5/30/2018

Find stocks with extra ordinary momentum

As a trader you want to put your capital to work in situation where it will provide explosive returns in shortest possible time. If you can systematically identify and trade stocks with extra ordinary momentum you can quickly grow your account.

Stocks with extra ordinary momentum are for any given time frame the most under buy or sell pressure. During such periods they continuously make highs or lows. They have very little pullback as buyers are constantly buying them.

If you can identify such stocks early in their extra ordinary momentum phase then you can enter them with very close stops and become instantly profitable . Not only that but for your holding period the stock is going to move with rapid velocity and as a result you can make profit fast.

There are many ways to identify these stocks early and the exact parameters depend on software you use.

These three stocks are example of stocks with extra ordinary momentum in last 3 to 4 months.

You can find similar high momentum situation intraday.

Find and trade stocks with extra ordinary momentum to grow your acount aggressively.

Stocks with extra ordinary momentum are for any given time frame the most under buy or sell pressure. During such periods they continuously make highs or lows. They have very little pullback as buyers are constantly buying them.

If you can identify such stocks early in their extra ordinary momentum phase then you can enter them with very close stops and become instantly profitable . Not only that but for your holding period the stock is going to move with rapid velocity and as a result you can make profit fast.

There are many ways to identify these stocks early and the exact parameters depend on software you use.

These three stocks are example of stocks with extra ordinary momentum in last 3 to 4 months.

You can find similar high momentum situation intraday.

Find and trade stocks with extra ordinary momentum to grow your acount aggressively.

5/23/2018

Bullish and bearish anticipation watchlist

Anticipation allows c you to plan your entries and stops and enter very early in a potential breakout or breakdown.

Closer your stop is to entry less is the risk and the trade can become very quickly profitable. It also allows you to find more opportunities.

This is my bullish and bearish watchlist for today:

CMG

ATHM

DXCM

MEOH

ZBRA

LPNT

SPB

CVNA

SMCI

ACHC

GILD

VSH

RUN

FRTA

VDSI

MMI

TMO

CTL

GCAP

NRZ

CPRX

IRBT

SRI

BWA

TRIP

WHD

LPLA

FLR

MA

SIVB

BLK

Closer your stop is to entry less is the risk and the trade can become very quickly profitable. It also allows you to find more opportunities.

This is my bullish and bearish watchlist for today:

CMG

ATHM

DXCM

MEOH

ZBRA

LPNT

SPB

CVNA

SMCI

ACHC

GILD

VSH

RUN

FRTA

VDSI

MMI

TMO

CTL

GCAP

NRZ

CPRX

IRBT

SRI

BWA

TRIP

WHD

LPLA

FLR

MA

SIVB

BLK

5/16/2018

Finding explosive trades early

BLNK is a trade I did pre market and made very good profit for holding it 20 minutes or so . In order to find trades like these you need to setup right kind of scans in it. BLNK showed up on my Multi Strategy scan early as you can see above.

As a full time trader , I am always looking for trade opportunities. One of the good tools for finding explosive stocks quickly is Trade Ideas. It is a scanning software which allows you to find trades real time.

Trade Ideas scans I use to find both swing and day trade candidates early. For those with the software here are the scans you can replicate.

Stocks with the most upside momentum (These tends to keep going )

The above scan is good for finding the powerful breakouts that often go on to make big moves during the rest of the day and for next 5 to 10 days

Stocks with the most downside momentum (These tends to keep going )

The above scan is good for finding the powerful breakdowns that often go on to make big moves during the rest of the day and for next 5 to 10 days

Up 3% or more with Earnings Today

This is scan to find Episodic Pivots candidates that breakout big on earnings day

Biggest Gainers

Biggest gainers for the day.

Biggest Losers

Biggest Losers for the day/

Multi-strategy

<http://www.trade-ideas.com/Cloud.html?code=98bbc81038d96e7d5c200459d25321eb>

This has multiple strategies combined in one window is very useful for quickly spotting a breakout or breakdown. It also is useful to indicate intraday buying and selling pressure.

