There is an oft repeated adage on wall street, when they raid the whorehouse, they take everyone including the piano player. The recent market correction has been broadbased. But eventually when the market rallies, stocks which with stood selling will bounce back vigorously.

Stocks with superior earnings and growth will often correct with overall market correction. But if the underlying growth is not affected by market direction then these stocks find buyers at new level. Many times the current holders are reluctant to sell these shares, because they believe in their future prospects. The list below is what I am monitoring currently.

Watchlist

AMKR,Amkor Technology Inc

ARD,Arena Resources Inc

ARS,Aleris International Inc

ATHR,Atheros Communications Inc

BGC,General Cable Corp

CFK,Ce Franklin Ltd

CHAP,Chaparral Steel Company

CMG,Chipotle Mexican Grill

DXPE,Dxp Enterprises Inc

GDI,Gardner Denver Inc

GOOG,Google

HANS,Hansen Natural Corp

HNR,Harvest Natural Resources Inc

HOM,Home Solutions Of America

HSR,Hi-Shear Technology Corp

ICTG,Ict Group Inc

IIG,Imergent Inc

ISRG,Intuitive Surgical Inc

KFRC,Kforce.Com Inc

KMG,Kerr-Mcgee Corp

KNOT,The Knot Inc

KNXA,Kenexa Corp

LDSH,Ladish Co Inc

LVS,Las Vegas Sands

NTG,Natco Group Incorporated

NTRI,NutriSystem Inc

OYOG,Oyo Geospace Corp

PWEI,Pw Eagle Inc

SWIR,Sierra Wireless Inc

TTES,T-3 Energy Services Inc

ZUMZ,Zumiez Inc

ZVXI,Zevex Internat Inc

Stocks down 50% or more in a month

DHB,Dhb Industries Inc

DOVP,Dov Pharmaceutical Inc

EGI,Entree Gold Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

NBIX,Neurocrine Biosciences

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

Stocks up 50% or more in a month

IFO,Infosonics

Stocks with all time high volume

CGPI,Collagenex Pharmaceuticl

RZ,Raser Technologies Inc

TRB,Tribune Co

5/31/2006

5/30/2006

Volatile market requires greater trading skills

The market have entered the high volatility phase and the risk is higher. In a trending market like the one we saw for last 3-4 years it is easy, buy all pullbacks or breakouts. Now a more selective approach is required. Timing entries and exits on both long and short becomes more critical in such volatile environment. Stock selection becomes even more critical. Risk management and average trade size and time frame all need adjustments. If you trade diversified basket of markets then there are great opportunities in other markets like bonds and currencies currently.

Stocks up 50% or more in a month

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

DHB,Dhb Industries Inc

DOVP,Dov Pharmaceutical Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

NBIX,Neurocrine Biosciences

THLD,Threshold Pharmaceuticals

Stocks with all time high volume

CMOS,Credence Systems Corp

LOV,Spark Networks plc

PBJ,PowerShares Dynamic Food & Beverage Portfolio ETF

XTLB,XTL Biopharmaceuticals ADR

Round up

Britain's most famous portfolio manager is a closet chartist.

Easier it is to say a company's name, the more attractive it will be to investors claims a new reaserch.

All bubbles burst eventually. The newcomers to market take the maximum brunt when it happens. In the beginning there is shock and disbelief and then a hunt for scapegoats.

The newspaper industry is in trouble and long time bullish media analyst from Merrill raises alarm. Might be a good contrarian bet.

After writing about stocks for 28 years for Washington Post, Jerry Knight is buying his first stock at the age of 63. Imagine a food writer who does not cook and a travel writer who never travels.

Stocks up 50% or more in a month

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

DHB,Dhb Industries Inc

DOVP,Dov Pharmaceutical Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

NBIX,Neurocrine Biosciences

THLD,Threshold Pharmaceuticals

Stocks with all time high volume

CMOS,Credence Systems Corp

LOV,Spark Networks plc

PBJ,PowerShares Dynamic Food & Beverage Portfolio ETF

XTLB,XTL Biopharmaceuticals ADR

Round up

Britain's most famous portfolio manager is a closet chartist.

The media-shy Mr Bolton, who runs £6.5 billion on behalf of a quarter of a million Fidelity Investments clients, said that he used charts to time his entry into some investments.

Chartism, the study of past patterns in stock prices to determine investment decisions is regarded by some investment purists as mumbo-jumbo and a waste of time.

However, Mr Bolton said: I've found charts very useful, particularly on bigger companies, especially for timing. When the technicals confirm the fundamentals, I use them in that way.

Charts were also useful in preventing him from buying into a blue chip too soon, he said. To be too early on a stock can be costly. It's a healthcheck. It's a bit like going to the doctor.

Easier it is to say a company's name, the more attractive it will be to investors claims a new reaserch.

All bubbles burst eventually. The newcomers to market take the maximum brunt when it happens. In the beginning there is shock and disbelief and then a hunt for scapegoats.

The newspaper industry is in trouble and long time bullish media analyst from Merrill raises alarm. Might be a good contrarian bet.

After writing about stocks for 28 years for Washington Post, Jerry Knight is buying his first stock at the age of 63. Imagine a food writer who does not cook and a travel writer who never travels.

5/26/2006

The right stock at the right time

There is a tide in the affairs of men,

Which, taken at the flood, leads on to fortune;

Omitted, all the voyage of their life

Is bound in shallows and in miseries.

This applies to stocks as well. Look at the three stocks in these lists:

IFO,Infosonics, JOYG,Joy Global Inc and MT,Mittal Steel Company N.V. These three stocks I have owned and traded in recent years.

Stocks up 50% or more in a month

IFO,Infosonics has rallied back to its old high. Look at the fundamentals to get a clue about why this stock has rallied so rapidly. It has almost doubled revenue from 73 million to 143 million in a year. This quarter the revenue has doubled compared to the same quarter a year earlier. If you look at earnings in 2005 they were 44 cents per share compared to a loss a year earlier. This quarter earnings are up almost 4 fold. Very few stocks have these kind of dramatic growth. Look at MED,Medifast and you will see similar kind of growth story.

If you monitor just the top 2% earning/sales performer in the market and forget about rest of the market, you will find a list of stocks like these. These stocks are volatile but they make dramatic price moves when they get going.

IFO,Infosonics

MED,Medifast Inc

Stocks with all time high volume

JOYG, Joy Global Inc made a move from a low price of 3.42 to 70 in few years. Look at the earning increases:1.20(2005),0.46 (2004),0.17(2003),-0.20(2002). Now yesterday it had a all time high volume. This coincides with latest earnings release. Which hinted at earnings slowdown. The party is over for this stock now. Rest of its life it will spend basing or going down.

MT,Mittal Steel Company N.V. was a penny stock few years ago. It made a low of 80 cents. From that low it went as high as 40 in few years. Look at the earnings during the fast price growth phase of this stock and you will understand why.

The all time high volume is linked to the failed merger.

EPL,Energy Partners Ltd

GCS,DWS Global Commodities Trust

JOYG,Joy Global Inc

MT,Mittal Steel Company N.V.

PBJ,PowerShares Dynamic Food & Beverage Portfolio ETF

Stocks down 50% or more in a month

BCGI,Boston Communications Gr

DOVP,Dov Pharmaceutical Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

LOUDD,Loudeye Corporation

NBIX,Neurocrine Biosciences

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

NOTE: To understand these list and philosophy behind them read following posts

The logic behind monitoring all time high volume

Why study stocks making 50% or a move in a month everyday

How I use the stock with extreme volume signal

How I trade momentum stocks

Tops or bottoms- it's a stock pickers market

How to find good stocks

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

Which, taken at the flood, leads on to fortune;

Omitted, all the voyage of their life

Is bound in shallows and in miseries.

This applies to stocks as well. Look at the three stocks in these lists:

IFO,Infosonics, JOYG,Joy Global Inc and MT,Mittal Steel Company N.V. These three stocks I have owned and traded in recent years.

Stocks up 50% or more in a month

IFO,Infosonics has rallied back to its old high. Look at the fundamentals to get a clue about why this stock has rallied so rapidly. It has almost doubled revenue from 73 million to 143 million in a year. This quarter the revenue has doubled compared to the same quarter a year earlier. If you look at earnings in 2005 they were 44 cents per share compared to a loss a year earlier. This quarter earnings are up almost 4 fold. Very few stocks have these kind of dramatic growth. Look at MED,Medifast and you will see similar kind of growth story.

If you monitor just the top 2% earning/sales performer in the market and forget about rest of the market, you will find a list of stocks like these. These stocks are volatile but they make dramatic price moves when they get going.

IFO,Infosonics

MED,Medifast Inc

Stocks with all time high volume

JOYG, Joy Global Inc made a move from a low price of 3.42 to 70 in few years. Look at the earning increases:1.20(2005),0.46 (2004),0.17(2003),-0.20(2002). Now yesterday it had a all time high volume. This coincides with latest earnings release. Which hinted at earnings slowdown. The party is over for this stock now. Rest of its life it will spend basing or going down.

MT,Mittal Steel Company N.V. was a penny stock few years ago. It made a low of 80 cents. From that low it went as high as 40 in few years. Look at the earnings during the fast price growth phase of this stock and you will understand why.

The all time high volume is linked to the failed merger.

EPL,Energy Partners Ltd

GCS,DWS Global Commodities Trust

JOYG,Joy Global Inc

MT,Mittal Steel Company N.V.

PBJ,PowerShares Dynamic Food & Beverage Portfolio ETF

Stocks down 50% or more in a month

BCGI,Boston Communications Gr

DOVP,Dov Pharmaceutical Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

LOUDD,Loudeye Corporation

NBIX,Neurocrine Biosciences

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

NOTE: To understand these list and philosophy behind them read following posts

The logic behind monitoring all time high volume

Why study stocks making 50% or a move in a month everyday

How I use the stock with extreme volume signal

How I trade momentum stocks

Tops or bottoms- it's a stock pickers market

How to find good stocks

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

5/25/2006

More proof of bottom

This is the cover of latest issue of Economist. If you are short run to get this issue.

