The Market Report is updated daily and summarizes the short (1 week), intermediate (1 month), and long-term (6 months) market behavior. The 6-month relative strength for each industry, top 20 sub-industries, and bottom 20 sub-industries is calculated to help gauge the long term behavior of the market. The 1-month change in relative strength for each industry, top 20 sub-industries, and bottom 20 sub-industries is calculated to gauge the intermediate behavior of the market. The top 10 instrustries with the largest percent of stocks making new 52-week highs helps identify weak industries that may be starting new up trends, or to gauge the continuing strength of current up trends. The bottom 10 instrustries with the largest percent of stocks making new 52-week lows helps identify strong industries that may be starting new down trends, or to gauge the continuing weakness of current down trends. The dollar volume analysis shows the ten largest stocks (>$100 million DV) that are making daily moves larger than 4% up or down. This helps to determine if institutions are buying or selling stocks, which can effect market direction in the short term.

9/30/2010

Novice trader

Keeping track of daily market trends in sector is very helpful. The blog Novice Trader Journey has found a very good visual way to do this. At one glance it gives you sector trends. Good creative way to present data.

9/29/2010

Why sausage making process is important

I am often asked by readers of this blog who are not members as to what happens on members site. Here is a post I made today on members site, which should give you idea as to what happens.

Reproduced from the members site......

Reproduced from the members site......

Why sausage making process is important

One of the things this site does is it shows you the sausage making process along with the final product. Most newsletter and trading sites do not do that. They give you final pick or decision and you never get to see how that person scanned for it or arrived at that decision.

If you go to say Dan Zanger site what you get is final 3-5 stocks which he highlights as possible buy with entry targets. You do not get to see how he arrives at them step by step. The sausage making process to a large extent is opaque. Same way if you go to Harry Boxers site you get some stock as buys or sells but do not necessarily get to see the process used to arrive at those decisions. This is true of most other sites. On the other hand there are some sites which tell you a bit about the process but the actual trades are hidden.

Unlike those approaches on Stockbee Members site the sausage making process is the key emphasis. You know what tools and scans are used. After that how step wise the sausage happens. The objective of that approach is to transfer process knowledge. If you understand the process and can replicate it then you can get similar stocks. All stages of that process from entry, exit, risk, screw ups , wrong decisions, hasty decisions, right decisions are transparent to you.

If you want to be profitable trader then you must spend time understanding those processes than actual trade alerts. This is as much true for my trade alerts as is true for Tumblers or others trading alerts.

You should focus your questions on the sausage making process more. For example you want to know in significant detail what process Tumbler follows to identify his trades before market, during trading hours, after hours and so on. You want to know the process involved in entry, exit, per trade risk and so on. Then sit down and write a process document and study it. then you can develop your own process.

What happens sometimes is traders get focused too much on specific trade alert or trade. That in my opinion is waste of effort. The process is key....

and here are the comments on the post by members...

ratrader

@easyguru that is so true about many of the real popular subscription services. I always used to wonder how these people were able to look at 6000 or so charts and come up with 4 or 5 stocks as their picks and make it seem so easy till I joined this site and started learning about process and setups. I am a beginner and I sure have a long way to go but I feel that I am learning as each day goes along

dcummiskey

even if you followed the trade alerts exactly, you will not be able to match the returns.

tumbler

gone thru my stuff w/many via email and will do it anytime...but sometimes i give them a nut...i give them a bolt..i give them a wrench...they want a screwdriver...

youngamerican

Good post Guru. For some knowing the process spoils the mystique of the pick, ie. the wizard of oz effect.

and here are the comments on the post by members...

ratrader

@easyguru that is so true about many of the real popular subscription services. I always used to wonder how these people were able to look at 6000 or so charts and come up with 4 or 5 stocks as their picks and make it seem so easy till I joined this site and started learning about process and setups. I am a beginner and I sure have a long way to go but I feel that I am learning as each day goes along

dcummiskey

even if you followed the trade alerts exactly, you will not be able to match the returns.

tumbler

gone thru my stuff w/many via email and will do it anytime...but sometimes i give them a nut...i give them a bolt..i give them a wrench...they want a screwdriver...

youngamerican

Good post Guru. For some knowing the process spoils the mystique of the pick, ie. the wizard of oz effect.