5/11/2018

Fine tuning entries can be very profitable

For any trade your risk is entry-stop price. Let us say you are entering a stock at 20 and your stop is 19 then your risk is one dollar. But if you can reduce this 1 dollar risk to say 40 cents then your profit will be higher.

How can you do that?

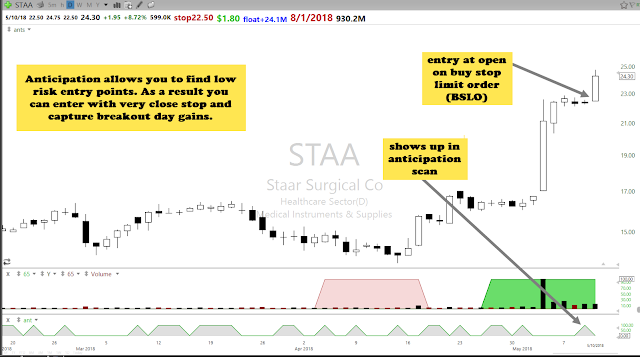

The anticipation setup detailed on this site multiple times allows you to do that. Once you become good at trading anticipation setups you can enter a breakout setup with a very close stop.

Here are some examples of recent trades I did using anticipation.

As the stock was in my anticipation scan night before the breakout I had a entry in first 5 minutes of open and the stop was just 70 cents and then the stock immediately took off allowing stop to be moved to break even within the first 30 minutes. If you can do that the risk reward equation is highly favorable. In this case for risking 70 cents the trade made 8 dollars.

These kind of trades can be very profitable and best part about them is they are planned trades as your order and stop can be in place before market open using BSLO.

See the trade below on STAA I did yesterday . It was instantly profitable. For risking 40 cents for few minutes at open before moving stop to break even and then moving it up and selling in to strength on an average the trade made 1.60 . That is 4R. And in reality because the trade took of immediately post entry the stop was never in doubt.

ISRG was another similar trade but as it is high priced stop was 2 dollars. The stock showed up n anticipation scan day before yesterday. It was down -0.07%. The entry was near open and stop was 2 dollars which subsequently moved to break even.

If you can find trades like these you can have highly skewed risk reward situation and you can make money without risking much .

There s lot of money to be made using this low risk setup strategy. If you are serious about making money trading go through my number of posts on anticipatory setups shared over last couple of years.

How can you do that?

The anticipation setup detailed on this site multiple times allows you to do that. Once you become good at trading anticipation setups you can enter a breakout setup with a very close stop.

Here are some examples of recent trades I did using anticipation.

As the stock was in my anticipation scan night before the breakout I had a entry in first 5 minutes of open and the stop was just 70 cents and then the stock immediately took off allowing stop to be moved to break even within the first 30 minutes. If you can do that the risk reward equation is highly favorable. In this case for risking 70 cents the trade made 8 dollars.

These kind of trades can be very profitable and best part about them is they are planned trades as your order and stop can be in place before market open using BSLO.

See the trade below on STAA I did yesterday . It was instantly profitable. For risking 40 cents for few minutes at open before moving stop to break even and then moving it up and selling in to strength on an average the trade made 1.60 . That is 4R. And in reality because the trade took of immediately post entry the stop was never in doubt.

ISRG was another similar trade but as it is high priced stop was 2 dollars. The stock showed up n anticipation scan day before yesterday. It was down -0.07%. The entry was near open and stop was 2 dollars which subsequently moved to break even.

If you can find trades like these you can have highly skewed risk reward situation and you can make money without risking much .

There s lot of money to be made using this low risk setup strategy. If you are serious about making money trading go through my number of posts on anticipatory setups shared over last couple of years.

5/10/2018

Why new traders struggle

When you are new trader or new to a setup you struggle because you are rigidly trying to adhere to taught rules or plans

You have little situational awareness so are not flexible and nimble. When faced with novel situation your rules and guidelines alone are not sufficient.