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

All time high volume in QQQQ and SPY signals end of market correction

The bears have retreated on massive volume. This correction is over for now. The QQQQ,Nasdaq 100 Index Tracking Stock ETF, SPY,SPDRs S&P 500 Trust Series ETF and IWM,iShares Russell 2000 Index Fund ETF all three had a positive day on all time high volume.

Many of the components of NASDAQ 100 have already seen buying interest for last two to three days.

Also notice OIH,HOLDRS Oil Service ETF had a all time high volume. Keep a close eye on this sector for further clues to direction.

Keep your watchlist ready.

Stocks with all time high volume

BUF,Minrad International Inc

EEM,iShares MSCI Emerging Markets Index Fund ETF

EWZ,iShares MSCI Brazil Index Fund ETF

GGB,Gerdau Sa Ads

IWM,iShares Russell 2000 Index Fund ETF

LINTA,Liberty Media Interactive Class A

MDG,Meridian Gold Inc

OIH,HOLDRS Oil Service ETF

QQQQ,Nasdaq 100 Index Tracking Stock ETF

SBAC,Sba Communications Corp

SPY,SPDRs S&P 500 Trust Series ETF

Stocks up 50% or more in a month

IFO Infosonics

Stocks down 50% or more in a month

BCGI,Boston Communications Gr

DOVP,Dov Pharmaceutical Inc

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

NBIX,Neurocrine Biosciences

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

NOTE: To understand these list and philosophy behind them read following posts

The logic behind monitoring all time high volume

Why study stocks making 50% or a move in a month everyday

How I use the stock with extreme volume signal

How I trade momentum stocks

Tops or bottoms- it's a stock pickers market

How to find good stocks

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

5/24/2006

Linkfest

A business school in France is seeking a professor of Champagne

Driving around USA to find Top ten fast food.

The U.S. Postal Service is allowing companies to advertise on stamps.

Levi Strauss has designed a pair of jeans able to control a wearer's iPod.

Hedge fund manager loves getting his hands dirty when it comes to digging for stocks.

A poker champion who makes 7.5 million in a year.

It would take UK credit card debtors more than 75 years to clear borrowings at an affordable rate.

It is better to buy the worst house in the toniest neighbourhood rather than the best house on a modest street.

Shaking hands with arguably the most powerful man in the world.

"Our customers don't know jack about IPO valuations. Quick--sell 'em stock!"

How to Set Up Your Own Hedge Fund

Fed Uncertainty Means Market Uncertainty

Move over "chick lit" , now there is "lad lit" for guys.

There are worse things a girl could say to a guy.

Driving around USA to find Top ten fast food.

The U.S. Postal Service is allowing companies to advertise on stamps.

Levi Strauss has designed a pair of jeans able to control a wearer's iPod.

Hedge fund manager loves getting his hands dirty when it comes to digging for stocks.

A poker champion who makes 7.5 million in a year.

It would take UK credit card debtors more than 75 years to clear borrowings at an affordable rate.

It is better to buy the worst house in the toniest neighbourhood rather than the best house on a modest street.

Shaking hands with arguably the most powerful man in the world.

"Our customers don't know jack about IPO valuations. Quick--sell 'em stock!"

How to Set Up Your Own Hedge Fund

Fed Uncertainty Means Market Uncertainty

Move over "chick lit" , now there is "lad lit" for guys.

There are worse things a girl could say to a guy.

"The market will never rally again"

UPDATE: All time high volume in QQQQ and SPY signals end of market correction

Yesterday I got an email from one of the readers in response to yesterdays post.

It goes on and on about how we are doomed and how Bush has ruined the country and so on. I love it when the bears come out like this in full force.

The market action yesterday was disappointing. The market gapped up overnight but fizzled in last hour. There are several theories being talked about why it happened. The bird flue in Indonesia being the most talked about. You can never correlate news like that to markets action. Bad news in weak market is bad but the same bad news in strong market is shrugged off. Very bad news and series of bad news are also most common at extreme weakness level.

Some sectors attracted buying. This was mostly concentrated in the metals and energy sector. The ethanol stocks again seems to be in favor.

Market like this are good time to catch up with some readings and spend time on R&D. I have been catching up with lot of reading and will write about some good recent books I read. I have also been experimenting with new strategies using Trade-ideas and have found some good trading systems to add to my existing strategies.

Above all one needs to maintain sanity during such times. High velocity can play havoc with your emotions. You need perspective. You need confidence and conviction in your methodology. Backtesting can help. Market experience and knowledge of market history can also help .

Stocks up 50% or more in a month

All three plays in this list are related to strong earnings. HSR, Hi-Shear Technology Corp had a earning acceleration in recent quarter and is worth keeping an eye on.

HSR,Hi-Shear Technology Corp

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

BCGI,Boston Communications Gr

DOVP,Dov Pharmaceutical Inc

DSCO,Discovery Labs Inc

EDAP,Edap Tms Sa Adr

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

Stocks with all time high volume

PEIX,Pacific Ethanol Inc is the ethanol play. It also is experiencing significant sales acceleration.

AZK,Aurizon Mines Ltd

IWO,iShares Russell 2000 Growth Index Fund ETF

PEIX,Pacific Ethanol Inc

Stocks on my watchlist

The list continues to shrink. Those still on the list might be next to break down or in early stage of breakdown. Some are hanging on to their recent high and experiencing little volume. Those are the ones to watch for.

ACLI,American Commercial Lines Inc

ADLR,Adolor Corporation

AEM,Agnico-Eagle Mines Ltd

AMLN,Amylin Pharmaceuticals

ANAD,Anadigics Inc

ANDE,Andersons Inc (The)

AP,Ampco-Pittsburgh Corp

APAC,Apac Customer Services

APN,Applica Inc

ARD,Arena Resources Inc

ARS,Aleris International Inc

ASPV,Aspreva Pharmaceuticals

ATLS,Atlas America Inc

AXTI,Axt Inc

AZK,Aurizon Mines Ltd

BGC,General Cable Corp

BGO,Bema Gold Corp

BMD,Birch Mountain Resources Ltd

BUCY,Bucyrus International Inc

CAMT,Camtek Ltd

CBG,Cb Richard Ellis Svcs

CCJ,Cameco Corp

CELG,Celgene Corp

CELL,Brightpoint Inc

CFK,Ce Franklin Ltd

CHAP,Chaparral Steel Company

CLG,Cumberland Resources Ltd

CMCO,Columbus Mckinnon Cp(Ny)

COGO,Comtech Group Inc

CTRN,Citi Trends Inc

CUP,Peru Copper Inc

DAKT,Daktronics Inc

DBRN,Dress Barn Inc

DCEL,Dobson Communications A

DMX,I-trax Inc

DNR,Denbury Resources Ltd

DRQ,Dril-Quip Inc

DTLK,Datalink Corporation

DXPE,Dxp Enterprises Inc

ECOL,American Ecology Corp

EMIS,Emisphere Technologies

EUROD,EuroTrust A/S ADR

FAL,Falconbridge Ltd

FJC,Fedders Corp

FMCN,Focus Media Holding Ltd ADR

FNSR,Finisar Corporation

FRNS,First Avenue Networks Inc

FTI,Fmc Technologies

FTO,Frontier Oil Corp

FWLT,Foster Wheeler Ltd

GAIA,Gaiam Incorporated Cl A

GDI,Gardner Denver Inc

GEX,Globix Corp

GFX,Media Sciences Intl Inc

GI,Giant Industries Inc

GIGM,Gigamedia Limited

GLBL,Global Industries Ltd

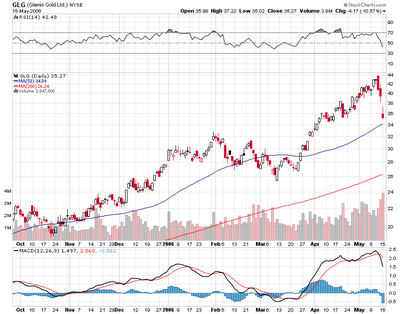

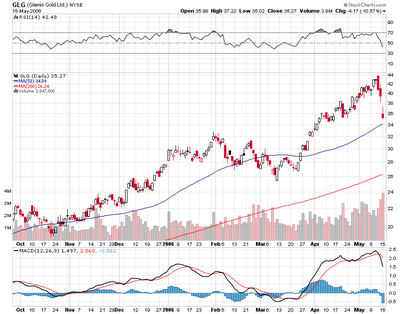

GLG,Glamis Gold Ltd

GMTC,Gametech Internat Inc

GORX,Geopharma Inc

GROW,U.S. Global Invest Inc A

GVP,Gse Systems Inc

GYMB,Gymboree Corp

HANS,Hansen Natural Corp

HOC,Holly Corp

HOM,Home Solutions Of America

HSR,Hi-Shear Technology Corp

ICCA,Internet Commerce Cl A

ICON,Iconix Brand Group

ICTG,Ict Group Inc

IFO,Infosonics

IIG,Imergent Inc

IIP,Internap Network Svcs Cp

ILMN,Illumina Inc

IMCO,Impco Technologies Inc

INB,Integrated BioPharma Inc

ISIG,Insignia Systems Inc

ISRG,Intuitive Surgical Inc

ISV,Insite Vision Inc

JLL,Jones Lang Lasalle Inc

JOYG,Joy Global Inc

KFRC,Kforce.Com Inc

KNDL,Kendle Internat Inc

KNOL,Knology Inc

KNOT,The Knot Inc

KNXA,Kenexa Corp

KRSL,Kreisler Manufacturing

LANV,Lanvision Systems Inc

LCC,US Airways Group Inc

LCRD,Lasercard Corporation

LDSH,Ladish Co Inc

LMIA,Lmi Aerospace Inc

LNUX,Va Software Corp

LTXX,Ltx Corp

LUFK,Lufkin Industries Inc

LVLT,Level 3 Communications

LVS,Las Vegas Sands

MBRX,Metabasis Therapeutics Inc

MDR,Mcdermott Internat Inc

MED,Medifast Inc

MGPI,Mgp Ingredients Inc

MORN,Morningstar Inc

MOVE,HomeStore Inc

MOVI,Movie Gallery Inc

MTRX,Matrix Service Co

MTW,Manitowoc Co Inc

MWRK,Mothers Work Inc

NAVI,Navisite Incorporated

NEU,Newmarket Corp

NITE,Knight Capital Group Inc Cl A

NTG,Natco Group Incorporated

NTRI,NutriSystem Inc

NXXI,Nutrition 21 Inc

NXY,Nexen Inc

OII,Oceaneering Internat

OMNI,Omni Energy Services Cp

OS,Oregon Steel Mills Inc

OYOG,Oyo Geospace Corp

PAE,Peace Arch Entmt Grp Inc

PGS,Petroleum Geo-services Asa

PGWC,Pegasus Wireless Corp (NV)

