S&P Yearly Returns 1926 to 2009 sorted by % change

5/30/2010

5/26/2010

Daily Market Analysis Video

- overall market direction

- Market Monitor

- Sectors

- Top Ranked stocks

- ETF momentum

5/24/2010

Think methods

IKEA Instructions

One of the most useful thing you must do if you want to be successful in trading or life is to think methods. To be successful trader what you need is a well thought out method. If you want to trade say growth stocks, then you should have a method to find growth stocks. If you want to trade pullbacks, you must have method to find pullbacks. If you want to trade breakout, you must have a method to find breakout. If you want to use stops in your trading you need a method to determine stops. If you want to time the market, you need method to tell you which is good time to enter and which is good time to exit.

Why is it difficult to think methodically. In many cases people do not have skills in methodical thinking. The other problem is we are surrounded by opinions and judgments. Everyone has a opinion about everything, not necessarily based on facts. The mass media thrives on that, lot of blogosphere is about it. Opinions and judgments are unique to a person. They are about biases, misconception, ego, influence and seduction. How can you trade a opinion like "Bernanke is a idiot" or " we are all doomed" or "US is doomed". Opinions are opinions, they are not tradable. They get you on to TV or get you quoted in Newspaper but they are perfectly useless for trading. Motivations of those who offer opinions is to influence you or seduce you not necessarily to offer tradable method. Those who influence opinions have a method to generate opinions. Glenn Beck is a perfect example of that. 90% of what he says is his opinion it is not based on facts. What is his motivation for churning out all these opinion, money, fame, influence and so on. Same way if you look at CNBC most of it is about opinion.

But to make money in trading or in life you need method. What does a entrepreneur do, he finds a better way to do something. If you work in a organisation, what do successful managers, workers or supervisor do? They find a method to do the job more efficiently. As against that you will see lot of headless chickens wondering around asking what should they do. You will see the same thing in trading, people will ask you what do you think about AAPL or SNDK, or LOPE or any other stock, or ask I am in ATSG now what do I do. What does it tell you. That person has not thought about a method.

If you spend time on understanding a method and developing a method you will have method related question as against questions on specific trades. If you learn methods it will be life long learning and you will get benefit from the method for years. What stops people from thinking method. Most of the time they have been rewarded in life for not having a very good method. So methodical thinking is not part of their thinking repertoire.

If you can define a problem properly, you can find a method to solve that problem. Many people ask me what mutual funds they should buy or what ETF they should buy in their retirement account, but very few ask how do I go about finding which mutual funds or ETF to buy in my retirement account. If you ask the second question it is a method question and then one can methodically develop a way to find when to invest in IRA or 401k, how to find mutual funds to invest in, when to exit and so on. I have talked about my method to invest in 401k many times before. If you spend 3 days understanding and replicating it, you will have a lifelong way to answer your question which funds should you buy in 401k and when.

Same thing applies to trading. If you decide to trade momentum stocks, then you need to develop a method to find them, enter them, exit them and so on. What did William O'Neil do, he found a way to find and trade growth stocks. That method works for him. He has detailed it many times in his book , if you spend one month internalizing it, you can also handily beat the market. What did Charles Kirkpatrick do. He found a method to trade value stocks with momentum. If you spend just a week understanding his method, you will find profitable way to trade value stocks. And I can go on and on about this thing, but they key to trading success is about developing method.

Method is something which you can break down in to steps. Method is something which you can replicate. Method is something you can practice and learn. Method is like driving direction. If the directions are clear and you have the right vehicle you will be able to travel from A to B. Once you have a method you can train your procedural memory to become efficient at performing that method. Methods are about regiments, set of guidelines and rules. Opinions create dependency, methods are about independence. You can replicate a method and trade it on your own. You may or may not agree with the logic of a method and you may find different results with it, but ultimately it is a step by step replicable process.

Methods are like those stick figures Ikea provides to put together the furniture you bought.

When I visit a blog or read something on blog or interact with traders, I am primarily interested in learning what method does this person use. I have studied most of the trading blogs and made detail notes about methods and incorporated some in to my methods. Similarly when I am reading a book or come across an idea my primary focus is how do you make this work. How can I design a method to make this work. As Brett Steenbarger says trading is performance sports. Performance is all about methods.

If you can draw a Ikea style instruction about your trading method then you have a method.....

