Will be back on Monday.

9/29/2011

9/28/2011

Market has no surprize

Market is doing exactly what you would expect it to do in a range. Volatile moves is characteristic of range bound action.

Earnings season will determine next move for the market. If earnings stat deteriorating or guidance starts going down then the range will break to downside. If earnings surprise then we will have rally.

Any move out of this range will be big move. However many will deplete the account playing the range and suffering death by thousand cuts.

Earnings season will determine next move for the market. If earnings stat deteriorating or guidance starts going down then the range will break to downside. If earnings surprise then we will have rally.

Any move out of this range will be big move. However many will deplete the account playing the range and suffering death by thousand cuts.

9/26/2011

Back to range

Buyers lack conviction. sellers lack conviction. End result range bound action.

Individual stock action does not show lot of setups for intermediate term swing trades. 3 to 4 days weak bounces and rally failures is what you will find in most cases. It continues to be day traders market. However next earning season is fast approaching and that will likely offer some good trade opportunities.

Individual stock action does not show lot of setups for intermediate term swing trades. 3 to 4 days weak bounces and rally failures is what you will find in most cases. It continues to be day traders market. However next earning season is fast approaching and that will likely offer some good trade opportunities.

9/23/2011

Remain in capital protection mode

Range is being tested currently. While short term bounce is possible, a break below range will be good for longer term bottom formation.

The rush to buy every dip is not a sign of capitulation. Capitulation kind selling leads to sustainable bounces. Capitulation, fear , and extreme bearish sentiments is what will lead to bottom.

If you are intermediate swing trader , being on sideline is your best strategy. A bounce will setup more shorts in few days.

PCYC is the best looking long setup out of over 1000 stocks I looked at today.

Remain in capital protection mode.

9/22/2011

Not surprised by the drop

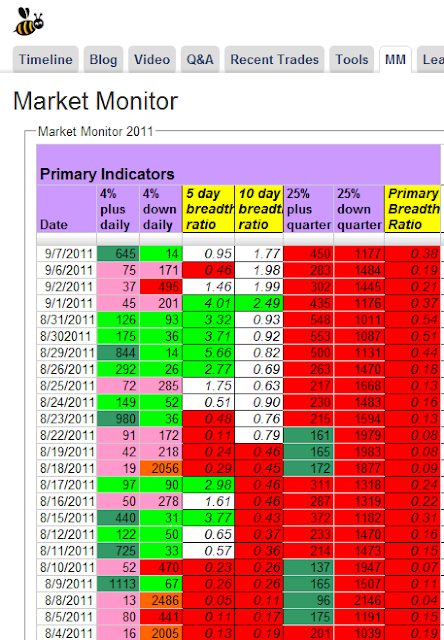

Throughout the range bound action, the breadth remained firmly in negative territory. Which indicated that the bounce had no broad based support. Market bottoms are characterized by breadth turning positive. The Stockbee Market Monitor Timing model never signaled a market turn.

As they say the key to profitable trading is to play great defense and avoid certain periods. Market breadth allows you to do that. It helps you avoid the risky periods and concentrate your buying power during safe periods.

Related posts:

As they say the key to profitable trading is to play great defense and avoid certain periods. Market breadth allows you to do that. It helps you avoid the risky periods and concentrate your buying power during safe periods.

Related posts:

How to use market breadth to avoid market crashes

Why book on market breadth retails for $450

How focusing on methods help

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.

9/20/2011

9/19/2011

Range in play

The market is near top of the range. It had trouble breaking out of range last time. We will see if this time it manages to break it.

The breadth has improved a bit but not yet in bullish crossover mode.

Time to keep an eye on new leadership. Stocks that are outperforming the market during this range bound market or are holding up well are the stocks likely to lead next phase.

ATHN

CALP

CIIC

EXK

GKK

GLBL

GNK

GRO

LPHI

LQDT

MELA

MITK

MMI

NETL

NXG

OPTR

PANL

PRKR

PSMT

RIC

SPRD

STAA

STMP

TMF

TVIX

VGZ

VIXY

VRUS

VXX

WPRT

The breadth has improved a bit but not yet in bullish crossover mode.

Time to keep an eye on new leadership. Stocks that are outperforming the market during this range bound market or are holding up well are the stocks likely to lead next phase.