PJC,Piper Jaffray Companies

PLLL,Parallel Petroleum Corp

PLXS,Plexus Corp

PMTR,Pemstar Inc

PSTA,Monterey Gourmet Foods Inc

PWEI,Pw Eagle Inc

RAIL,FreightCar America Inc

RATE,Bankrate Inc

RBAK,Redback Networks Inc

RCCC,Rural Cellular Corp

RHAT,Red Hat Inc

RICK,Rick's Caberet Intl

RMIX,U.S. Concrete Inc

RNOW,Rightnow Technologies Inc

RPRX,Repros Therapeutics Inc

RTI,Rti Internat Metal Inc

RTK,Rentech Inc

SA,Seabridge Gold Inc

SHOO,Steven Madden Ltd

SMDI,Sirenza Microdevices

SMSI,Smith Micro Software Inc

SNTO,Sento Corporation

SPN,Superior Energy Svcs Inc

STIZ,Scientific Technologies

STRL,Sterling Construction Comp Inc

SU,Suncor Energy

SUPX,Supertex Inc

SVL,Silverleaf Resorts Inc

SVVS,SAVVIS Inc

SWIR,Sierra Wireless Inc

TACT,Transact Technologies

TESOF,Tesco Corp

TFSM,24/7 Real Media Inc

TIE,Titanium Metals Corp New

TMY,Transmeridian Exploration Inc

TRE,Tanzanian Royalty Exploration Corp

TRN,Trinity Industries Inc

TSCM,Thestreet.Com

TTES,T-3 Energy Services Inc

TTI,Tetra Technologies Inc

TWGP,Tower Grp Inc

TWIN,Twin Disc Inc

TWTC,Time Warner Telecom Inc

TWTR,Tweeter Home Entertainmt

UPL,Ultra Petroleum Corp

USEY,U.S. Energy Systems Inc

USG,Usg Corp

WCC,Wesco International Inc

WHQ,W-h Energy Services Inc

WIRE,Encore Wire Corp

WWWW,Web.Com Inc

XTXI,Crosstex Energy

ZOLT,Zoltek Companies Inc

ZRAN,Zoran Corp

ZUMZ,Zumiez Inc

ZVXI,Zevex Internat Inc

NOTE: To understand these list and philosophy behind them read following posts

The logic behind monitoring all time high volume

Why study stocks making 50% or a move in a month everyday

How I use the stock with extreme volume signal

How I trade momentum stocks

Tops or bottoms- it's a stock pickers market

How to find good stocks

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

Yesterday I got an email from one of the readers in response to yesterdays post.

"The market is not going to rally again. You are an idiot. You don't understand markets and keep looking for bounce. Learn short selling........"

It goes on and on about how we are doomed and how Bush has ruined the country and so on. I love it when the bears come out like this in full force.

The market action yesterday was disappointing. The market gapped up overnight but fizzled in last hour. There are several theories being talked about why it happened. The bird flue in Indonesia being the most talked about. You can never correlate news like that to markets action. Bad news in weak market is bad but the same bad news in strong market is shrugged off. Very bad news and series of bad news are also most common at extreme weakness level.

Some sectors attracted buying. This was mostly concentrated in the metals and energy sector. The ethanol stocks again seems to be in favor.

Market like this are good time to catch up with some readings and spend time on R&D. I have been catching up with lot of reading and will write about some good recent books I read. I have also been experimenting with new strategies using Trade-ideas and have found some good trading systems to add to my existing strategies.

Above all one needs to maintain sanity during such times. High velocity can play havoc with your emotions. You need perspective. You need confidence and conviction in your methodology. Backtesting can help. Market experience and knowledge of market history can also help .

Stocks up 50% or more in a month

All three plays in this list are related to strong earnings. HSR, Hi-Shear Technology Corp had a earning acceleration in recent quarter and is worth keeping an eye on.

HSR,Hi-Shear Technology Corp

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

BCGI,Boston Communications Gr

DOVP,Dov Pharmaceutical Inc

DSCO,Discovery Labs Inc

EDAP,Edap Tms Sa Adr

ERS,Empire Resources

ESCL,Escala Group Inc

FLYIQ,FLYI Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

NTMD,Nitromed Inc

THLD,Threshold Pharmaceuticals

Stocks with all time high volume

PEIX,Pacific Ethanol Inc is the ethanol play. It also is experiencing significant sales acceleration.

AZK,Aurizon Mines Ltd

IWO,iShares Russell 2000 Growth Index Fund ETF

PEIX,Pacific Ethanol Inc

Stocks on my watchlist

The list continues to shrink. Those still on the list might be next to break down or in early stage of breakdown. Some are hanging on to their recent high and experiencing little volume. Those are the ones to watch for.

ACLI,American Commercial Lines Inc

ADLR,Adolor Corporation

AEM,Agnico-Eagle Mines Ltd

AMLN,Amylin Pharmaceuticals

ANAD,Anadigics Inc

ANDE,Andersons Inc (The)

AP,Ampco-Pittsburgh Corp

APAC,Apac Customer Services

APN,Applica Inc

ARD,Arena Resources Inc

ARS,Aleris International Inc

ASPV,Aspreva Pharmaceuticals

ATLS,Atlas America Inc

AXTI,Axt Inc

AZK,Aurizon Mines Ltd

BGC,General Cable Corp

BGO,Bema Gold Corp

BMD,Birch Mountain Resources Ltd

BUCY,Bucyrus International Inc

CAMT,Camtek Ltd

CBG,Cb Richard Ellis Svcs

CCJ,Cameco Corp

CELG,Celgene Corp

CELL,Brightpoint Inc

CFK,Ce Franklin Ltd

CHAP,Chaparral Steel Company

CLG,Cumberland Resources Ltd

CMCO,Columbus Mckinnon Cp(Ny)

COGO,Comtech Group Inc

CTRN,Citi Trends Inc

CUP,Peru Copper Inc

DAKT,Daktronics Inc

DBRN,Dress Barn Inc

DCEL,Dobson Communications A

DMX,I-trax Inc

DNR,Denbury Resources Ltd

DRQ,Dril-Quip Inc

DTLK,Datalink Corporation

DXPE,Dxp Enterprises Inc

ECOL,American Ecology Corp

EMIS,Emisphere Technologies

EUROD,EuroTrust A/S ADR

FAL,Falconbridge Ltd

FJC,Fedders Corp

FMCN,Focus Media Holding Ltd ADR

FNSR,Finisar Corporation

FRNS,First Avenue Networks Inc

FTI,Fmc Technologies

FTO,Frontier Oil Corp

FWLT,Foster Wheeler Ltd

GAIA,Gaiam Incorporated Cl A

GDI,Gardner Denver Inc

GEX,Globix Corp

GFX,Media Sciences Intl Inc

GI,Giant Industries Inc

GIGM,Gigamedia Limited

GLBL,Global Industries Ltd

GLG,Glamis Gold Ltd

GMTC,Gametech Internat Inc

GORX,Geopharma Inc

GROW,U.S. Global Invest Inc A

GVP,Gse Systems Inc

GYMB,Gymboree Corp

HANS,Hansen Natural Corp

HOC,Holly Corp

HOM,Home Solutions Of America

HSR,Hi-Shear Technology Corp

ICCA,Internet Commerce Cl A

ICON,Iconix Brand Group

ICTG,Ict Group Inc

IFO,Infosonics

IIG,Imergent Inc

IIP,Internap Network Svcs Cp

ILMN,Illumina Inc

IMCO,Impco Technologies Inc

INB,Integrated BioPharma Inc

ISIG,Insignia Systems Inc

ISRG,Intuitive Surgical Inc

ISV,Insite Vision Inc

JLL,Jones Lang Lasalle Inc

JOYG,Joy Global Inc

KFRC,Kforce.Com Inc

KNDL,Kendle Internat Inc

KNOL,Knology Inc

KNOT,The Knot Inc

KNXA,Kenexa Corp

KRSL,Kreisler Manufacturing

LANV,Lanvision Systems Inc

LCC,US Airways Group Inc

LCRD,Lasercard Corporation

LDSH,Ladish Co Inc

LMIA,Lmi Aerospace Inc

LNUX,Va Software Corp

LTXX,Ltx Corp

LUFK,Lufkin Industries Inc

LVLT,Level 3 Communications

LVS,Las Vegas Sands

MBRX,Metabasis Therapeutics Inc

MDR,Mcdermott Internat Inc

MED,Medifast Inc

MGPI,Mgp Ingredients Inc

MORN,Morningstar Inc

MOVE,HomeStore Inc

MOVI,Movie Gallery Inc

MTRX,Matrix Service Co

MTW,Manitowoc Co Inc

MWRK,Mothers Work Inc

NAVI,Navisite Incorporated

NEU,Newmarket Corp

NITE,Knight Capital Group Inc Cl A

NTG,Natco Group Incorporated

NTRI,NutriSystem Inc

NXXI,Nutrition 21 Inc

NXY,Nexen Inc

OII,Oceaneering Internat

OMNI,Omni Energy Services Cp

OS,Oregon Steel Mills Inc

OYOG,Oyo Geospace Corp

PAE,Peace Arch Entmt Grp Inc

PGS,Petroleum Geo-services Asa

PGWC,Pegasus Wireless Corp (NV)