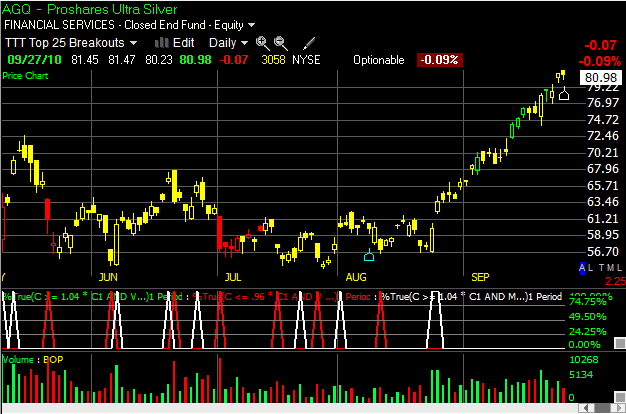

Top 25 ETF by six month relative strength

Investors follow latest fashions. Recently a book on Exchange Traded Funds ( ETF) promoting 6 month relative strength as primary way to build ETF portfolio has been released. Suddenly people are looking for ways to rank ETF by 6 month momentum.

While a momentum based approach works on ETF, the real art is in the nuances involved in making it work. If you don't understand how momentum works and how to design strategies for entering momentum based vehicles at right time, you will be the last fool to buy them before they reverse. When you use momentum based ranking to invest in ETF top 10 ranked ETF can also be the most extended ETF and just near their top. Without understanding that if you start dabbling in momentum investing you will soon be disillusioned and be searching for next hot book on ETF.

Momentum rankings are very easy to derive. Anyone with basic maths skills and free data sources like Google spreadsheet or excel can easily develop their own ranking method. Momentum or relative strength rankings are arrived at by calculating Rate of Change or ROC.There are many ways to calculate ROC and each of the ways can give you slightly different ranking and each approach has some benefits or short comings.

The easy way to calculate relative strength is by calculating 6 month price change and ranking ETF by it. In Telechart this can be done easily using Price Percent Change 26-Week which is a System sort criteria. The Telechart pcf for it is: 100*(c-c126)/c126.

Another better way to rank ETF by 6 month relative strength is by calculating ROC as a ratio of price to six month average price. The advantage of this approach is it uses average price of last 6 month as against a one price point of six month ago price in earlier ROC calculation. In Telechart this is easy to do using a PCF like c/avgc126.

In addition to ROC rank you must also use some kind of liquidity filter to eliminate ETF with low trading volume. Let us say you want only to focus on ETF trading 100000 plus daily to avoid slippage. Then you can use a sort to eliminate such ETF using a Telechart pcf like minv3>=1000.

Using both these criteria I created a list of 25 ETF that are highest ranked by momentum:

AGQ,Proshares Ultra Silver

BRF,Market Vectors Brazil Small-Cap

DAG,DB Agriculture Double Long ETN

DBS,PowerShares DB Silver Fund

DGP,DB Gold Double Long ETN

ECH,iShares MSCI Chile Index Fund ETF

EDC,Direxion Daily Emerging Markets Bull 3x Shares

EPI,WisdomTree India Earnings Fund ETF

EPU,iShares MSCI All Peru Capped Index Fund

EWD,iShares MSCI Sweden Index Fund ETF

EZA,iShares MSCI South Africa Index Fund ETF

FDN,First Trust Dow Jones Internet Index Fund ETF

FRN,Claymore/BNY Mellon Frontier Markets ETF

GDXJ,Market Vectors Junior Gold Miners ETF

HAO,Claymore/Alphashrs 2 Sm Cap

IDX,Market Vectors Indonesia Index

INP,iPath MSCI India Index ETN

PIE,PowerShares DWA Emerging Markets Technical Leaders Portfolio ETF

RJA,ELEMENTS Linked to the Rogers International Commodity Index - Agriculture Total Return ETN

SIVR,ETFS Silver Trust

SLV,iShares Silver Trust ETF

THD,iShares MSCI Thailand Investable Market Index Fund ETF

TQQQ,ProShares UltraPro QQQ

TUR,iShares MSCI Turkey Investable Market Index Fund ETF

UYM,ProShares Ultra Basic Materials

While a momentum based approach works on ETF, the real art is in the nuances involved in making it work. If you don't understand how momentum works and how to design strategies for entering momentum based vehicles at right time, you will be the last fool to buy them before they reverse. When you use momentum based ranking to invest in ETF top 10 ranked ETF can also be the most extended ETF and just near their top. Without understanding that if you start dabbling in momentum investing you will soon be disillusioned and be searching for next hot book on ETF.