When I visit a blog or read something on blog or interact with traders, I am primarily interested in learning what method does this person use. I have studied most of the trading blogs and made detail notes about methods and incorporated some in to my methods. Similarly when I am reading a book or come across an idea my primary focus is how do you make this work. How can I design a method to make this work. As Brett Steenbarger says trading is performance sports. Performance is all about methods.

If you can draw a Ikea style instruction about your trading method then you have a method.....

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.

5/21/2010

Popular Posts

- A cherry coke , a billionaire , and the 52 week low list

- Do you have a plan for today

- Earnings season and Cinderella strategy

- How momentum stocks perform in pullbacks

- How to become good at trading Episodic Pivots

- How to develop trading expertise

- How to find shorts using Telechart

- How to find stocks likely to bounce back using Telechart

- How to find stocks with high short interest using Telechart

- How to pick stocks based on earnings surprise

- How to profit from a free email service

- How to spot new leadership

- How to use Guppy MMA to gauge market strength

- If you are a new trader do this first

- If you want to avoid market surprises, study market breadth

- Lady Gaga and Episodic Pivots

- New Traders and cognitive load

- Study of setups: Charles Kirkpatrick

- Study of Setups: Notable Calls

- The Kirk Report Strategy Session Q

- The little secret to trading success

- Trading checklist for morning

- Trading psychology issues to think about

- Two Types of Traders

- Two ways to find shorts

- Understanding swing trading

- What are Episodic Pivots and how to find them

- What color is Dan Zanger's underwear

- Why setup selection is key to decreasing cognitive load

- Why understanding procedural memory is key to trading success

- Why you should aim for a orbital change

5/20/2010

What you need to know about market breadth

Extreme positive or negative breadth leads to reversal

When breadth becomes extremely positive or negative such situations resolve in trend change or pullback or correction. In Market Monitor when following things happen it indicates extreme breadth

# of stocks up>25% in a quarter goes below 200 (bullish)

# of stocks down>25% in a quarter goes below 200 (bearish)

# of stocks up>50% in a month goes above 20 (bearish)

# of stocks down>50% in a month goes above 20 (bullish)

% of stocks in confirmed uptrend using Guppy MMA goes below 30 (bullish)% of stocks in confirmed uptrend using Guppy MMA goes above 70 (bearish)

Such high readings should be interpreted as bullish zone or bearish zones. The actual bullish or bearish reversal may take 8 to 10 days after readings reach such extremes.

Breadth thrust precedes trend change

Breadth thrust means a dramatic change in breadth in short period of time. Breadth thrusts are typically calculated using cumulative breadth. To further refine the breadth thrust smoothing is used along with exponential average of breadth. Then the ratio is further converted in to a oscillator. Zweig Breadth thrust, Absolute breadth Thrust, McClellan Oscillator and many other indicators are based on such breadth thrust calculation. (The actual maths used in doing that is complicated).

Breadth thrust in either direction after a long rally or decline indicates change of trend. In Market Monitor Breadth Thrust is indicated by 10 day ratio.

When the 10 day ratio goes above 2 after market has been in bearish phase for sometime, it indicates bullish breadth thrust and possible change of direction for market.

When the 10 day ratio goes below .5 after market has been bullish for sometime, it indicates a bearish thrust and possible change of direction for market.

Breadth crossover confirm trend change

When breadth turns from positive to negative or the other way, it indicates confirmation of primary breadth trend. In Market Monitor this is indicated by:

# of stocks up>25% in a quarter / # of stocks down>25% in a quarter

# of stocks up>25% in a month / # of stocks down>25% in a month

# of stocks up>13% in 34 days / # of stocks down>13% in 34 days

What happens at the beginning of a rally

A big 300 plus day on # of stocks up> 4% in day on high volume

Series of 300 plus days in 5to 10 days time frame.

The Cumulative Breadth Ratio goes above 2 confirming start of a bull move.

The Primary Indicator turns bullish

Bottoms tend to be formed suddenly.

What happens at the end of a rally

There is a slow deterioration in breadth on Primary Indicator.

After weeks or month Primary Indicator turns bearish.

The cumulative breadth ratio goes below .5

Real selling starts after that.

Breadth deteriorates slowly at the top

Tops take a long time to form and are difficult to spot. This correction is not following that pattern. I have studied every top in last 40 years or so and seldom market top starts with a crash.

Breadth suddenly improves at bottom

Market bottoms happen suddenly. Market turns often are a single day phenomenon.

Why it is difficult to understand breadth for beginners

Because lot of concepts in breadth are new to them. Many breadth charts are not interpreted the way most people are used to interpreting charts.

