Most of these things you can see in good breakouts. If you understand and internalize these things you can select a good IBD 200 breakout in a snap.

If you internalize this you can anticipate some IBD 200 breakouts.

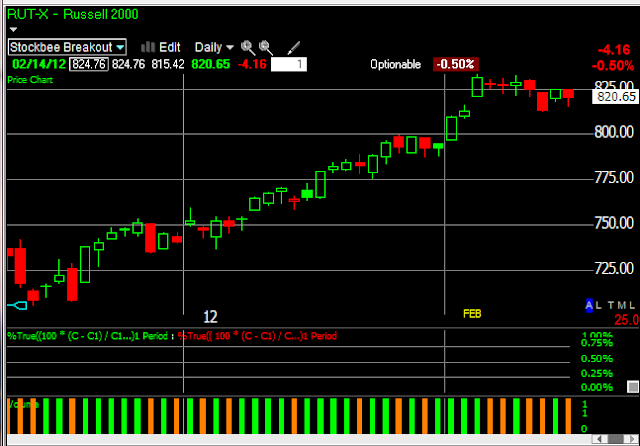

This kind of swing trading method works best in a market undergoing momentum phase. In that kind of market breakouts are aggressively bought and tend to have 3 to 5 days follow through.

Those 3 to 5 days follow through moves tend to be of 8 to 20% magnitude during bull phases.

That is why Market Monitor filter or breadth thrust filter is important to improve your odds of success.

For working people with complicated lifestyle the IBD 200 offers a very convenient way to focus on Top 200 momentum stocks with growth characters. In a traditional bull market growth stocks make big moves so this list will keep you on right side of the stock selection universe.

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.