Momentum rankings are very easy to derive. Anyone with basic maths skills and free data sources like Google spreadsheet or excel can easily develop their own ranking method. Momentum or relative strength rankings are arrived at by calculating Rate of Change or ROC.There are many ways to calculate ROC and each of the ways can give you slightly different ranking and each approach has some benefits or short comings.

The easy way to calculate relative strength is by calculating 6 month price change and ranking ETF by it. In Telechart this can be done easily using Price Percent Change 26-Week which is a System sort criteria. The Telechart pcf for it is: 100*(c-c126)/c126.

Another better way to rank ETF by 6 month relative strength is by calculating ROC as a ratio of price to six month average price. The advantage of this approach is it uses average price of last 6 month as against a one price point of six month ago price in earlier ROC calculation. In Telechart this is easy to do using a PCF like c/avgc126.

In addition to ROC rank you must also use some kind of liquidity filter to eliminate ETF with low trading volume. Let us say you want only to focus on ETF trading 100000 plus daily to avoid slippage. Then you can use a sort to eliminate such ETF using a Telechart pcf like minv3>=1000.

Using both these criteria I created a list of 25 ETF that are highest ranked by momentum:

AGQ,Proshares Ultra Silver

BRF,Market Vectors Brazil Small-Cap

DAG,DB Agriculture Double Long ETN

DBS,PowerShares DB Silver Fund

DGP,DB Gold Double Long ETN

ECH,iShares MSCI Chile Index Fund ETF

EDC,Direxion Daily Emerging Markets Bull 3x Shares

EPI,WisdomTree India Earnings Fund ETF

EPU,iShares MSCI All Peru Capped Index Fund

EWD,iShares MSCI Sweden Index Fund ETF

EZA,iShares MSCI South Africa Index Fund ETF

FDN,First Trust Dow Jones Internet Index Fund ETF

FRN,Claymore/BNY Mellon Frontier Markets ETF

GDXJ,Market Vectors Junior Gold Miners ETF

HAO,Claymore/Alphashrs 2 Sm Cap

IDX,Market Vectors Indonesia Index

INP,iPath MSCI India Index ETN

PIE,PowerShares DWA Emerging Markets Technical Leaders Portfolio ETF

RJA,ELEMENTS Linked to the Rogers International Commodity Index - Agriculture Total Return ETN

SIVR,ETFS Silver Trust

SLV,iShares Silver Trust ETF

THD,iShares MSCI Thailand Investable Market Index Fund ETF

TQQQ,ProShares UltraPro QQQ

TUR,iShares MSCI Turkey Investable Market Index Fund ETF

UYM,ProShares Ultra Basic Materials

The top 3 ETF by 6 month momentum or relative strength currently are:

DAG DB Agriculture Double Long ETN

AGQ Proshares Ultra Silver

THD ishares MSCI Thailand Investable Market Index funds

Before you use a momentum or relative strength based approach to invest in ETF, mutual funds or stocks you should spend sometime thoroughly understanding the concept behind momentum and how it works, why it works, when it works, what are the risk involved in using it and so on. If you do not have that conceptual understanding of momentum , you can do great damage to to your account by buying stocks , ETF or mutual funds exactly at wrong time.

If you are serious about enhancing your understanding of relative strength then I suggest you read a good book on relative strength by Michael Carr . It is one of the best book on that topic. I have written a review of it when it came out in August 2008, if you see the comments on that post the author has also commented on the post. You can see the review below:

. It is one of the best book on that topic. I have written a review of it when it came out in August 2008, if you see the comments on that post the author has also commented on the post. You can see the review below:

8/27/2008

Smarter Investing In Any Economy- The Definitive Guide to Relative Strength Investing by Michael Carr

Smarter Investing In Any Economy- The Definitive Guide to Relative Strength Investing by Michael Carr

The book as name suggest goes in to details about using Relative Strength to design a trading strategy. Relative strength based strategies are one of the ways to exploit the momentum anomaly. Relative strength strategies aim to find strongest or weakest stocks, ETFs, or sectors in any market environment and to trade them on long or short side till they maintain there relative strength. Well formulated relative strength based strategies keep you on the right side of market.