PJC,Piper Jaffray Companies

PLLL,Parallel Petroleum Corp

PLXS,Plexus Corp

PMTR,Pemstar Inc

PSTA,Monterey Gourmet Foods Inc

PWEI,Pw Eagle Inc

RAIL,FreightCar America Inc

RATE,Bankrate Inc

RBAK,Redback Networks Inc

RCCC,Rural Cellular Corp

RHAT,Red Hat Inc

RICK,Rick's Caberet Intl

RMIX,U.S. Concrete Inc

RNOW,Rightnow Technologies Inc

RPRX,Repros Therapeutics Inc

RTI,Rti Internat Metal Inc

RTK,Rentech Inc

SA,Seabridge Gold Inc

SHOO,Steven Madden Ltd

SMDI,Sirenza Microdevices

SMSI,Smith Micro Software Inc

SNTO,Sento Corporation

SPN,Superior Energy Svcs Inc

STIZ,Scientific Technologies

STRL,Sterling Construction Comp Inc

SU,Suncor Energy

SUPX,Supertex Inc

SVL,Silverleaf Resorts Inc

SVVS,SAVVIS Inc

SWIR,Sierra Wireless Inc

TACT,Transact Technologies

TESOF,Tesco Corp

TFSM,24/7 Real Media Inc

TIE,Titanium Metals Corp New

TMY,Transmeridian Exploration Inc

TRE,Tanzanian Royalty Exploration Corp

TRN,Trinity Industries Inc

TSCM,Thestreet.Com

TTES,T-3 Energy Services Inc

TTI,Tetra Technologies Inc

TWGP,Tower Grp Inc

TWIN,Twin Disc Inc

TWTC,Time Warner Telecom Inc

TWTR,Tweeter Home Entertainmt

UPL,Ultra Petroleum Corp

USEY,U.S. Energy Systems Inc

USG,Usg Corp

WCC,Wesco International Inc

WHQ,W-h Energy Services Inc

WIRE,Encore Wire Corp

WWWW,Web.Com Inc

XTXI,Crosstex Energy

ZOLT,Zoltek Companies Inc

ZRAN,Zoran Corp

ZUMZ,Zumiez Inc

ZVXI,Zevex Internat Inc

NOTE: To understand these list and philosophy behind them read following posts

The logic behind monitoring all time high volume

Why study stocks making 50% or a move in a month everyday

How I use the stock with extreme volume signal

How I trade momentum stocks

Tops or bottoms- it's a stock pickers market

How to find good stocks

Special offers:

Try Telechart now. First 30 days free

Get 7 days free trial of Trade-ideas

5/23/2006

Ready for the next market move

When the US markets sneeze, others catch cold. A policy decision in USA about interest rates is playing havoc with the emerging markets. International diversification of your portfolio was the latest buzz for many investment advisors and portfolio managers. The theory was that the US has structural problems with its deficit and so the international markets were safe heaven. Another theme which people had digested and started believing in was commodities. Everyone has discovered that when the market tumbles there are no safe heavens.

GS, Goldman Sachs Group Inc pushed for the BRIC economies in 2003 and they were right about it. But now these market have taken big hits. The suddenness and speed of the decline has caught many people in wrong position.

A 10% down move in market after a long move is just a healthy correction. Now Goldman Sachs analyst are calling this correction a result of " Bernanke Bind". The hypothesis is that he is underestimating the risk of inflation. Plus he has the credibility problem after his famous fling with Maria Bartiromo.

Now that everyone is convinced crash is just a matter of time, the market will have its own agenda and will not follow the anticipated script. So a tradeable bounce is the next likely move. I am nibbling at some longs and all ready with my buylist once the market tips it hand this week.

When the market bounces back new themes will emerge. Some stocks in beaten down technology sector look attractive and have not been dented by the correction. Keep an eye on GOOG and AAPL

Stocks up 50% or more in a month

IFO,Infosonics

LBY,Libbey Inc

MED,Medifast Inc

Stocks down 50% or more in a month

EDAP,Edap Tms Sa Adr

ERS,Empire Resources

ESCL,Escala Group Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

Stock with all time high volume

ARWR,Arrowhead Research Corp

BWCF,Bwc Financial Corp

CORE,Core-Mark Holding Company Inc

CURN,Curon Medical Inc

EEM,iShares MSCI Emerging Markets Index Fund ETF

EWT,iShares MSCI Taiwan Index Fund ETF

EWW,iShares MSCI Mexico Index Fund ETF

EWY,iShares MSCI South Korea Index Fund ETF

EWZ,iShares MSCI Brazil Index Fund ETF

FXI,iShares FTSE/Xinhua China 25 Index Fund ETF

GGY,Compagnie Generale De Ge

IFN,India Fund

ILF,iShares S&P Latin America 40 Index Fund ETF

ITU,Banco Itau S A Adr

JAMS,Jameson Inns Inc

MTU,Mitsubishi UFJ Financial Group Inc

TRID,Trident Microsystems Inc

GS, Goldman Sachs Group Inc pushed for the BRIC economies in 2003 and they were right about it. But now these market have taken big hits. The suddenness and speed of the decline has caught many people in wrong position.

A 10% down move in market after a long move is just a healthy correction. Now Goldman Sachs analyst are calling this correction a result of " Bernanke Bind". The hypothesis is that he is underestimating the risk of inflation. Plus he has the credibility problem after his famous fling with Maria Bartiromo.

Now that everyone is convinced crash is just a matter of time, the market will have its own agenda and will not follow the anticipated script. So a tradeable bounce is the next likely move. I am nibbling at some longs and all ready with my buylist once the market tips it hand this week.

When the market bounces back new themes will emerge. Some stocks in beaten down technology sector look attractive and have not been dented by the correction. Keep an eye on GOOG and AAPL

Stocks up 50% or more in a month

IFO,Infosonics

LBY,Libbey Inc

MED,Medifast Inc

Stocks down 50% or more in a month

EDAP,Edap Tms Sa Adr

ERS,Empire Resources

ESCL,Escala Group Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

Stock with all time high volume

ARWR,Arrowhead Research Corp

BWCF,Bwc Financial Corp

CORE,Core-Mark Holding Company Inc

CURN,Curon Medical Inc

EEM,iShares MSCI Emerging Markets Index Fund ETF

EWT,iShares MSCI Taiwan Index Fund ETF

EWW,iShares MSCI Mexico Index Fund ETF

EWY,iShares MSCI South Korea Index Fund ETF

EWZ,iShares MSCI Brazil Index Fund ETF

FXI,iShares FTSE/Xinhua China 25 Index Fund ETF

GGY,Compagnie Generale De Ge

IFN,India Fund

ILF,iShares S&P Latin America 40 Index Fund ETF

ITU,Banco Itau S A Adr

JAMS,Jameson Inns Inc

MTU,Mitsubishi UFJ Financial Group Inc

TRID,Trident Microsystems Inc

5/22/2006

Going long

Market opened ugly today but by end of day found buyers. I am putting capital back to work on long side. I am looking at number of earnings play and many signaled entry today. Feels like a tradeable bounce is developing.

Police on alert for suicides after stocks slide

The Indian stock market has crashed trapping many over eager bulls. The Indian market has a history of crashes. The regulations are lax and seldom enforced leading to periodic scandals.

Mumbai, May 22: Police are watching out for possible suicides by brokers and investors after a steep market slide wiped out billions of dollars in share values, officials said on Monday.

Policemen were keeping a watch near lakes and canals, possible places where people in distress could head to kill themselves. They said rescue teams were on alert.

Stock Market pauses but .......

After multi day sell off the market paused on Friday. Many indexes are showing high volume because of option expiration effect. Beaten down stocks have seen some stabilization. We may see more weakness at this level as the groups which have topped attract more unloading of long built positions. I am expecting more weakness before the market becomes tradeable.

The weekly commentary is bearish and full of apocalypse scenarios . The new theme now is inflation. There are some arguing about how the CPI is a conspiracy and it understates inflation. Most of the time such conspiracy theories are used by commentators to push pet theories and to use them selectively when it is convenient.

The fact is that the market downturn was inevitable for many reasons. The market was rallying without major pullback for months. The commodities market was in a blowout phase. The bond market was signaling higher interest rates. Worldwide the central bankers were raising interest rate.

The market correction coincides with earning period end. So there is window of 10-12 weeks for this correction to play out. In another 6 weeks the market will again move in earning anticipation mode. So long opportunities will emerge. The summer months are slow months and soon we should see that effect in markets.

Stocks up 50% or more in a month

Not much activity in this list. FRNS, First Avenue Networks Inc move in merger related. So the market likes the merger. MED, Medifast Inc and IFO,Infosonics are both earnings play and have not been affected by the market weakness.

FRNS,First Avenue Networks Inc

IFO,Infosonics

MED,Medifast Inc

Stocks with all time high volume

AMT,American Tower Corp

ATI,Allegheny Technologies

BEE,Strategic Hotel & Resorts Inc

BZF,Brazil Fund Inc

EWM,iShares MSCI Malaysia Index Fund ETF

EWY,iShares MSCI South Korea Index Fund ETF

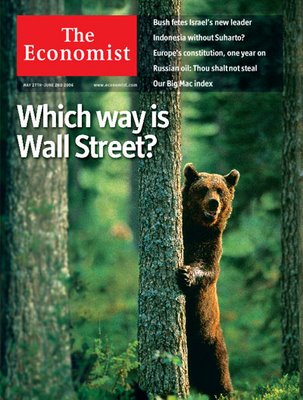

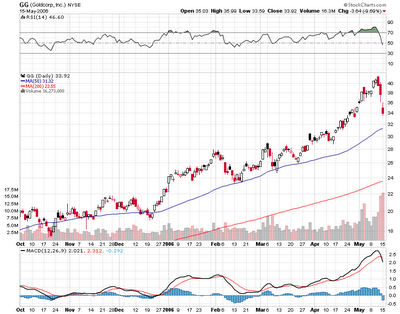

GG,Goldcorp Inc

GLG,Glamis Gold Ltd

IFN,India Fund

JKK,iShares Morningstar Small Growth Index Fund ETF

KNBWY,Kirin Brewery Company Ltd Adr

MT,Mittal Steel Company N.V.