No discretionary judgment. is used by new traders. They want to rigidly adhere to rules. You can see this in trading world where traders vow to strictly follow their rules. Rules with no understanding of situation are counter productive.

Novices traders have not done enough trades and have no "life experience" in the application of trading rules they picked up from others or books or blog or training program. As against that expert traders have done thousands of trades.

"Just tell me what I need to do and I'll do it." But that does not work if there is a situation changes. markets and stocks are dynamic and the market ecosystem changes constantly.

This frustrates traders. And as result give up on potentially very profitable setup idea pre maturely. They try lots of this with very little success.

The good skilled trader no longer relies on rigid rules, guidelines . They operate within certain framework of rules but they are not rigid.

They have flexibility to bend rules and guidelines as they dynamically read the situation and can change on the fly during the trade.

The trader, with an enormous background of experience gained through thousands of trades , now has an intuitive grasp of the trading setup and several variation of that setup along with accumulated understanding of individual stock behavior. As a result makes minor adjustment to his trade as he or she reads to context of the trade and they can do this very quickly.

The expert trader operates from a deep understanding of his setup , market conditions, his process and the total situation. That is difficult to explain to novice trader.

The chess master, for instance, when asked why he or she made a particularly masterful move, will just say: "Because it felt right; it looked good." The performer is no longer aware of features and rules;' his/her performance becomes fluid and flexible and highly proficient.

In order to improve your trade performance you need to do hundreds of trades . Or study hundreds of past patterns.

5/09/2018

Understanding nature of stock moves

It has been observed and verified that stocks move in momentum bursts during bullish periods in indexes (bull markets).

During "established" downtrend (bear markets) in index they show same phenomenon on the downside. They go down in momentum bursts of 3 to 5 days.

In this kind of momentum burst move in a stock , the first day is range expansion which is immediately followed by follow through.

The sequence looks like:

Range expansion day

Up day (follow through)

Up day (follow through)

pullback

followed by end of momentum

That is the bullish sequence. Variation can be 5 day burst. In rare cases you will get a 8 to 10 day burst.

Sometime it will be variation of the 3 days with inside day or negative day after first day of range expansion.

There are many possible variations but essentially this is an impulse move of 3 to 5 day duration.

During this 3 to 5 days period stock would go up 8 to 20% ( lower priced stock can even have bursts of up to 40%).

Such bursts may or may not have clear identifiable catalyst. You need to know nothing about the company to trade this kind of burst.

This is a pattern and probability based trade.

It is largely mechanical way to trade for small profit targets.

Move starts with range expansion

All such momentum bursts start with a range expansion. The first day of the move is range expansion day. Often there is also volume expansion along with range expansion.

The price moves in the direction of range expansion.

When there is range expansion it attracts breakout traders, it attracts other momentum players, day traders, quants and so on. That results in continuation of move for few days.

Range expansion basically means a day which is up bigger than last 5 to 10 days bars. A range expansion preceded by series of range contraction days is good candidate in this setup. Moves preceded by orderly range contraction can be explosive.

A successful momentum burst will lead to immediate follow through. Say a stock breaks out in the morning, it will continue to go up through the day and will have immediate follow through in next 2 to 3 days. And the follow through should also be of big 4 to 5% plus magnitude on second or third day.

In most cases the momentum dies down in 3 to 5 days.

If you keep holding after the 3 to 5 days period, you would often see the stock ends up giving up all the burst gains and may not have another momentum burst for several weeks or months. Sometime the burst gains vanish intraday itself.

Depending on price of the stock such momentum bursts can be of 8 to 40% magnitude. Lower price stocks tend to make bigger moves.

For a stock trading below 5 dollars a breakout day move itself might be of 10 to 20% magnitude. For traders with small accounts that offers good opportunity.

As a practical matter if you have large amount of capital to trade with it is difficult to grow your account by just focusing on these low priced stocks. You might have to buy lots of 50000 to 100000 shares for meaningful difference to your account.

Lower float stocks make bigger moves. Low float and high demand creates explosive moves.