For example Zweig breadth thrust charts are hardly useful because the breadth thrust signal definition is when the readings go up from below 40 to 61.5% that indicates start of a big bull move. The average gain after such breadth thrust is 24% in 11 months post signal. But the signal is very rare. The last Zweig Breadth Thrust signal was on March 23 2009. Before that the breadth thrust gave a signal on August 23 rd 1984. So if you look at Zweig Thrust charts everyday, it is waste of time.

Similarly interpreting McClellan Summation Index is difficult unless you understand the concept behind it. The charts by themselves of it do not tell you much about how signals are generated.

I will again advise anyone serious about market breadth to read The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength . It will take you some time to understand and interpret market breadth.

. It will take you some time to understand and interpret market breadth.

5/19/2010

The Dreyfus model of skill acquisition and developing trading expertise

As I have said earlier the key to success in trading is about developing procedural memory. Procedural memory is a long term memory for skills. It is implicit memory and as a result difficult to verbalize.

Procedural memories are muscle or thinking sequences which have been internalized by the brain and when required to perform a task the procedural memory kicks in and you can effortlessly do the task without being aware of steps. Procedural memory is also called skills memory.

The most well known psychological model of skill acquisition is called Dreyfus model. In 1980, two brothers working in the area of artificial intelligence and software were commissioned by the Air Force Office of Scientific Research (AFSC)to study skill acquisition. They submitted a report to AFSC titled " A five stage model of mental activities involved in skill acquisition".

Subsequently the model was published by them in a book Mind over machine: The power of human intuition and expertise in the era of the computer

The five stages of development are:

- Stage 1: novice

- Stage 2 : advanced beginner

- Stage 3: competent

- Stage 4 : proficient

- Stage 5: expert

Novice

At novice stage it is all about following the rules. The novice thinks in terms of rules but has no context or ability to modify rules. At this stage the energy is focusing on following the rules rather than thinking.

Advance Beginner

Is still rule based but rules are now situational based . So instead of blindly using the rules at this stage you start using a set of rule in a A situation and different set of rules in B situation.

Competent

At this stage you start to realize that performing this skill has more to it than just following rules or changing rules according to situation. You start to see patterns and principles and start realizing rules are not absolute and they are guidelines or rule of thumb. You start performing the skills more by experience and active decision making rather than strict rules.

Proficient

At this stage you start thinking in terms of complete picture. You develop a perspective about your area of skill or focus.

Expert

At this stage it is intuitively appropriate action without being conscious of you skills.

5/18/2010

Essential Books for growth and momentum traders

There was a question about which books I recommend . You will rarely get a complete setup in any book. Even if you get it, you may not appreciate it because you have not gone through the discovery process and rejection of several setups before the author found what works for him. There is lot of learnings in rejected setups.

William O'neil

Read all editions of O'Neil book starting with First Edition

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

The Successful Investor: What 80 Million People Need to Know to Invest Profitably and Avoid Big Losses

How to Make Money Selling Stocks Short (Wiley Trading)

24 Essential Lessons for Investment Success: Learn the Most Important Investment Techniques from the Founder of Investor's Business Daily

How To Make Money In Stocks: A Winning System in Good and Bad Times-

Jesse Livermore

Reminiscences of a Stock Operator (Wiley Investment Classics)

How to Trade In Stocks

Nicolas Darvas

How I Made $2,000,000 in the Stock Market

Mark Boucher

The Hedge Fund Edge: Maximum Profit/Minimum Risk Global Trend Trading Strategies (Wiley Trading)

Dave Landry

Dave Landry's 10 Best Swing Trading Patterns and Strategies

Richard Love

Superperformance stocks: An investment strategy for the individual investor based on the 4-year political cycle

Charles Kirkpatrick

Beat the Market: Invest by Knowing What Stocks to Buy and What Stocks to Sell

Michael Carr

Smarter Investing in Any Economy: The Definitive Guide to Relative Strength Investing

5/17/2010

MA, GILD, and HAL amongst weakest stocks in the market

|

| GILD: Gilead Science Inc |

|

| MA: Mastercard Inc |

Stocks in bottom 20% by six month, 3 month, and one month relative strength

MYGN

NE

NETC

NMR

NOK

NTY

NVS

ONXX

PAG

PBCT

PBR

PBR.A

PDC

PDE

PDS

PKX

PUK

PXP

QCOM

REP

RIG

RINO

RTP

SCCO

SCHW

SGMS

SGY

SLT

SNY

SOHU

SPIL

SPWRA

SPWRB

STD

STP

SVNT

SVU

TAM

TC

TEF

TKC

TMX

TNDM

TNE

TOT

TRGL

TRH

TS

TSYS

UIS

VE

VNDA

VOD

VPRT

WFR

WG

YGE

ZGEN

5/14/2010

Homebuilders, retailers and China were leading to downside

Have a look at this video to see where the selling was concentrated.....