NXG,Northgate Minerals Corp

QSFT,Quest Software Inc

RACK,Rackable Systems Inc

TTM,Tata Motors Ltd Ads

Stocks down 50% or more in a month

EDAP,Edap Tms Sa Adr

ESCL,Escala Group Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

The weekly commentary is bearish and full of apocalypse scenarios . The new theme now is inflation. There are some arguing about how the CPI is a conspiracy and it understates inflation. Most of the time such conspiracy theories are used by commentators to push pet theories and to use them selectively when it is convenient.

The fact is that the market downturn was inevitable for many reasons. The market was rallying without major pullback for months. The commodities market was in a blowout phase. The bond market was signaling higher interest rates. Worldwide the central bankers were raising interest rate.

The market correction coincides with earning period end. So there is window of 10-12 weeks for this correction to play out. In another 6 weeks the market will again move in earning anticipation mode. So long opportunities will emerge. The summer months are slow months and soon we should see that effect in markets.

Stocks up 50% or more in a month

Not much activity in this list. FRNS, First Avenue Networks Inc move in merger related. So the market likes the merger. MED, Medifast Inc and IFO,Infosonics are both earnings play and have not been affected by the market weakness.

FRNS,First Avenue Networks Inc

IFO,Infosonics

MED,Medifast Inc

Stocks with all time high volume

AMT,American Tower Corp

ATI,Allegheny Technologies

BEE,Strategic Hotel & Resorts Inc

BZF,Brazil Fund Inc

EWM,iShares MSCI Malaysia Index Fund ETF

EWY,iShares MSCI South Korea Index Fund ETF

GG,Goldcorp Inc

GLG,Glamis Gold Ltd

IFN,India Fund

JKK,iShares Morningstar Small Growth Index Fund ETF

KNBWY,Kirin Brewery Company Ltd Adr

MT,Mittal Steel Company N.V.

NXG,Northgate Minerals Corp

QSFT,Quest Software Inc

RACK,Rackable Systems Inc

TTM,Tata Motors Ltd Ads

Stocks down 50% or more in a month

EDAP,Edap Tms Sa Adr

ESCL,Escala Group Inc

FORD,Forward Industries Inc

NBIX,Neurocrine Biosciences

NMHC,National Med Hlth Card

5/19/2006

The Investors Business Daily has interesting statistics about the market in today's newspaper. But it only tells part of the story. You may want to look at what happened 10 days, a month, a quarter or a year after that.

There are two kinds of corrections. The sharp corrections are invariable followed by sharp rebounds. The slow drip drip kind of corrections last longer in duration.

Stocks with extreme volume

NBR,Nabors Industries Inc had all time high volume yesterday. The stock did not participate much in the Energy sector rally last year and lagged its peers in yearly price growth rates. Might be a good candidate to watch for short sell.

HW,Headwaters Inc

ILF,iShares S&P Latin America 40 Index Fund ETF

JSDA,Jones Soda Co

NBR,Nabors Industries Inc

Stocks up 50% or more in a month

Keep both these stocks IFO,Infosonics and MED,Medifast Inc in your watchlist, when the market clears, they might have potential, as both have excellent EPS, sales and price growth.

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

To see how stocks on short side behave, I created this mirror image scan of 'Stocks up 50% or more in a month'. You will notice in spite of overall market weakness there are only 4 stocks on this list. This should not be a surprise to those who have tested short strategies. Short strategies have lower expectancies and offer fewer trading opportunities. Also seldom you will get smooth down trends. Most of the time it will be series of gap downs making it difficult to time entries.

ESCL,Escala Group Inc

NBIX,Neurocrine Biosciences

PLAY,Portalplayer

PQE,Proquest Company

Stocks down 50% or more in a year

Now to get a broader picture I looked at a scan of stocks down 50% or more for a year.(price above 50% and average daily cash flow of above 250000 for month) It has 33 stocks only. How does this compare to 443 stocks up 100% or more in a year. We will see if this universe increases dramatically in bear market as the market has just turned bearish while it was in bull market for four years.

ABLE,Able Energy Inc

ANTP,Phazar Corp

ARBX,Arbinet-thexchange

BHIP,Natural Health Trends Corp

BKF,Bkf Capital Group

BTRX,Barrier Therapeutics

CCOI,Cogent Communications Group Inc

CHCI,Comstock Homebuilding Comp

CMN,Cantel Medical Corp.

DDIC,Ddi Corp

DRL,Doral Financial Corp

ENWV,Endwave Corporation

FBP,First Bancorp Holding Co

FORD,Forward Industries Inc

HDL,Handleman Co

IDIX,Idenix Pharmaceuticals Inc

IOC,Interoil Corporation

MRH,Montpelier Re

NABI,Nabi Biopharmaceuticals

NPSP,Nps Pharmaceuticals Inc

PLB,American Italian Pasta

PQE,Proquest Company

RIGL,Rigel Pharmaceuticals Inc

SFCC,SFBC International Inc

SGTL,Sigmatel

SNDA,Shanda Interactive Ent Ltd

SPC,Spectrum Brands Inc

TARO,Taro Pharmaceutical Inds

TIV,Tri-valley Corp

TRMM,Trm Corporation

TWMC,Trans World Entertain Cp

WON,Westwood One Inc

WPTE,WPT Enterprises Inc

Remider: Try Trade-Ideas beta for free

This version has more options for sounds including custom sounds that you can make yourself! It will be released Week of 5/22. Click to download the beta 1.9

The beta is free in demo mode. Use "demo" for username and password and select the "Free High/Low Ticker".

Since1974, the Nasdaq has seen only six losing streaks longer than the current eight-day skid. The composite flashed two nine-day losing streaks in 1982. It's seen three 10 day slumps, once in 1975, 1975 and 1984. The worst stretch came in'84 when the Nasdaq tumbled 16 days in a row.

There are two kinds of corrections. The sharp corrections are invariable followed by sharp rebounds. The slow drip drip kind of corrections last longer in duration.

Stocks with extreme volume

NBR,Nabors Industries Inc had all time high volume yesterday. The stock did not participate much in the Energy sector rally last year and lagged its peers in yearly price growth rates. Might be a good candidate to watch for short sell.

HW,Headwaters Inc

ILF,iShares S&P Latin America 40 Index Fund ETF

JSDA,Jones Soda Co

NBR,Nabors Industries Inc

Stocks up 50% or more in a month

Keep both these stocks IFO,Infosonics and MED,Medifast Inc in your watchlist, when the market clears, they might have potential, as both have excellent EPS, sales and price growth.

IFO,Infosonics

MED,Medifast Inc

Stocks down 50% or more in a month

To see how stocks on short side behave, I created this mirror image scan of 'Stocks up 50% or more in a month'. You will notice in spite of overall market weakness there are only 4 stocks on this list. This should not be a surprise to those who have tested short strategies. Short strategies have lower expectancies and offer fewer trading opportunities. Also seldom you will get smooth down trends. Most of the time it will be series of gap downs making it difficult to time entries.

ESCL,Escala Group Inc

NBIX,Neurocrine Biosciences

PLAY,Portalplayer

PQE,Proquest Company

Stocks down 50% or more in a year

Now to get a broader picture I looked at a scan of stocks down 50% or more for a year.(price above 50% and average daily cash flow of above 250000 for month) It has 33 stocks only. How does this compare to 443 stocks up 100% or more in a year. We will see if this universe increases dramatically in bear market as the market has just turned bearish while it was in bull market for four years.

ABLE,Able Energy Inc

ANTP,Phazar Corp

ARBX,Arbinet-thexchange

BHIP,Natural Health Trends Corp

BKF,Bkf Capital Group

BTRX,Barrier Therapeutics

CCOI,Cogent Communications Group Inc

CHCI,Comstock Homebuilding Comp

CMN,Cantel Medical Corp.

DDIC,Ddi Corp

DRL,Doral Financial Corp

ENWV,Endwave Corporation

FBP,First Bancorp Holding Co

FORD,Forward Industries Inc

HDL,Handleman Co

IDIX,Idenix Pharmaceuticals Inc

IOC,Interoil Corporation

MRH,Montpelier Re

NABI,Nabi Biopharmaceuticals

NPSP,Nps Pharmaceuticals Inc

PLB,American Italian Pasta

PQE,Proquest Company

RIGL,Rigel Pharmaceuticals Inc

SFCC,SFBC International Inc

SGTL,Sigmatel

SNDA,Shanda Interactive Ent Ltd

SPC,Spectrum Brands Inc

TARO,Taro Pharmaceutical Inds

TIV,Tri-valley Corp

TRMM,Trm Corporation

TWMC,Trans World Entertain Cp

WON,Westwood One Inc

WPTE,WPT Enterprises Inc

Remider: Try Trade-Ideas beta for free

This version has more options for sounds including custom sounds that you can make yourself! It will be released Week of 5/22. Click to download the beta 1.9

The beta is free in demo mode. Use "demo" for username and password and select the "Free High/Low Ticker".

5/18/2006

Babak at Tradersnarrative has a good analysis of current market situation.

Here'’s another statistic that will blow your mind: out of all the thousands of stocks out there, less than a third have managed to close up for the day in the past five consecutive days. This has happened at market bottoms like Sept 2001, October 2002 and May 2004. But before you get excited, this sort of pattern also has a history of presaging market drops (like 1987).