The book goes in to details of various ways to rank stocks. Formulas for calculating relative strength using absolute difference, normalised ROC, moving averages, front or back weighted ROC, and standard deviation are detailed.

In the next section the author demonstrates ways to build trading strategy using Relative strength. He goes in to issues like:

- What vehicles to buy using Relative Strength

- What time frames for relative strength are ideal

- When should you buy and sell

- How should you manage your risk

The author provides a researched strategy using the relative strength. Various application of relative strength for stocks, etf, mutual funds and futures are discussed , to provide further ideas for investors.

Some of the most successful trading methods in the market are based on relative strength . It is one of the proven methods in the market that works. This book provides a good guide to investors interested in learning and applying about relative strength based strategies.

The book certainly is not "The Definitive Guide to Relative Strength Investing " because it is very narrowly focused on one trading system application of relative strength. It could have done a much better job of illustrating many more relative strength based approaches. The first chapter in the book is the worst, it never defines relative strength properly and spends more time trying to repudiate momentum investing, when in fact the entire rational of relative strength investing is based on stock momentum.

In spite of some reservations, this is one of the best books out of 70-80 books on trading I have read so far this year. I highly recommend this book because it contains ideas and concept which can make you money.

Are you serious about your trading?

If you are serious about your trading and want to build an enduring edge the Stockbee Member site might help you. Members tell me they have tried lot of things before coming to my site and it has offered them the most extensive and detailed methods to swing and position trade.

It is only for those who want to develop their own self sufficient trading method. It is not a stock picking service. It is service for you to build your own scans and trading method to have your own daily pick based on your method.

Be warned it will take you time to learn to trade. Learning to trade is difficult art and unless you are willing to spend months or years to perfect your strategy and also develop your mental edge you are unlikely to succeed in this game. Unless you understand that no site, no service, and no mentoring is going to work.

Why traders come to stockbee?

The member site is one of the most recommended site for learning to trade by other traders and bloggers. You will see no advertising, no hard marketing, no promotions, no free offers, no affiliate marketing, no incentive to other bloggers to promote the site, no constant twits self promoting the site, no free trial and no tall claims of making you instantly wealthy, and yet the site attracts new members everyday. Members come from all walks of life and all kinds of trading size and trading styles.

You will see that many trading bloggers have been using my market timing methods, scans , stock ranking lists and chart templates. They have developed their own methods based on my methods. Many paid newsletter site recommend my site to their subscriber for learning about trading and market.

Over the years thousands of traders have been members and those who benefited from the learning talk about the site to others or talk about the methods used and that is how new members learn about the site.

What will I learn in the members site?

The members site will give you in depth understanding to develop your own trading method. The emphasis is on making you self sufficient and confident of your own trading method and style.

As a member you will learn the basics of swing trading, momentum investing, growth investing and risk management.

You will learn about Stockbee Trend Intensity Breakouts method that uses momentum based swing trading to find 3 to 5 day swing trades for 8 to 40% profit.

You will learn about Stockbee Episodic Pivots Breakout method which uses Post Earnings Announcement Drift (PEAD) to find stocks that had a game changing earnings and that are likely to rally for 3 months to 12 months.

You will learn about Stockbee Dollar Breakout method that uses momentum, range expansion and swing trading approach to find 5 to 40 dollar moves in high priced stocks.

You will learn about Stockbee Lemonade Strategy for 401k which uses market timing and momentum to invest in 401k. You will get weekly update on how I am using the strategy on our 401k to do allocation decision.

You will learn about Stockbee Market Monitor method for market timing using breadth. It allows you to avoid risky periods in market and allows you to identify market turns. It is used for 401k allocation decisions.

You will learn about Stockbee Double Trouble method to find stock with confirmed upside momentum using anchored momentum and that are likely to continue their up move.

You will learn about Stockbee Night Time is Right Time method to find news catalyst based trade ideas for short term day trade and swing trade.

You will learn about Investor's Business Daily’s IBD 200 list and how it can be used to find swing trading candidates for explosive moves.

You will learn about Telechart 2000 and how to use it effectively to scan for swing and position trade ideas and to set up your 401k strategy.

You will learn about Jesse Livermore Range Breakout, Darvas Box setup, and many other member shared methods.

