4/25/2024

4/23/2024

4/10/2024

1/24/2024

1/23/2024

Miami Bootcamp May

Miami

- Price: $750 (cancellation fee $200) ( only for members)

- Date: May 24—26, 2024

- Time:Fri—Sat, 9:00 AM to 5:00 PM

Sun, 9:00 AM to 1:00 PM - Meals: Coffee, pastries and lunch

- Venue: Shalala Student Center

University of Miami

1/22/2024

1/15/2024

1/13/2024

Copenhagen Bootcamp in July

Dates and venue are confirmed for the Copenhagen Bootcamp

Date: July 5—7, 2024

Time: Fri—Sat, 9:00 AM to 5:00 PM, Sun, 9:00 AM to 1:00 PM

Seats: 40 ( Members only price $750)

Venue: Copenhagen Professional College - Sigurdsgade Campus (view on Google Maps)

1/11/2024

Examine your trading beliefs

You can only trade what you believe in.

Your beliefs drive your behavior. This is true not only of trading but also in real life. If you know a person's beliefs, you know how he will behave.

If you "believe " the markets are efficient and there is no way to make money by selecting stocks, you will go and buy ETF.

If you "believe" the only way to trade is using mechanical methods ( that is a belief) and discretionary trading is too vague (that is a belief), as a result, all your behavior will flow from it.

If you "believe," you should only trade triple ETF and not waste time on individual stocks (that is a belief), and as a result, all your behavior will flow from it.

If you "believe" that the only way to trade is with big risk and fully invested on margin, as a result, all your behavior will flow from it.

If you "believe" market will crash (it is a belief) you will spend time constantly shorting.

If you believe trading options is the path to big success (that is a belief), you will spend time trading options.

If you believe momentum stocks offer the best opportunities, you will trade them.

If you believe growth stocks offer biggest opportunities to profit from the growth you will build methods around your belief..

You will become a value investor if you believe growth investors are fools buying expensive companies.

If you believe stocks move in a momentum burst of 3 to 5 days, you will find ways to exploit that phenomenon.

If you "believe" barring liquid stocks, all other stocks are junk, you will only trade liquid stocks.

If you "believe" anticipation setup allows you to make money with the least amount of drawdowns, you will spend time trading them.

If you believe working people can not trade, then you will find a hundred reasons to justify your belief.

If you believe working people like you can still profitably trade, then you will find creative ways to find time for trading.

Every trade has deeply held beliefs like these.

The bundle of deeply held beliefs drives what kind of setup they will trade, what kind of timeframe they will trade, and also all elements of trade like entry, exit, risk, and number of positions held.

The beliefs determine where you will spend your efforts.

1/10/2024

How to deep dive daily

I am interested in trading the most explosive moves for the week or month. By studying these daily, you know the nature of moves in 5-day time frames.

If you want a hold period of one month, do this Deep dive for one month, six months, or a year, depending on your objective.

Just do one thing daily without fail.

Study stocks that are up 20% for a week and up 100% for a year

Everything you need to make money, you will learn from that.

You need to understand the nature of stock moves and how they start, progress, and reverse. Doing this daily will give you a working model of what works in the current market. Then, you can start designing the scans to find them.

This study will help you develop "your understanding " of market moves. Once you have sufficient experience of doing this, you can start discounting a lot of conventional wisdom or market speak. Because you can see what the Guru is telling you on Twitter in the book or in a blog, it is not in line with what actually happens in the market.

How can you do this

Run simple scans in Telechart

Study Bullish 20% c/c5>=1.2 and minv3.1>100000 and c>=5

Study Bearish 20% c/c5<.8 and minv3.1>100000 and c>=5

Study 20 Dollar plus Bullish c-c5>=20 and minv3.1>=100000

Study 20 Dollars plus bearish c5-c>=20 and minv3.1>=100000

If you are trading low-priced stocks, you can eliminate the last condition of c>=5

Do this daily, and you are guaranteed to be a better trader.

1/09/2024

JBLU U NN URNM

NVDA Day vs Swing vs Position Trade

1/08/2024

APLS, AVGO, FNGU, TREE and a Market monitor tip

APLS

FNGU

AVGO

TREE

Does Overhead resistance matter? (Video 2 min)

1/05/2024

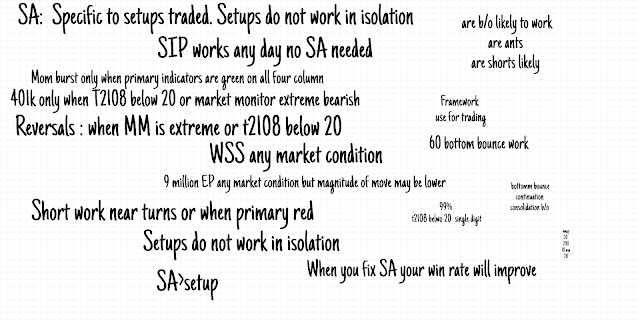

For high win rate fix Situational Awareness

Every day, we do this to answer whether our setup is likely to work and only trade when the probability is in our favor for that setup.

Over the years over 10000 traders have learned. Situational Awareness and Market Monitor-based framework for trading, and you will see thousands of them on Twitter doing similar things.

If your trading is not going anywhere fix your Situational Awareness and you will find instant difference.

.png)