My conclusion? I thought you'’d never ask. If you had short exposure, (congratulations! but…) this is the time to think about exit targets and adjusting your stops lower. It is not the time to be pressing shorts or initiating new short positions. We may have another whoosh down but the probability now points more to a rally. I would be searching here for potential long setups. I think we'’re going to have so many soon that it'’ll make you dizzy to choose from amongst them.

What I am monitoring and why

These are the kind of stocks, I have in my watchlist (at the bottom of the post). All of them meet the criteria of either high EPS, sales or price growth. Many of these have not been dented much by the recent overall market correction. Some of these will break down if the down move continues and for those seeking short entry might provide good candidates. During sustained market turns one by one such leading stocks break down adding more fuel.

When the markets rebounds, some of these stocks will be the first to rebound. A 2-4 weeks counter trend rallies during sustained market weaknesses are a common phenomenon and stocks like these can make good moves during that period.

Also certain sectors act contrary to the market move because of the nature of their business. During the 2001 correction following groups had 30% or more price growth for a year. Three groups out of these had 90% move (highlighted in bold). Over 300 stocks doubled during that period.

MG328,Office Supplies,CONSUMER NON-DURABLES - Office Supplies

MG345,Dairy Products,FOOD & BEVERAGE - Dairy Products

MG515,Drug Related Products,DRUGS - Drug Related Products

MG631,Residential Construction,MATERIALS & CONSTRUCTION - Residential Construction

MG632,Manufactured Housing,MATERIALS & CONSTRUCTION - Manufactured Housing

MG736,Home Improvement Stores,RETAIL - Home Improvement Stores

MG737,Home Furnishing Stores,RETAIL - Home Furnishing Stores

MG738,Auto Parts Stores,RETAIL - Auto Parts Stores

MG739,Catalog & Mail Order Houses,RETAIL - Catalog & Mail Order Houses

MG741,Sporting Goods Stores,SPECIALTY RETAIL - Sporting Goods Stores

MG744,Music & Video Stores,SPECIALTY RETAIL - Music & Video Stores

MG745,Auto Dealerships,SPECIALTY RETAIL - Auto Dealerships

MG751,Auto Parts Wholesale,WHOLESALE - Auto Parts Wholesale

MG752,Building Materials Wholesale,WHOLESALE - Building Materials Wholesale

MG763,Personal Service,DIVERSIFIED SERVICES - Personal Services

MG764,Consumer Services,DIVERSIFIED SERVICES - Consumer Services

MG766,Security & Protection Services,DIVERSIFIED SERVICES - Security & Protection Services

MG821,Multimedia & Graphics Software,COMPUTER SOFTWARE & SERVICES - Multimedia & Graphics Software

These stocks were up 500% or more during the worst phase of bear market. This list does not include stocks which have merged or bought out.

AFAM,Almost Family Inc

AHN,Atc Healthcare Inc

ASCA,Ameristar Casinos Inc

BDY,Bradley Pharmaceuticals

BYI,Bally Technologies Inc

CBK,Christopher & Banks Corp

DYII,Dynacq Healthcare Inc

GMCR,Green Mountain Coffee Roasters

HW,Headwaters Inc

HWAY,Healthways Inc

IMA,Inverness Medical Tchnlg

KMX,Carmax Inc

KOSP,Kos Pharmaceuticals Inc

MGAM,Multimedia Games Inc

MOVI,Movie Gallery Inc

MSCC,Microsemi Corp

NG,Novagold Resources Inc

NPTH,Enpath Medical Inc

NVDA,NVIDIA Corporation

PNRA,Panera Bread Co Cl A

PPHM,Peregrine Pharmaceuticls

PRX,Par Pharmaceutical Co Inc

PSAI,Pediatric Services Am

SMD,Singing Machine

TARO,Taro Pharmaceutical Inds

TRR,Trc Companies Inc

So there are long opportunities to be found in such conditions. What you need is a systematic methodology and approach to find them. You need right tools/ scans and methods to find such opportunities. Above all you need a way to shut off the market noise.

Watchlist

ACLI,American Commercial Lines Inc

ADLR,Adolor Corporation

AE,Adams Resources & Energy

AKAM,Akamai Technologies Inc

ALY,Allis-Chalmers Energy Inc

AMKR,Amkor Technology Inc

ANAD,Anadigics Inc

ANDE,Andersons Inc (The)

AP,Ampco-Pittsburgh Corp

ARS,Aleris International Inc

ASPV,Aspreva Pharmaceuticals

ASTSF,Ase Test Limited Ord Shr

ATI,Allegheny Technologies

BFT,Bally Total Fit Hldg

BGC,General Cable Corp

BMD,Birch Mountain Resources Ltd

BTUI,Btu International Inc

BWNG,Broadwing Corp

CELG,Celgene Corp

CHAP,Chaparral Steel Company

CHDX,Chindex International Inc

CHIC,Charlotte Russe Hldg Inc

CMCO,Columbus Mckinnon Cp(Ny)

CPTS,Conceptus Inc

CTRN,Citi Trends Inc

DCEL,Dobson Communications A

DIL,Dyadic International Inc

DNR,Denbury Resources Ltd

DRQ,Dril-Quip Inc

DXPE,Dxp Enterprises Inc

EAGL,Egl Incorporated

ECOL,American Ecology Corp

EMIS,Emisphere Technologies

EUROD,EuroTrust A/S ADR

EZPW,Ezcorp Inc Cl A

FAL,Falconbridge Ltd

FMCN,Focus Media Holding Ltd ADR

FTI,Fmc Technologies

FTO,Frontier Oil Corp

FWLT,Foster Wheeler Ltd

GAIA,Gaiam Incorporated Cl A

GDI,Gardner Denver Inc

GI,Giant Industries Inc

GIGM,Gigamedia Limited

GLBL,Global Industries Ltd

GMTC,Gametech Internat Inc

GPIC,Gaming Partners Intl

GROW,U.S. Global Invest Inc A

GYMB,Gymboree Corp

HANS,Hansen Natural Corp

HOC,Holly Corp

HOM,Home Solutions Of America

HSR,Hi-Shear Technology Corp

IAAC,Internat Asset Holdg Cp

ICE,Intercontinental Exchange Inc

ICON,Iconix Brand Group

ICTG,Ict Group Inc

IFO,Infosonics

IIG,Imergent Inc

ILMN,Illumina Inc

IMCO,Impco Technologies Inc

IPII,Imperial Industries Inc

IPSU,Imperial Sugar Company

ISRG,Intuitive Surgical Inc

ITG,Investment Technology

JLL,Jones Lang Lasalle Inc

KFRC,Kforce.Com Inc

KKD,Krispy Kreme Doughnuts

KNOL,Knology Inc

KNOT,The Knot Inc

KNXA,Kenexa Corp

LCC,US Airways Group Inc

LDSH,Ladish Co Inc

LIFC,Lifecell Corporation

LMIA,Lmi Aerospace Inc

LTXX,Ltx Corp

LVS,Las Vegas Sands

MDR,Mcdermott Internat Inc

MED,Medifast Inc

MERX,Merix Corp

MGPI,Mgp Ingredients Inc

MICC,Millicom Intl Cellular Sa

MORN,Morningstar Inc

MTRX,Matrix Service Co

MWRK,Mothers Work Inc

NEU,Newmarket Corp

NGPS,Novatel Inc

NITE,Knight Capital Group Inc Cl A

NTG,Natco Group Incorporated

NTRI,NutriSystem Inc

OII,Oceaneering Internat

OYOG,Oyo Geospace Corp

PEIX,Pacific Ethanol Inc

PGS,Petroleum Geo-services Asa

PGWC,Pegasus Wireless Corp (NV)

PLLL,Parallel Petroleum Corp

PLXS,Plexus Corp

PSTA,Monterey Gourmet Foods Inc

QLTY,Quality Distribution

RADN,Radyne Comstream

RAIL,FreightCar America Inc

RBAK,Redback Networks Inc

RMIX,U.S. Concrete Inc

RNOW,Rightnow Technologies Inc

RTI,Rti Internat Metal Inc

SHOO,Steven Madden Ltd

SMDI,Sirenza Microdevices

SMSI,Smith Micro Software Inc

SNTO,Sento Corporation

SPN,Superior Energy Svcs Inc

STRL,Sterling Construction Comp Inc

SWIR,Sierra Wireless Inc

TACT,Transact Technologies

TFSM,24/7 Real Media Inc

TNL,Technitrol Inc

TRE,Tanzanian Royalty Exploration Corp

TRID,Trident Microsystems Inc

TRN,Trinity Industries Inc

TSCM,Thestreet.Com

TTES,T-3 Energy Services Inc

TTI,Tetra Technologies Inc

TWGP,Tower Grp Inc

TWTC,Time Warner Telecom Inc

TWTR,Tweeter Home Entertainmt

URGI,United Retail Group Inc

USG,Usg Corp

WFR,Memc Electronic Material

WIRE,Encore Wire Corp

WXS,Wright Express Corp

ZOLT,Zoltek Companies Inc

ZRAN,Zoran Corp

ZUMZ,Zumiez Inc

ZVXI,Zevex Internat Inc

When the markets rebounds, some of these stocks will be the first to rebound. A 2-4 weeks counter trend rallies during sustained market weaknesses are a common phenomenon and stocks like these can make good moves during that period.

Also certain sectors act contrary to the market move because of the nature of their business. During the 2001 correction following groups had 30% or more price growth for a year. Three groups out of these had 90% move (highlighted in bold). Over 300 stocks doubled during that period.