5/13/2010

People are watching too many movies according to top 50 momentum stocks

NFLX: Netflix Inc

CSTR: Coinstar Inc

Market has bounced back sharply in last 3 days. One of the sectors leading higher is the video and dvd rental services. Both NFLX and CSTR had good earnings in recent quarters and are going up post the earnings.50 stocks Top Ranked by momentum

ACTG

AGM

ANV

APKT

APPY

ARRY

AXTI

BBW

BC

BIDU

BTN

CPWM

CPY

CRUS

CSTR

CVGI

DCTH

DDIC

DTG

FBN

GTN

HOV

HTRN

IDT

INTT

ISLN

KEI

KERX

LDSH

LIOX

LSCC

MHR

NENG

NEWS

NFLX

NPSP

OKSB

PACR

PBTH

PFSW

PONE

PPO

PWER

RAS

RBCN

SMTX

SNDK

TAL

TRS

UPI

WAL

WNC

5/12/2010

Top ranked 50 stocks by momentum

As always there are some stocks holding up well during this correction.

50 stocks top ranked by 6 month, 3 month, and 1 month momentum

ACTG

AGM

ANN

ANV

APKT

APPY

ARRY

AXTI

BBW

BC

BTN

BXG

CPWM

CPY

CRUS

CUR

CVGI

DCTH

DDIC

DTG

HOV

HTRN

IDT

INTT

ISLN

KEI

KERX

LDSH

LIOX

LSCC

MHR

NENG

NEWS

NFLX

NPSP

OKSB

PACR

PBTH

PFSW

PONE

PWER

RAS

SNDK

SPF

TAL

THMD

TLB

TRS

UPI

WAL

PACR: Pacer International Inc.

50 stocks top ranked by 6 month, 3 month, and 1 month momentum

ACTG

AGM

ANN

ANV

APKT

APPY

ARRY

AXTI

BBW

BC

BTN

BXG

CPWM

CPY

CRUS

CUR

CVGI

DCTH

DDIC

DTG

HOV

HTRN

IDT

INTT

ISLN

KEI

KERX

LDSH

LIOX

LSCC

MHR

NENG

NEWS

NFLX

NPSP

OKSB

PACR

PBTH

PFSW

PONE

PWER

RAS

SNDK

SPF

TAL

THMD

TLB

TRS

UPI

WAL

5/11/2010

Goldman Sachs amongst weakest 100 stocks

GS: Goldman Sachs

Weakest 100 stocks by 6 month , 3 month and one month relative strengthAONE

APC

APWR

ARD

ARST

ART

ATHN

ATW

AYE

BAX

BBVA

BG

BLK

BP

BWLD

CAM

CCJ

CCK

CEDC

CEL

CF

CGA

CHNG

CMED

CNX

COG

CRK

CRL

CRY

CRZO

CSIQ

CSR

DEER

DF

DO

DRWI

DT

DVR

E

EEFT

EJ

ENER

EXEL

FE

FIRE

FORM

FTE

FUQI

GAP

GDP

GILD

GLBL

GMXR

GS

GSK

HAL

HEAT

HGSI

HK

HOLI

HSC

ISIS

ITMN

KG

KWK

LOGI

MCO

MDU

MFE

MON

MYGN

NE

NETC

NMR

NOK

NTES

NVTL

OTE

OVIP

PBCT

PDC

PDE

PWRD

PXP

RIG

RINO

SD

SGMS

SINA

SNY

SOHU

SPWRA

SPWRB

STD

STP

SVNT

SVU

SWS

SYKE

TEF

TLCR

TMX

TNDM

TNE

TNP

TOT

TSYS

TTEC

UIS

UTA

VE

VNDA

VOD

VPRT

WG

XCO

YGE

5/10/2010

Strong stocks in a weak market

Market has taken a big pounding in last one week. While most of the stocks have been hit hard and have had pullback or correction, there are new set of stocks which have tentatively held up well and can lead next phase after some days.