You will learn how to set up your own scans, select right kind of stocks, how to set up stops, when to enter , when to exit, how much to risk, how to track your trades and all other details about trading. You will learn about developing your own methods and not relying on others for trade ideas.

The site has hundreds of videos and trading methods and variation of methods. Members help each other in developing the methods and share actively their research and finding. A collaborative spirit allows you to get input from others on your trading ideas or problems.

The site gives you opportunity to interact with some of the most successful traders and learn from them about their trading methods. It is a vibrant community with members from different background and experience willing to help each other. The emphasis is on continuous learning and up gradation of market knowledge and setup knowledge. The members range from hedge fund employees, financial advisers, active swing traders, investors and new traders.

If you are looking to develop your own trading strategy the membership site might be for you. You have to be willing to put in the effort to build your own method. There are no silver bullets offered on members site. Every method, every scan, every nuance is detailed and all possible help is offered to design your own method.

Do you have a trial?

If you are just looking for trial you are better off trying thousands of other trading sites that offer free trial or one month trial and offer you promise of riches.

It is for those who are ready beyond the trial phase and ready to put serious months or years of efforts to learn to trade on their own. It is for those who want to learn to find their own fish.

The free blog has all the details about the methods I trade and if you go through the posts highlighted in the sidebar you will learn about them.

How can I become a member?

To sign up go to www.stockbee.biz and follow the sign up process. The site uses Paypal for payment processing.

9/28/2010

Copycat posts and copycat lists

Many of the regular readers have pointed out and emailed to me about copycat posts on earnings strategies, procedural memories, momentum methods, and book reviews done by me are being promoted by some as their own work and which are essentially rewritten from my blog or members area.

Similarly copycat lists similar to the 50 lists generated by Patientfisherman using same logic and formats and same Google spreadsheets are being passed on by some as their own work without attributing the source of the ideas. I am completely aware of that. There is nothing I can do about it.

The person or the persons and the organisation doing that might have many motives for it. But what can I say, you can not teach morality and honesty to people.

Similarly copycat lists similar to the 50 lists generated by Patientfisherman using same logic and formats and same Google spreadsheets are being passed on by some as their own work without attributing the source of the ideas. I am completely aware of that. There is nothing I can do about it.

The person or the persons and the organisation doing that might have many motives for it. But what can I say, you can not teach morality and honesty to people.

25 ETF ranked by trend intensity

The following ETF are Top 25 ETF ranked by Trend intensity. Trend intensity tells you how strong the prevailing trend is. It does not tell you the direction. So both a ETF going up or going down can have high trend intensity.

AGQ,Proshares Ultra Silver

BGZ,Direxion Large Cap Bear 3x

DPK,Direxion Daily Developed Markets Bear 3x

DRN,Direxion Daily Real Estate Bull 3X Shares

DRV,Direxion Daily Real Estate Bear 3X Shares

EDC,Direxion Daily Emerging Markets Bull 3x Shares

EDZ,Direxion Daily Emerging Markets Bear 3x

EEV,ProShares UltraShort MSCI Emerging Mkts

EPU,iShares MSCI All Peru Capped Index Fund

EPV,ProShares UltraShort MSCI Europe

GDXJ,Market Vectors Junior Gold Miners ETF

QID,ProShares UltraShort QQQ

QLD,ProShares Ultra QQQ

SIL,Global X Silver Miners Etf

SMN,ProShares Ultrashort Basic Material

SPXU,ProShares UltraPro Short S&P500

SQQQ,ProShares UltraPro Short QQQ

SRS,ProShares UltraShort Real Estate

SRTY,ProShares UltraPro Short Russell 2000

THD,iShares MSCI Thailand Investable Market Index Fund ETF

TQQQ,ProShares UltraPro QQQ

TYH,Technology Bull 3X

TZA,Direxion Small Cap Bear 3x

UYM,ProShares Ultra Basic Materials

VXX,iPath S&P 500 VIX Short-Term Futures

ZSL,Proshares Ultrashort Silver

One of the ways to use trend intensity is to use it as filter for selecting ETF or stocks to trade using trend following method or trend exhaustion method. When trend intensity breaks above a certain threshold it tells you that market is no more in range but is trending. In that circumstances swing trading strategy using trend following approach can be used.

When trend intensity is at extremely high level a trend exhaustion kind of swing trading approach can be used.