MG328,Office Supplies,CONSUMER NON-DURABLES - Office Supplies

MG345,Dairy Products,FOOD & BEVERAGE - Dairy Products

MG515,Drug Related Products,DRUGS - Drug Related Products

MG631,Residential Construction,MATERIALS & CONSTRUCTION - Residential Construction

MG632,Manufactured Housing,MATERIALS & CONSTRUCTION - Manufactured Housing

MG736,Home Improvement Stores,RETAIL - Home Improvement Stores

MG737,Home Furnishing Stores,RETAIL - Home Furnishing Stores

MG738,Auto Parts Stores,RETAIL - Auto Parts Stores

MG739,Catalog & Mail Order Houses,RETAIL - Catalog & Mail Order Houses

MG741,Sporting Goods Stores,SPECIALTY RETAIL - Sporting Goods Stores

MG744,Music & Video Stores,SPECIALTY RETAIL - Music & Video Stores

MG745,Auto Dealerships,SPECIALTY RETAIL - Auto Dealerships

MG751,Auto Parts Wholesale,WHOLESALE - Auto Parts Wholesale

MG752,Building Materials Wholesale,WHOLESALE - Building Materials Wholesale

MG763,Personal Service,DIVERSIFIED SERVICES - Personal Services

MG764,Consumer Services,DIVERSIFIED SERVICES - Consumer Services

MG766,Security & Protection Services,DIVERSIFIED SERVICES - Security & Protection Services

MG821,Multimedia & Graphics Software,COMPUTER SOFTWARE & SERVICES - Multimedia & Graphics Software

These stocks were up 500% or more during the worst phase of bear market. This list does not include stocks which have merged or bought out.

AFAM,Almost Family Inc

AHN,Atc Healthcare Inc

ASCA,Ameristar Casinos Inc

BDY,Bradley Pharmaceuticals

BYI,Bally Technologies Inc

CBK,Christopher & Banks Corp

DYII,Dynacq Healthcare Inc

GMCR,Green Mountain Coffee Roasters

HW,Headwaters Inc

HWAY,Healthways Inc

IMA,Inverness Medical Tchnlg

KMX,Carmax Inc

KOSP,Kos Pharmaceuticals Inc

MGAM,Multimedia Games Inc

MOVI,Movie Gallery Inc

MSCC,Microsemi Corp

NG,Novagold Resources Inc

NPTH,Enpath Medical Inc

NVDA,NVIDIA Corporation

PNRA,Panera Bread Co Cl A

PPHM,Peregrine Pharmaceuticls

PRX,Par Pharmaceutical Co Inc

PSAI,Pediatric Services Am

SMD,Singing Machine

TARO,Taro Pharmaceutical Inds

TRR,Trc Companies Inc

So there are long opportunities to be found in such conditions. What you need is a systematic methodology and approach to find them. You need right tools/ scans and methods to find such opportunities. Above all you need a way to shut off the market noise.

Watchlist

ACLI,American Commercial Lines Inc

ADLR,Adolor Corporation

AE,Adams Resources & Energy

AKAM,Akamai Technologies Inc

ALY,Allis-Chalmers Energy Inc

AMKR,Amkor Technology Inc

ANAD,Anadigics Inc

ANDE,Andersons Inc (The)

AP,Ampco-Pittsburgh Corp

ARS,Aleris International Inc

ASPV,Aspreva Pharmaceuticals

ASTSF,Ase Test Limited Ord Shr

ATI,Allegheny Technologies

BFT,Bally Total Fit Hldg

BGC,General Cable Corp

BMD,Birch Mountain Resources Ltd

BTUI,Btu International Inc

BWNG,Broadwing Corp

CELG,Celgene Corp

CHAP,Chaparral Steel Company

CHDX,Chindex International Inc

CHIC,Charlotte Russe Hldg Inc

CMCO,Columbus Mckinnon Cp(Ny)

CPTS,Conceptus Inc

CTRN,Citi Trends Inc

DCEL,Dobson Communications A

DIL,Dyadic International Inc

DNR,Denbury Resources Ltd

DRQ,Dril-Quip Inc

DXPE,Dxp Enterprises Inc

EAGL,Egl Incorporated

ECOL,American Ecology Corp

EMIS,Emisphere Technologies

EUROD,EuroTrust A/S ADR

EZPW,Ezcorp Inc Cl A

FAL,Falconbridge Ltd

FMCN,Focus Media Holding Ltd ADR

FTI,Fmc Technologies

FTO,Frontier Oil Corp

FWLT,Foster Wheeler Ltd

GAIA,Gaiam Incorporated Cl A

GDI,Gardner Denver Inc

GI,Giant Industries Inc

GIGM,Gigamedia Limited

GLBL,Global Industries Ltd

GMTC,Gametech Internat Inc

GPIC,Gaming Partners Intl

GROW,U.S. Global Invest Inc A

GYMB,Gymboree Corp

HANS,Hansen Natural Corp

HOC,Holly Corp

HOM,Home Solutions Of America

HSR,Hi-Shear Technology Corp

IAAC,Internat Asset Holdg Cp

ICE,Intercontinental Exchange Inc

ICON,Iconix Brand Group

ICTG,Ict Group Inc

IFO,Infosonics

IIG,Imergent Inc

ILMN,Illumina Inc

IMCO,Impco Technologies Inc

IPII,Imperial Industries Inc

IPSU,Imperial Sugar Company

ISRG,Intuitive Surgical Inc

ITG,Investment Technology

JLL,Jones Lang Lasalle Inc

KFRC,Kforce.Com Inc

KKD,Krispy Kreme Doughnuts

KNOL,Knology Inc

KNOT,The Knot Inc

KNXA,Kenexa Corp

LCC,US Airways Group Inc

LDSH,Ladish Co Inc

LIFC,Lifecell Corporation

LMIA,Lmi Aerospace Inc

LTXX,Ltx Corp

LVS,Las Vegas Sands

MDR,Mcdermott Internat Inc

MED,Medifast Inc

MERX,Merix Corp

MGPI,Mgp Ingredients Inc

MICC,Millicom Intl Cellular Sa

MORN,Morningstar Inc

MTRX,Matrix Service Co

MWRK,Mothers Work Inc

NEU,Newmarket Corp

NGPS,Novatel Inc

NITE,Knight Capital Group Inc Cl A

NTG,Natco Group Incorporated

NTRI,NutriSystem Inc

OII,Oceaneering Internat

OYOG,Oyo Geospace Corp

PEIX,Pacific Ethanol Inc

PGS,Petroleum Geo-services Asa

PGWC,Pegasus Wireless Corp (NV)

PLLL,Parallel Petroleum Corp

PLXS,Plexus Corp

PSTA,Monterey Gourmet Foods Inc

QLTY,Quality Distribution

RADN,Radyne Comstream

RAIL,FreightCar America Inc

RBAK,Redback Networks Inc

RMIX,U.S. Concrete Inc

RNOW,Rightnow Technologies Inc

RTI,Rti Internat Metal Inc

SHOO,Steven Madden Ltd

SMDI,Sirenza Microdevices

SMSI,Smith Micro Software Inc

SNTO,Sento Corporation

SPN,Superior Energy Svcs Inc

STRL,Sterling Construction Comp Inc

SWIR,Sierra Wireless Inc

TACT,Transact Technologies

TFSM,24/7 Real Media Inc

TNL,Technitrol Inc

TRE,Tanzanian Royalty Exploration Corp

TRID,Trident Microsystems Inc

TRN,Trinity Industries Inc

TSCM,Thestreet.Com

TTES,T-3 Energy Services Inc

TTI,Tetra Technologies Inc

TWGP,Tower Grp Inc

TWTC,Time Warner Telecom Inc

TWTR,Tweeter Home Entertainmt

URGI,United Retail Group Inc

USG,Usg Corp

WFR,Memc Electronic Material

WIRE,Encore Wire Corp

WXS,Wright Express Corp

ZOLT,Zoltek Companies Inc

ZRAN,Zoran Corp

ZUMZ,Zumiez Inc

ZVXI,Zevex Internat Inc

Stocks with extreme volume

QQQQ,Nasdaq 100 Index Tracking Stock ETF last had an extreme volume day 1463 days ago. SPY,SPDRs had extreme volume day 223 days ago. How much more selling is remaining?

I have a compilation of market bottoms from past many years. I leaf through it every week. It shows what was the move before market correction and what happened afterwards. Most of the time after such sell offs the market turns on a dime and just shoots up for many weeks. Constant study of such things help you to anticipate and react to such moves.

You can see Dow Bottoms from 1932 till 1982 here.

Based on the past patterns, I think the market will have a snap back rally in next few days. If you are short be careful. Before you realize what happened profits will vanish. Expect lots of buy programs to kick in.

CYB,Cybex Internat

DMC,Document Security Systems

EAG,Eagle Broadband Inc

EWO,iShares MSCI Austria Index Fund ETF

EWW,iShares MSCI Mexico Index Fund ETF

EWZ,iShares MSCI Brazil Index Fund ETFl

HNAB,Hana Biosciences Inc

MDV,Medivation Inc

QQQQ,Nasdaq 100 Index Tracking Stock ETF

RLH,Red Lions Hotel Corp

SDA,Sadia S.A.

SPY,SPDRs S&P 500 Trust Series ETF

Stocks up 50% or more in a year

IFO,Infosonics

MED,Medifast Inc

SCR--A,Sea Containers Cl A

From 30 to 3 in a week. Get your buying list ready.

MED,Medifast Inc

SCR--A,Sea Containers Cl A

From 30 to 3 in a week. Get your buying list ready.

5/17/2006

Try Trade-Ideas beta for free

This version has more options for sounds including custom sounds that you can make yourself! It will be released Week of 5/22. Click to download the beta 1.9

The beta is free in demo mode. Use "demo" for username and password and select the "Free High/Low Ticker".

Update: see the comments below

The beta is free in demo mode. Use "demo" for username and password and select the "Free High/Low Ticker".

Update: see the comments below

GOOG, Google Inc finds support

In the sea of red, some stocks are stabilising. Look at GOOG, Google Inc. It has stabilized and is up for day. The price level also happens to be a level where it had secondary offering when it was added to S&P. Footprints of big boys at work.