If you see in any year the most short term explosive moves will be on extremely low float stocks. For those with smaller account size there is distinct edge in trading low float stocks.

No specific catalyst is needed for these momentum bursts.

Why do these moves happen?

In some case there might be a specific news catalyst on day of first range expansion day , but in vast majority of these kind of momentum moves, there is no clearly identifiable catalyst.

However tracking news on daily basis might help you enter some of these momentum bursts very early and magnify your profit.

During bull moves in overall market such momentum bursts have been observed for over 100 years.

This is structural nature of market.

You should be independently able to verify this.

Stocks seldom run up or down smoothly.

A 30% move in stock over 3 months in a stock might be completed in 2 momentum bursts of 10 to 15% in just 5 to 6 days. Rest of the time the stock might retract or go in range.

In a year you will probably find 5000 to 10000 such 3 to 5 day setups when both bullish and bearish setups are combined.

Momentum burst kind of swing trading allows you to grow your account with very low risk.

For a mere 3 to 5 day exposure to market you capture the most explosive part of the move and you are not seating in dead periods holding stock waiting or anticipating a breakout which may or may not come.

Trading this kind of setup requires extremely good ability to ruthlessly cut losses if a trade does not work immediately .

It also requires skill to exit when things are still in explosive phase and not wait for reversal.

Per trade profit on these kind of trades will be on an average just 5 to 8% as you are only going to get part of the 8 to 20% move. By the time you enter on breakout day the stock might be up 4 to 10% , so you will not be able to capture that part of the range expansion move.

To trade this kind of setup you need to be willing to do 200 to 1000 or more trades in a year.

You make money by compounding these small gains.

So this is high frequency and low per trade profitability method.

There are periods in market where these kind of setups are prone to failure.

This happens near market turns where in short period lot of breakouts fail.

The bullish breakout trade needs to be avoided during fast selling phases in market.

The bearish breakdown trade works best after a downtrend is clearly established on 10 plus day time frame.

In a bull market trading 3 day bearish setups will lead to lot of failed breakdowns.

Because of the nature of the overall markets (they have significant positive bias), there are in number terms more bullish momentum bursts than bearish momentum bursts.

Once you understand this momentum burst based short term phenomenon, the next task becomes how to trade it by setting up proper procedure for it.

If you understand this market move and build your trading around it you can make millions in market. Buy before momentum burst in anticipation (Stockbee Anticipation setup) or buy on first day of momentum burst (Stockbee 4% and $ breakouts setup)

5/03/2018

How to profit from good anticipation setups daily

Anticipating a breakout gives you an opportunity to enter potential breakout stock ahead of actual breakout or within first 10 to 40 cents of its breakout depending on price.

If you master the anticipation setup you can find 1 to 5 good trades daily which in many cases are instantly profitable in first 30 minutes itself.

ARNA is an example of that kind of trade I did yesterday.

Because of its narrow range consolidation it was on my 39 dollars plus anticipation scan. I entered it in first 7 minutes with very close 20 cents stop. The stock had a breakout and kept going up after that.

There are 3 to 10 opportunities like this everyday. If you know how to find them , you can have trades with very low risks as the stops on such trades can be very close.

As stock gain momentum they undergo periods of fast moves followed by periods of pullbacks and consolidation. The pullbacks and consolidation periods offer you an opportunity to anticipate a breakout and enter with very close stop or enter with order few cents above the consolidation.

In case of ARNA it had 2 days of big breakout couple of weeks ago , that was followed by very compact consolidation near high. The consolidation had very low volatility and was primed for breakout. Identifying this stock previous night allows you to watch it intently next day or create a Buy Stop Limit Order (BSLO) and enter as it breaks out of the narrow consolidation.

If you are an active trader and looking to make money frequently, anticipation setup offers you such opportunity. All the work involved in this setup is previous night before market opens. You have all the time to find the best anticipation setups and plan your entries , stops and exits.

can daily for stocks with momentum that are undergoing range contraction. A range contraction scan will help you quickly find such stocks. After that narrow your list to 3 to 5 top quality setups and then watch them in first 10 minutes. Most good anticipation setups breakout in first 10 to 15 minutes of open.

