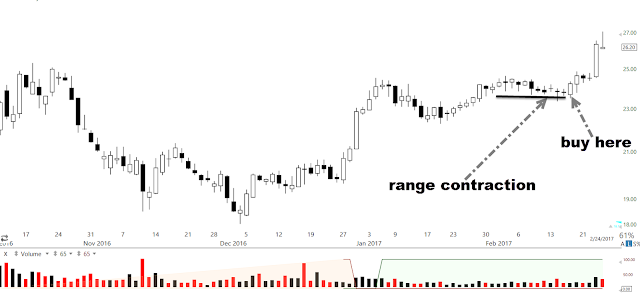

Stocks go through periods of range contraction or trend periods and periods of range contraction or consolidation. One of the best way to make money in the stock market is to buy range expansion at the beginning of a swing after a stock has had series of range contraction days.

Buy range expansion after a period of 5 to 10 day consolidation and an orderly consolidation. Orderly consolidations are low volatility periods where buyer and seller at equilibrium.

Buy range expansion preceded by low volatility period. A range expansion from that phase indicates fresh buying pressure.

Buy range expansion after a negative day. A range expansion preceded by a negative day indicates start of a fresh swing.

Buy range expansion after a narrow range day. Narrower the range better it is. Narrow ranges often lead to explosive moves on range expansion.

Buy range expansion after a narrow range day. Narrower the range better it is. Narrow ranges often lead to explosive moves on range expansion.

Buy range expansion after a series of narrow range days. That is even better.

Buy range expansion if stock is not up 3 days in a row.

Buy range expansion if stock is not up 3 days in a row.

As a swing trader, if you regularly buy stocks up 3 days in a row , you are likely to sooner or later blow up your account. The Professional trader buy on first day of the swing as soon as range expansion is signaled. Second day follow through id driven by residual buyers, newsletter followers or slow reactors. Third day is when many novice notice the move and get excited. the professionals sell in to that euphoria. They are happy with their 8 to 20% profit in 3 days and the third day buyer becomes the bag holder.

Buy range expansion early in a trend.

Buy range expansion early in a trend.

Say a stock is rang bound for 3 to 6 month and then it breaks out then that is a young trend. Buying proper momentum burst setups in these your trend first or second or third time works . But same stock when it is up say 6 month and trading near its high and all time high at some stage buying a extended move on that kind of stock will likely hasten your death as a trader. Even if you have to trade those kind of extended moves , ensure extremely good risk control and position sizing. As trends get extended they can become vulnerable to swing failures.

The most important thing to remember as swing trader is that always buy range expansion at beginning of swing move. That one rule can make you millions and save you lot of heartburn.

The most important thing to remember as swing trader is that always buy range expansion at beginning of swing move. That one rule can make you millions and save you lot of heartburn.

In order to find such stock setups daily scan for range contraction periods. From that list narrow your options and enter on range expansion day.

Here are some of the stocks with range contraction setups:

BC JAZZ NSIT LW FNSR EFX IDXX SAGE DNKN MYL BEN CRCM DORM IMOS SANM AGN ELLI RF MDSO BLDR ACAD FBK