Currently the top five ETF ranked by trend intensity are:

AGQ,Proshares Ultra Silver

BGZ,Direxion Large Cap Bear 3x

DPK,Direxion Daily Developed Markets Bear 3x

DRN,Direxion Daily Real Estate Bull 3X Shares

DRV,Direxion Daily Real Estate Bear 3X Shares

EDC,Direxion Daily Emerging Markets Bull 3x Shares

EDZ,Direxion Daily Emerging Markets Bear 3x

EEV,ProShares UltraShort MSCI Emerging Mkts

EPU,iShares MSCI All Peru Capped Index Fund

EPV,ProShares UltraShort MSCI Europe

GDXJ,Market Vectors Junior Gold Miners ETF

QID,ProShares UltraShort QQQ

QLD,ProShares Ultra QQQ

SIL,Global X Silver Miners Etf

SMN,ProShares Ultrashort Basic Material

SPXU,ProShares UltraPro Short S&P500

SQQQ,ProShares UltraPro Short QQQ

SRS,ProShares UltraShort Real Estate

SRTY,ProShares UltraPro Short Russell 2000

THD,iShares MSCI Thailand Investable Market Index Fund ETF

TQQQ,ProShares UltraPro QQQ

TYH,Technology Bull 3X

TZA,Direxion Small Cap Bear 3x

UYM,ProShares Ultra Basic Materials

VXX,iPath S&P 500 VIX Short-Term Futures

ZSL,Proshares Ultrashort Silver

One of the ways to use trend intensity is to use it as filter for selecting ETF or stocks to trade using trend following method or trend exhaustion method. When trend intensity breaks above a certain threshold it tells you that market is no more in range but is trending. In that circumstances swing trading strategy using trend following approach can be used.

When trend intensity is at extremely high level a trend exhaustion kind of swing trading approach can be used.

Currently the top five ETF ranked by trend intensity are:

- VXX (in downtrend)

- AGQ (in uptrend)

- ZSL (in downtrend)

- SQQQ (in downtrend)

- TQQQ (in downtrend)

One of the things to think about is why the short ETF's tend to have higher trend intensity compared to long when market is going up. There by hangs a tell for some smart investors.....

9/27/2010

How Dan Zanger Finds his buy ideas

From his recent inteview in TradersWorld

This is extremely easy to setup in Telechart.

Dan Zanger Dollar Scan

(C - C1) >= 1

Add Liquidity Condition to eliminate low liquidity stocks.

MINV3.1 >= 1000

You can make this setup work in exactly same manner like in Top 25 breakouts method. Just sort the list by momentum rank pcf and look for stock making 1 dollar move after 5 to 20 days sideways moves.

Basically a breakout swing trading setup.

Top Ranked Exchange Traded Fund (ETF) for September 27, 2010

Top Ranked Exchange Traded Funds for September 27, 2010:

Country ETF's have been doing very well.

AGQ,Proshares Ultra Silver

BHH,HOLDRS B2B Internet ETF

CHIQ,Global X China Consumer ETF

EPU,iShares MSCI All Peru Capped Index Fund

EWD,iShares MSCI Sweden Index Fund ETF

EWH,iShares MSCI Hong Kong Index Fund ETF

EZA,iShares MSCI South Africa Index Fund ETF

FDN,First Trust Dow Jones Internet Index Fund ETF

GDXJ,Market Vectors Junior Gold Miners ETF

HAO,Claymore/Alphashrs 2 Sm Cap

INP,iPath MSCI India Index ETN

PALL,ETFS Physical Palladium Shares

PIE,PowerShares DWA Emerging Markets Technical Leaders Portfolio ETF

RJA,ELEMENTS Linked to the Rogers International Commodity Index - Agriculture Total Return ETN

THD,iShares MSCI Thailand Investable Market Index Fund ETF

TUR,iShares MSCI Turkey Investable Market Index Fund ETF

URE,ProShares Ultra Real Estate ETF

9/24/2010

3 Things you can learn from Charles Kirk

Charles Kirk has been mentoring a group of traders for couple of years and he holds a annual retreat for them every year. Last week he had the annual retreat for his group and based on his discussion and observation of the group he wrote a long post on his The Kirkreport Members site. Three things out of that stand out as very important learnings.