Once you have anticipation candidate ,look for early entry on it. If you wait for breakout to buy then the entire effort is wasted. Ideal entry is where you risk just few cents or less than 2% to get in early. This requires either entering before breakout or entering with a order few cents above yesterday's action.

Anticipating a breakout helps you get an early entry and can improve your per trade profits. It also can lower your risk as your stop is closer. It can help you profit from even smaller moves as you can also capture breakout day gains. For that entry without waiting for breakout is best.

Anticipation requires more pre planning and effort than buying a breakout. You need a process flow to do that. The process should be efficient and done daily after the market close or open. It takes me around 15 minutes to generate my list of candidates daily. I look at around 100 to 300 candidates to boil down to just 1 to 5 good candidates for entry next day.

What to look for in good anticipation setup

- series of narrow range days in pullback/consolidation

- orderly pullback with no 4% b/d during the pullback or consolidation

- low volume pullback

- low volatility during pullback

- linear first leg if looking as continuation setup

- Stock should go up smoothly and not in volatile manner

- 3 to 10 days consolidation/pullback

- not up 3 days in a row

If you have a burning desire to be profitable trader and want to develop a low risk high reward trading setup , then anticipation is for you.

5/02/2018

A starting point for new trader

Everyday I get lots of emails from beginner traders or traders who are struggling to make money asking questions about what should they do. The journey from beginner or struggling trader to consistently profitable trader is step by step process and can be quick if you know what is important in trading.

The most critical insight which a beginner trader needs is that the money making setup you use is under your control. Markets and market reactions are not controllable . If you do good job of controlling the controllable variables you can build profitable trading strategies.

For beginner traders that can often be slightly difficult to understand due to lack of experience and profits.

Markets are ever changing. Markets are not completely predictable. Markets are complex and evolve as technology evolves.

Markets seemingly offers too many choices. This can lead to confusion and scattered efforts.

Market is not controllable. But methods are controllable. Methods can be constant irrespective of the market situations. Methods are under traders control.

Your trading mix is completely controllable and that is the key to profitability.

In marketing there is a concept called marketing mix. The central hypothesis is that you can not control the consumer behaviour but what you can control is the marketing mix.

Same way your trading mix is completely under your control. The elements of trading mix are :

Market selection (equity selection in stock market case, or instrument selection like options or futures)

Entries selection

Exits selection

Risk selection

Like in marketing the product is critical no amount of price, promotion or place variable changes can substitute for poor product strategy. Similarly as a trader your most important decision is equity selection. Which stocks to trade is 80% of the solution to profitable trading success.

In marketing there is a concept called marketing mix. The central hypothesis is that you can not control the consumer behaviour but what you can control is the marketing mix.

Marketing decisions generally fall into the following four controllable categories:

* Product

* Price

* Place (distribution)

* Promotion

The term "marketing mix" became popularized after Neil H. Borden published his 1964 article, The Concept of the Marketing Mix. Borden began using the term in his teaching in the late 1940's after James Culliton had described the marketing manager as a "mixer of ingredients". The ingredients in Borden's marketing mix included product planning, pricing, branding, distribution channels, personal selling, advertising, promotions, packaging, display, servicing, physical handling, and fact finding and analysis.

These four P's are the parameters that the marketing manager can control, subject to the internal and external constraints of the marketing environment. The goal is to make decisions that center the four P's on the customers in the target market in order to create perceived value and generate a positive response.

Same way your trading mix is completely under your control. The elements of trading mix are :

Market selection (equity selection in stock market case, or instrument selection like options or futures)

Entries selection

Exits selection

Risk selection

Like in marketing the product is critical no amount of price, promotion or place variable changes can substitute for poor product strategy. Similarly as a trader your most important decision is equity selection. Which stocks to trade is 80% of the solution to profitable trading success.

That is why basic and simplistic technical analysis often does not produce the desired results because it primarily deals with entry and exit selection. But with little bit of tweaking it works.