ATHN

CALP

CIIC

EXK

GKK

GLBL

GNK

GRO

LPHI

LQDT

MELA

MITK

MMI

NETL

NXG

OPTR

PANL

PRKR

PSMT

RIC

SPRD

STAA

STMP

TMF

TVIX

VGZ

VIXY

VRUS

VXX

WPRT

Unless breadth deteriorates significantly, we will continue to be in range bound mode. Mosdt moves will be of smaller magnitude till range breaks.

9/15/2011

Ingredients are lining up for a sustainable move

Market is stuck in a range. Moves on both bullish and bearish side have lasted for 3 to 4 days. Will this time be different.

More time market spends in this range the better it will be. That will ensure the next leg up or down is big.

The sentiments are now starting to favor bullish case.

For the first time you see sentiments flipping to bearish in recent weeks on the Investors Intelligence polls.

Ingredients are lining up for a sustainable move, but the volatility is too high and as of now only handful of leadership stocks have started showing up. It is still news driven whipsaw action.

More time market spends in this range the better it will be. That will ensure the next leg up or down is big.

The sentiments are now starting to favor bullish case.

For the first time you see sentiments flipping to bearish in recent weeks on the Investors Intelligence polls.

Ingredients are lining up for a sustainable move, but the volatility is too high and as of now only handful of leadership stocks have started showing up. It is still news driven whipsaw action.

9/14/2011

Some signs of stabilization

The market is attempting a botom formation here. After the big down move, selling has not been severe and every time there was selling buyers are stepping in.

More stocks are going in to sideways bases. From such bases a new bull move can start. If the market spends more time going sideways, it will be better. As of now it looks like a good setup for last quarter rally. The momentum scans have started showing some good setups. That universe should expand if the market puts in a bottom here.

But it still remains very volatile market. The volatility has to drop for meaningful bottom.

More stocks are going in to sideways bases. From such bases a new bull move can start. If the market spends more time going sideways, it will be better. As of now it looks like a good setup for last quarter rally. The momentum scans have started showing some good setups. That universe should expand if the market puts in a bottom here.

But it still remains very volatile market. The volatility has to drop for meaningful bottom.

9/13/2011

Number of stocks forming constructive bases

c

Market had a vertical drop from last week of July to around first week of August. In 11 days market lost between 12 to 20% on key Indices. This was the sharpest drop in 11 days in 40 year history.

Since then the market has stabilized and form a range for last 5 to 6 week. The range has been very volatile with 2% plus moves on daily basis.

The low established during the correction has held and as of now we are witnessing breadth divergences. Fresh selling has been on lower breadth. Fresh selling has not had major follow through.

During the first phase of selling most stocks followed the market and had vertical drops. But now in last 4 to 6 weeks some are resisting fresh selling and forming constructive bases. Number of stocks have started to show signs of building compact bases. These stocks are likely to be leaders of next move.

If you run momentum scans currently and look at top 300 stocks by momentum you would see many signs of stocks settling in sideways bases and resisting further selling. These are the stock to focus on for any up move. Some stocks have had recent breakout and follow through which is also a good sign. Time to start building a buy list and be ready.

Any breadth thrust here will see many of these stocks breaking out to the upside. If the range breaks to the downside then all bets are off.

But as of now a short term bullish patterns are in play.

9/12/2011

Volatility is the name of the game

Market continues its volatile move in a range. The range has not yet broken. Expect more of the same for sometime.

Breadth trends are negative. There was a brief bounce in breadth trends some weeks ago but that has now been negated. At some stage the breadth will flip and that will be powerful signal.

Breadth trends are negative. There was a brief bounce in breadth trends some weeks ago but that has now been negated. At some stage the breadth will flip and that will be powerful signal.

9/09/2011

9/08/2011

Key is follow through

Big breadth day on positive side . Key is follow through. We have not seen follow through beyond 3 or 4 days on positive side in last many weeks.

Unless trading on very small time frames you can get whipsawed to death. Volatile periods are followed by better trading periods that last for months, but for that patience is needed.

9/07/2011

Large swings of 1 to 2 % daily

Market continues to form range hear. The breadth trends continue to improve compared to August.

Volatile market with large swings of 1 to 2 % daily on either side is the current situation. To trade it you need to have intra day time frames. For swing trades on momentum stocks there are hardly any setups.

9/06/2011

9/01/2011

Stocks up 25% in a month

Very small number of stocks are showing momentum leadership currently. Z, LPHi, GNK, MAKO, STAA, FXCM, SUSS, RIMM, LOGI, RIC, and PANL are true leaders of the move that are up 25% plus in month.

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.

Subscribe to:

Posts (Atom)