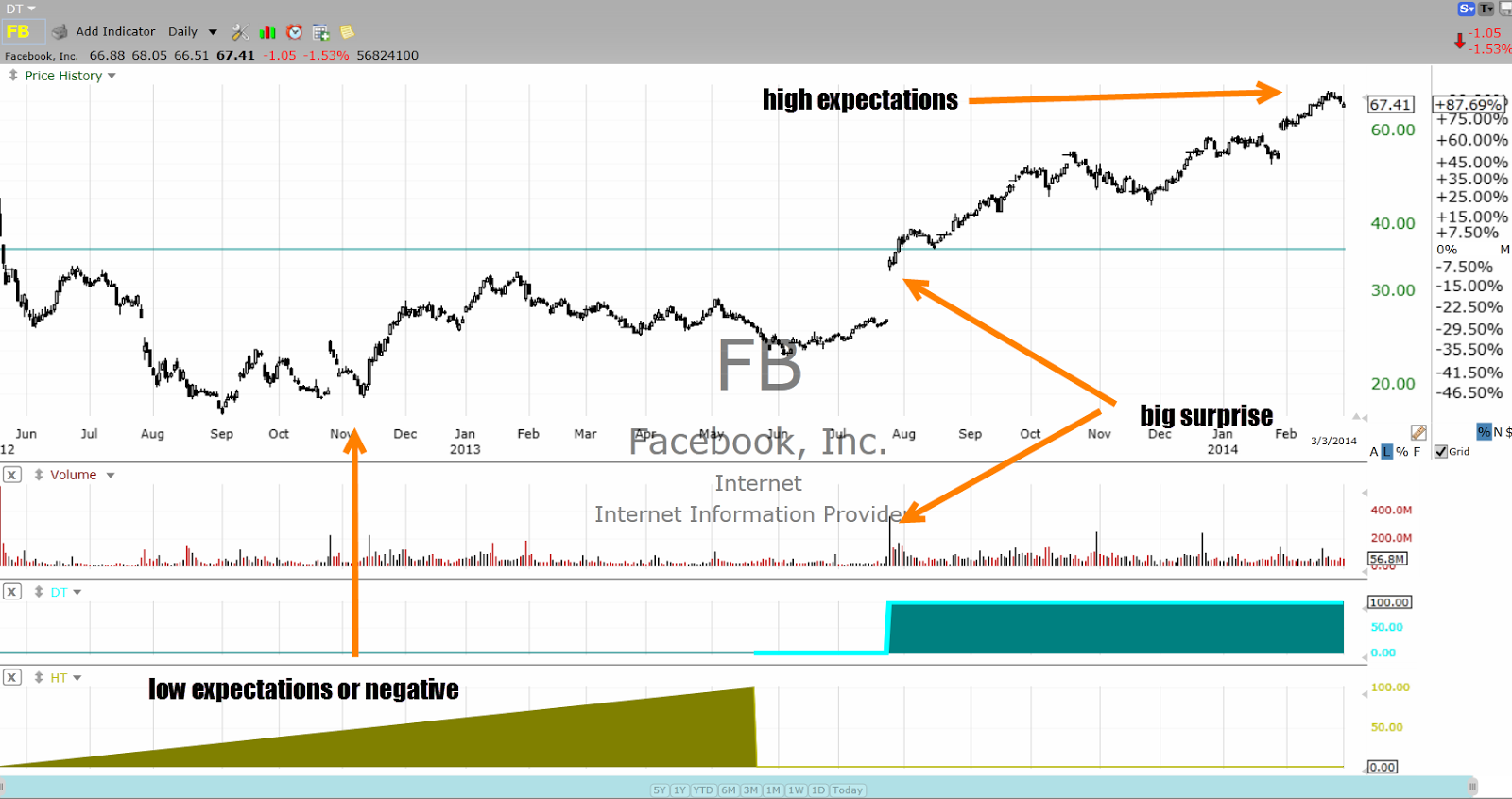

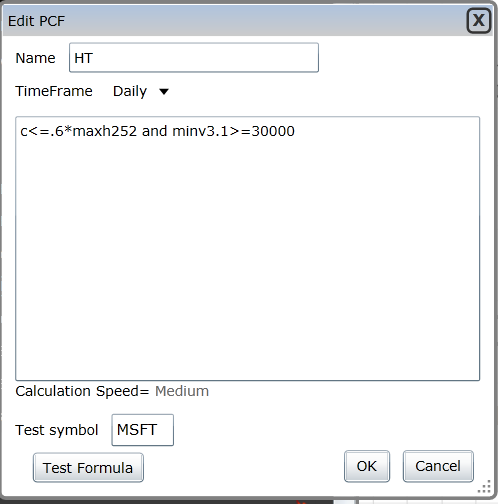

Telechart Scan for Half Trouble

c<=.6*maxh252 and minv3.1>=30000

c= closing price today

maxh252= highest price in last 252 days

minv3.1= minimum volume in last 3 days

The scan gives you stocks that have gone down at least 40% from their one year high and that have last 3 days volume above 30000 for each of the day. Beaten down stocks can often become neglected and can have lower daily volume near bottom.

The scan will give lot of small caps stocks. I want to focus only on stocks with revenue above 300 million. The smaller stocks are more speculative and difficult to track. By focusing only on 300 million plus sales we can reduce the list to few focused candidates.

Chart Settings for HT

c<=.6*maxh252 and minv3.1>=30000

c>1.8*minl252

One of the limitation of Telechart 2000 is it only shows 2 years of chart, in older version you will see this better.

Those who are serious can set this up on your own. If you do this religiously, you will find 5 to 6 good ideas in a year that will double or triple once catalyst comes in.