Select stocks with higher than normal probability of going up. For this you need to understand factors that make stocks go up or down rapidly and the conditions under which that happens.

In a complex market offering too many choices (around 8000 stocks), dynamically selecting the equities is the key.

In a complex market offering too many choices (around 8000 stocks), dynamically selecting the equities is the key.

As a beginner trader you need to understand the factors that lead to better stock selection. Momentum, earnings, volatility, valuation, liquidity, capitalisation are some well known factors that drive stock prices. If you use them to elect your stocks to trade it will improve your profitability.

As a beginner first spend your time on effort on better stock selection. Selection criteria then becomes a scanning criteria which should bring to your trading conveyor belt a series of best possible opportunities for given time periods.In a bear market or sideways market the method must select the best opportunities for that period dynamically. Similarly in a runaway markets it selects the best opportunities with runaway characteristics.

There are various way to select equities. But most of the one which work are based on some statistically proven anomalies. Hedge funds and big institutions have spent years and billions researching what to look for in equity selection. Traders may or may not be aware of them.

There are various way to select equities. But most of the one which work are based on some statistically proven anomalies. Hedge funds and big institutions have spent years and billions researching what to look for in equity selection. Traders may or may not be aware of them.

No matter the markets certain things work. The amplitude of return might be different but few key anomalies work across market situations and across stock markets in various countries. The earnings drift is one such thing. Earning momentum is one such thing. Price momentum is one such thing. Neglected IPO effect is one such thing. Like this if you start focusing on finding anomalies, you will find around 50 such anomalies which have edge. Some highly secretive hedge funds and traders may have found even more.

While there is a belief amongst most traders that if you share you will lose your edge, it might be true of certain anomalies, but some of the robust anomalies just do not disappear. They have been written about for donkeys years and various explanations have been offered as to why they work, but they continue to work. Knowing does not translate in to profitability. Making these insights work is a craft.

Making Pizza is very easy but only certain pizza outlets are extremely successful. The ingredients of pizza are no secret, but the craft of making it differs and most very successful or famous pizza places have a small unique twist to the method, which makes them stand apart.

While there is a belief amongst most traders that if you share you will lose your edge, it might be true of certain anomalies, but some of the robust anomalies just do not disappear. They have been written about for donkeys years and various explanations have been offered as to why they work, but they continue to work. Knowing does not translate in to profitability. Making these insights work is a craft.

Making Pizza is very easy but only certain pizza outlets are extremely successful. The ingredients of pizza are no secret, but the craft of making it differs and most very successful or famous pizza places have a small unique twist to the method, which makes them stand apart.

Similarly knowing a trading concept or method and making it work and making money out of that idea requires a trading craft. It might be qualitative pattern recognition or quantitative pattern recognition. Look around there are so many hedge funds or traders(pizza shops), they use same ingredients, have similar calibre quants or technical analyst, they know most of these anomalies (having worked in investment banks before), yet some hedge funds (pizza shops) consistently do well while others struggle.

Converting idea in to profitable idea is the craft.

One way to learn craft is by watching others who are more proficient at it. Deep knowledge works. Breaking down craft in to small units work. Mentoring works in high skilled professions. Crafts are difficult to transfer from one person to another. Transfer often requires an extended period of interaction between the two parties involved.

Learning craft also requires extraordinary level of motivation and dedication and time efforts. Both the person imparting the skill and person learning it must have extraordinary motivation for the process to work successfully. Most successful traders may not want to commit that level of time to transfer craft unless they find someone with potential. That is why trading remains so difficult and elusive craft.

But beginner traders in current conditions have much simpler path compared to pre internet era. Today there are thousands of good quality free resources for traders. A motivated trader if he or she follows the right approach can shorten his learnings curve quickly.

But beginner traders in current conditions have much simpler path compared to pre internet era. Today there are thousands of good quality free resources for traders. A motivated trader if he or she follows the right approach can shorten his learnings curve quickly.

Subscribe to:

Posts (Atom)