Keep your buy list ready

Quiet, weak markets are good to sell. They ordinarily develop into declining markets. But when a market has gone through the stages of quiet and weak to active and declining, then on semi-panic or panic, it should be bought freely.

Speculation As Fine Art by Dickson Watts

Victor Niederhoffer often quotes Henry Clews

Henry Clews

But few gain sufficient experience in Wall Street to command success until they reach that period of life in which they have one foot in the grave. When this time comes, these old veterans of the Street usually spend long intervals of repose at their comfortable homes, and in times of panic, which recur sometimes oftener than once a year, these old fellows will be seen in Wall Street, hobbling down on their canes to their brokers’ offices.

Then they always buy good stocks to the extent of their bank balances, which they have been permitted to accumulate for just such an emergency. The panic usually rages until enough of these cash purchases of stock is made to afford a big “rake in.” When the panic has spent its force, these old fellows, who have been resting judiciously on their oars in expectation of the inevitable event, which usually returns with the regularity of the seasons, quickly realize, deposit their profits with their bankers, or the overplus thereof, after purchasing more real estate that is on the up grade, for permanent investment, and retire for another season to the quietude of their splendid homes and the bosoms of their happy families.

Fifty Years in Wall Street by Henry Clews

S&P says better time for market ahead.

S&P predicts that oil and inflation worries will decrease, growth will slow, and equity prices will move higher

Stocks up 50% or more in a month

DXPE,Dxp Enterprises Inc

IFO,Infosonics

MED,Medifast Inc

PGWC,Pegasus Wireless Corp (NV)

SCR--A,Sea Containers Cl A

ZOLT,Zoltek Companies Inc

A week ago,this list ad 30 stocks. So a strong bounce is likely in next couple of days. Some stocks which will bounce will be the beaten down ones. At the same time new sectors, new stocks should start emerging soon to take on the new leadership role.

These are some of the stocks showing good price action.

AGP,Amerigroup

BIDU,Baidu.com Inc

BKD,Brookdale Senior Living Inc

CSPLF,Canada Southern Petroleum Ltd

DXPE,Dxp Enterprises Inc

ELN,Elan Corp Plc

EUROD,EuroTrust A/S ADR

GROW,U.S. Global Invest Inc A

HANS,Hansen Natural Corp

IFO,Infosonics

JAS,Jo-ann Stores Inc

JOBS,51job Inc Ads

JSDA,Jones Soda Co

LMIA,Lmi Aerospace Inc

MED,Medifast Inc

MGRM,Monogram Biosciences Inc

MLIN,Micro Linear Corp

MOVI,Movie Gallery Inc

NCOG,Nco Group Inc

PSTA,Monterey Gourmet Foods Inc

REMX,Remedytemp Inc

SCR--A,Sea Containers Cl A

UFPT,Ufp Technologies Inc

VVUS,Vivus Inc

IFO,Infosonics

MED,Medifast Inc

PGWC,Pegasus Wireless Corp (NV)

SCR--A,Sea Containers Cl A

ZOLT,Zoltek Companies Inc

A week ago,this list ad 30 stocks. So a strong bounce is likely in next couple of days. Some stocks which will bounce will be the beaten down ones. At the same time new sectors, new stocks should start emerging soon to take on the new leadership role.

These are some of the stocks showing good price action.

AGP,Amerigroup

BIDU,Baidu.com Inc

BKD,Brookdale Senior Living Inc

CSPLF,Canada Southern Petroleum Ltd

DXPE,Dxp Enterprises Inc

ELN,Elan Corp Plc

EUROD,EuroTrust A/S ADR

GROW,U.S. Global Invest Inc A

HANS,Hansen Natural Corp

IFO,Infosonics

JAS,Jo-ann Stores Inc

JOBS,51job Inc Ads

JSDA,Jones Soda Co

LMIA,Lmi Aerospace Inc

MED,Medifast Inc

MGRM,Monogram Biosciences Inc

MLIN,Micro Linear Corp

MOVI,Movie Gallery Inc

NCOG,Nco Group Inc

PSTA,Monterey Gourmet Foods Inc

REMX,Remedytemp Inc

SCR--A,Sea Containers Cl A

UFPT,Ufp Technologies Inc

VVUS,Vivus Inc

Stocks with extreme volume

CCL, Carnival Corp guides down and takes a tumble. It has been in down trend for some time. This might be the bottom offering potentially low risk entry if you are value oriented buyer.

NBIX, Neurocrine Biosciences had problem with getting its sleep drug approved. It is down 62% in a day. The biotech sector is always tricky sector to invest in because of such external risks.

HOM, Home Solutions Of America is one of my holdings. It just announced earnings. Keep a close eye on this for potential entry on pullback or if it forms a base. It is up around 846% for the year. These are the kind of stocks I like and my system tries to identify them early enough.

MED, Medifast Inc is another holding and had a recent good earnings announcement. It is up 460% for the year. There are many people who advocate not holding stocks close to earnings. It all depends on your entry price, risk tolerance and size of position. Above all confidence in your own trading system.

CCL,Carnival Corp

DOVP,Dov Pharmaceutical Inc

HOM,Home Solutions Of America

MED,Medifast Inc

NBIX,Neurocrine Biosciences

RHR,RMR Hospitality and Real Estate Fund

5/16/2006

While the market makes a feeble attempt to bounce, you might want to read about this bouncy matter:Why I called my boobs Simon & Garfunkel

John C. Bogle Blog

John Bogle of Vanguard Mutual funds the pioneer of the Index has started a blog.

The Bogle Blog. Can you believe it? A few months ago I barely knew what on earth a "“blog"” was, and now here I am blogging. I'’m excited, however, about the opportunities this new website will offer me, and hope that what you find here keeps you coming back to check in. You'’ll notice that most of the site'’s sections include an area for comments, and I encourage you to share your thoughts, and even submit questions to the "“Ask Jack"” section of the site. I can'’t promise that my schedule will allow me to respond to everyone, but I'’ll certainly make every effort to make this as "“interactive"” an experience as possible. At the least, I hope that you'’ll consider what you find here to be interesting, thought-provoking, and, well, a "“certain trumpet."”

Apple has new sleek product out:Macbook

AAPL, Apple Computer Inc looks attractive at this price level.

Greenback will fall, Armageddon will not follow

As everyone is focused on the dollar weakness currently, a contrary opinion like this is helpful.

Market reaction in the past week to the dollar'’s drop sharply suggests many investors buy this Great Dollar Death Spiral story. They shouldn'’t. Handled properly, with careful nurturing by the US and other central banks, the dollar'’s fall should prove to be not a trap door through which the world economy disappears, but a pleasantly upholstered springboard, propelling it to further sustained growth.

Barry Ritholtz at The Big Picture muses about how something that should matter doesn't for the longest time . . . and then it suddenly does

I find it incredible that suddenly, the denial we have been living with for so long gets removed. The robust inflation has been denied, ignored for so long. Despite all the evidence, the price increases on ordinary goods, medical services, housing, insurance, all the while commodity prices run amuck has been overlooked, as if its irrelevant.

Then suddenly, it matters.

Meanwhile, we see Housing, the prime (domestic) driver of the economy for the past 4 years, rapidly cool -- and the market has yet to discover this as an issue. If the Housing slowdown continues, expect Consumer spending in Q3 to be very soft. Target showed revenue growth of 12%, but missed earnings estimates due to increased costs -- (but there's no inflation). Hey, we still have a full 6 months before we have to start thinking about Xmas spending yet -- that could be way off also, if present trends accelerate.

It may be too early to "officially" say the end of this cyclical Bull market is upon us, but the past few days is certainly a warning shot across the market's bow.

Most markets, including India may correct by 30%: Faber

Marc Faber has a good track record on global investment trends and forecasted the commodity uptrend much before anyone else.

Investment Guru Marc Faber expects most markets including India to see a 30% correction, which is likely in both equities and commodities. He adds that the commodities complex is still attractive from the long-term view. Faber feels that industrial commodities may not make fresh highs in the near-term.

Faber believes that not much has changed but the markets became over-extended in the last ten days with some industrial commodities going up vertically. So the market was terribly overbought and now we have a setback but that is for the time being.

Bringing home the dollars to mama

Global asset relocation is happening. As everybody rushes for exit, the panic grows. When the dust settles down few leveraged hedge funds would be bust.

You can see this more clearly on following World Market Direction component list I monitor daily. Or you can monitor it here

AORD-X,Sydney All Ordinaries Index

EWA,iShares MSCI Australia Index Fund ETF

EWC,iShares MSCI Canada Index Fund ETF

EWD,iShares MSCI Sweden Index Fund ETF

EWG,iShares MSCI Germany Index Fund ETF

EWH,iShares MSCI Hong Kong Index Fund ETF

EWI,iShares MSCI Italy Index Fund ETF

EWJ,iShares MSCI Japan Index Fund ETF

EWK,iShares MSCI Belgium Index Fund ETF

EWL,iShares MSCI Switzerland Index Fund ETF

EWM,iShares MSCI Malaysia Index Fund ETF

EWN,iShares MSCI Netherlands Index Fund ETF

EWO,iShares MSCI Austria Index Fund ETF

EWP,iShares MSCI Spain Index Fund ETF

EWQ,iShares MSCI France Index Fund ETF

EWS,iShares MSCI Singapore Index Fund ETF

EWT,iShares MSCI Taiwan Index Fund ETF

EWU,iShares MSCI United Kingdom Index Fund ETF

EWW,iShares MSCI Mexico Index Fund ETF

EWY,iShares MSCI South Korea Index Fund ETF

EWZ,iShares MSCI Brazil Index Fund ETF

EZA,iShares MSCI South Africa Index Fund ETF

FDAC-X,Frankfurt Dax Index

FTSE-X,London Ftse-100 Index

MXY--X,Mexico Index

NIKI-X,Tokyo Nikkei Index

PCAC-X,Paris CAC-40 Index

SING-X,Singapore Straits Index