When market undergoes correction the momentum ranking undergoes rapid churn and soon new set of stocks start appearing in top momentum scans.

37 stocks with 6 month, 3 month and one month momentum

ACTG

AGM

APKT

APPY

ATSG

BXG

CMLS

CPWM

CPY

CVGI

DCTH

DDIC

DTG

GTN

HTRN

IDT

INTT

ISLN

KEI

KERX

LIOX

LSCC

MBI

ME

MHR

NEWS

NPSP

PBTH

PFSW

PONE

PWER

RAS

SFI

SMTX

SRLS

TWPG

WAL

What kind of stocks have held up well so far. Stocks with immediate earnings or other catalyst have held up well.

Some of the stocks with little damage during the correction are:

PBTH: Prolor Biotech Inc

SRLS: Seracare Life Sciences

ACTG: Acacia Research Acacia Tech

When markets corrects some stocks have orderly pullback and hey are the ones to watch for possible leadership in next bull phase.

When market undergoes correction the momentum ranking undergoes rapid churn and soon new set of stocks start appearing in top momentum scans.

37 stocks with 6 month, 3 month and one month momentum

ACTG

AGM

APKT

APPY

ATSG

BXG

CMLS

CPWM

CPY

CVGI

DCTH

DDIC

DTG

GTN

HTRN

IDT

INTT

ISLN

KEI

KERX

LIOX

LSCC

MBI

ME

MHR

NEWS

NPSP

PBTH

PFSW

PONE

PWER

RAS

SFI

SMTX

SRLS

TWPG

WAL

What kind of stocks have held up well so far. Stocks with immediate earnings or other catalyst have held up well.

Some of the stocks with little damage during the correction are:

PBTH: Prolor Biotech Inc

SRLS: Seracare Life Sciences

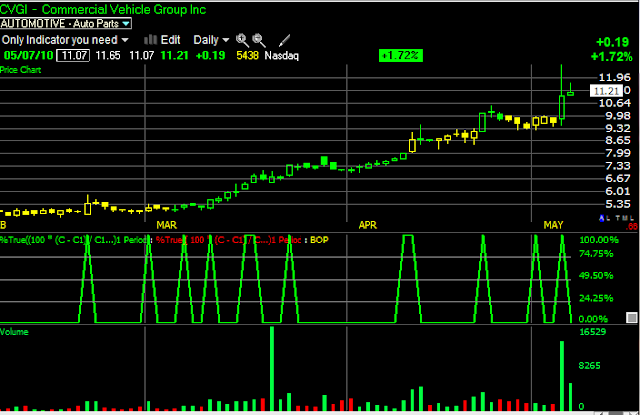

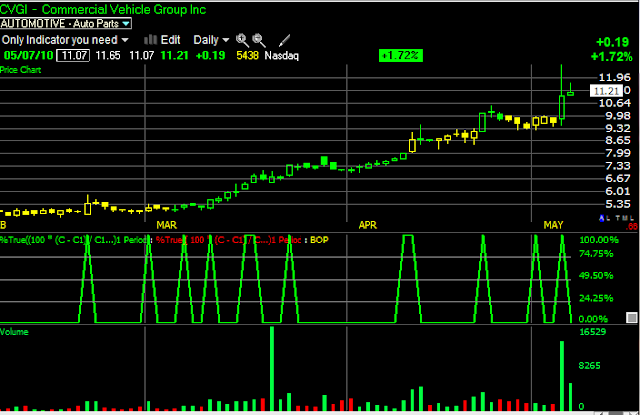

CVGI: Commercial Vehicle Group Inc

ACTG: Acacia Research Acacia Tech

When markets corrects some stocks have orderly pullback and hey are the ones to watch for possible leadership in next bull phase.

5/07/2010

100 weakest stocks

Stocks priced 5 plus ranked in bottom 20% by 6 month, one quarter and one month momentum:

AA

ACH

AMSC

AONE

APWR

ARST

ART

ATHN

ATW

AVP

BAX

BBVA

BG

BLK

BP

BSBR

BWLD

CCJ

CEDC

CEL

CF

CGA

CIG

CML

CMO

CNX

COG

CRK

CRL

CRZO

CS

CSIQ

DEER

DF

DO

DRWI

DT

DVR

E

EBR

EEFT

EHTH

EJ

ENER

EXEL

FE

FIRE

FORM

FTE

FUQI

FWLT

GAME

GAP

GDP

GILD

GLBL

GMXR

GOOG

GS

HEAT

HGSI

HK

HSC

IGD

IN

ING

ISIS

ITMN

KEP

KG

MDCO

MDU

MFA

MFC

MFE

MON

MYGN

NE

NETC

NMR

NOK

NVTL

ONXX

OVIP

PAG

PBR

PBR.A

PDC

PDE

PPL

PWRD

PXP

QCOM

REP

RIG

RINO

SGY

SINA

SNY

SOHU

SPWRA

SPWRB

SQM

STD

STP

SWS

TEF

TLCR

TMX

TNDM

TNE

TOT

TRH

TS

TSYS

TV

UEPS

UIS

VNDA

VPRT

WATG

WPP

YGE

AA

ACH

AMSC

AONE

APWR

ARST

ART

ATHN

ATW

AVP

BAX

BBVA

BG

BLK

BP

BSBR

BWLD

CCJ

CEDC

CEL

CF

CGA

CIG

CML

CMO

CNX

COG

CRK

CRL

CRZO

CS

CSIQ

DEER

DF

DO

DRWI

DT

DVR

E

EBR

EEFT

EHTH

EJ

ENER

EXEL

FE

FIRE

FORM

FTE

FUQI

FWLT

GAME

GAP

GDP

GILD

GLBL

GMXR

GOOG

GS

HEAT

HGSI

HK

HSC

IGD

IN

ING

ISIS

ITMN

KEP

KG

MDCO

MDU

MFA

MFC

MFE

MON

MYGN

NE

NETC

NMR

NOK

NVTL

ONXX

OVIP

PAG

PBR

PBR.A

PDC

PDE

PPL

PWRD

PXP

QCOM

REP

RIG

RINO

SGY

SINA

SNY

SOHU

SPWRA

SPWRB

SQM

STD

STP

SWS

TEF

TLCR

TMX

TNDM

TNE

TOT

TRH

TS

TSYS

TV

UEPS

UIS

VNDA

VPRT

WATG

WPP

YGE

5/06/2010

Two types of traders

You will see two types of traders today:

- Those who will externalize the problem

- Those who will internalize the problem

The second kind will develop method to as best as they can avoid a situation like this again....

The easiest thing is to externalize the problem..

But at same time you know there are traders who were on right side of this trade.

Not based on luck but based on method...

Minervini was out before this selloff and he has detailed his method for arriving at his decision...

Many other CANSLIM traders were in cash or lightly invested based on their method of looking at leading stocks.

A blog I have highlighted couple of times Wishing Wealth was also out and warning about this market since last couple of days based on his GMI index.

My own Market Monitor timing model was warning about a correction based on big moves breadth.

So people do have methods to determine when to be aggressive and when to be cautious.

Study those method...

It is easy to externalize problems, but if you are looking for real growth as a trader, internalize problem and search for solutions...

This applies not only to trading but to life in general....

Some reactions from Stockbee Members today:

Can I just raise a glass of single malt scotch to toast the market monitor - it got me out last week. It's taken 6+ months, but I'm finally getting a feel for MM :)

WOW....Thank you Pradeep, because of you I am in cash and not long.....Got out of my shorts too early but that is OK... Oportunity on the recovery...you definitely have my respect

Pradeep, my respect for you and MM have gone up hundred fold. Despite you teaching, I have done some stupid things - but I am in a much better position than the last market meltdown.

i second that! thank you Guru

: I am in the exact same boat as you are :). Guru, you are actually Maha-Guru.. "Shat, Shat Pranam"

now double thanks.... :0 i was sitting back and watching and laughing at the action... 'guru for president'

i hope everyone is having as much fun as i am :)

site has taught me that cash is a position. sometimes the best decision is the one not taken.

Thank God for Pradeep and his Market Monitor!

Pradeep - please bill your drink to my membership account. That $150 has paid for itself over and over and over and over and over and over and over.

guru have a drink. it's on me :)

Let me also chime in..For the first time in 8years moved to cash entirely last week and was in complete tune with MM numbers. Going into today had a couple of short positions including Guru's pick SOHU. Was a bit slow to cover into the frenzy. Nevertheless, the profits were protected. Not a penny lost infact made some in the catastrophe. Many thanks to Guru and his ingenious invention

Hats off to you Pradeep and your MM...moved to cash last Thursday, as I learned to respect MM signals the hard way. I owe you a debt of gratitude for all your apprenticeship. Cheers!!

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.

Subscribe to:

Posts (Atom)