- Those who have performed the best in the group are those who have learned methods to separate their opinions and beliefs away from their trading decisions. In other words, they have improved because they no longer seek to trade their opinions, but rather to exploit opportunities they see especially when they conflict with their internal viewpoints.

- Traders who have learned to “turn off” and “tune out” of all (or most) media input (including social networking) are outperforming significantly. The performance spread between those who read a lot online versus those who don’t is so significant that if you saw the difference you would radically change how you spend your own research time.

- Those in the group who have been focusing on developing one method/one strategy are faring far better than those who manage multiple systems. Those traders who have a tendency to switch and constantly tweak their systems and approaches often underperform during multiple time frames.

9/23/2010

Building Expertise: Cognitive Methods for Training and Performance Improvement by Ruth Colvin Clark

Building Expertise: Cognitive Methods for Training and Performance Improvement by Ruth Colvin Clark

This is a book I am reading currently. It was recommended by someone who read by blog post about procedural memory. Started reading last night and I am almost 90% through with it. This is very good book on expertise development process.

The book is written for those involved in training industry, but it clearly explains many concepts we have been discussing here for few years now.

Highly recommended if you want to go deeper in to understanding of expertise development process or in training industry like corporate training, instruction design or teaching.

It is also very easy to read unlike other books on expertise.

How to learn to be a profitable trader

The day you realize trading success is about developing procedural memory, you will be on path to success. Trading success is about developing expertise. When you try and develop expertise you train your procedural memory. If your efforts at training procedural memory are successful then you will become efficient in trading.

If we know that the key is procedural memory then why is it difficult to develop procedural memory?

To develop procedural memory you need highly structured environment. When you attempt to develop procedural memory on your own, unless you are extremely motivated and driven (or the correct word according to psychologists is you have very high self efficacy beliefs) the task is difficult. This is the reason most traders fail before they can achieve profitability. They blame markets or other things for it but in many cases the fault lies with failure to train procedural memory.

If you look at procedural memory development situations outside of trading then you will see that all of them impose enormous structure.

Dancing is a skill developed through procedural memory development. If you see the process used for training dancers you will see that it is highly structured and regimented. You are given specific skill to practice. There is close supervision of the practice. There is constant feedback loop. Enormous hours are spent on practice before a performance is attempted. The learning happens primarily from repeated practice. It takes 10 to 15 years of rigorous practice before ballerinas are considered suitable for major performance.

Sometime back I was watching the film Ballerina by Bertrand Norman

and it gives you a glimpse in to what goes in to making of a prima ballerina.

and it gives you a glimpse in to what goes in to making of a prima ballerina.

Sometime back I was watching the film Ballerina by Bertrand Norman

What does the Bolshoi Ballet Academy in Moscow do. It takes young girls from all over Russia and trains them in to ballet using a extremely structured method called Vaganova Method. The effort involved in brutal and the instructors are very demanding. It takes anywhere between 10 to 15 years of training to become good ballerina. (If you want to see what is involved in becoming a ballerina watch a documentary called A Beautiful Tragedy.)

The ballet training is primarily about developing implicit memory. Implicit memories are unconscious memories. They are formed through automation. Procedural memory is memory about skill. In the case of a dancer the procedural memory challenge is about developing a complex skill which require enormous co-ordination of various muscles. Through repeated practice the skill becomes automatic and a procedural memory for it is developed. Same way a good trader primarily has developed procedural memory skills related to specific setup.

The ballet training is primarily about developing implicit memory. Implicit memories are unconscious memories. They are formed through automation. Procedural memory is memory about skill. In the case of a dancer the procedural memory challenge is about developing a complex skill which require enormous co-ordination of various muscles. Through repeated practice the skill becomes automatic and a procedural memory for it is developed. Same way a good trader primarily has developed procedural memory skills related to specific setup.

Developing procedural memory skills requires breaking down a skill in to process and then mastering those processes. Simpler skills are easy to master. For example riding a bike is easy skill to develop as procedural memory skills involved are relatively easy. The time taken to learn it is small. But if you have to learn extremely complex skills and skills requiring use of multiple skills simultaneously then the training involved for it has to simulate those situations and also allow allow the learner to gain confidence in his own skills. That is the basis for developing procedural memory skills for commandos.

US Army, Navy, and Air force have world's best training programs. If you study the history of training skills development in these institutions you will find that they were the first to recognize the concept of procedural memory. If you read book on expertise development, you will see that vast amount of learning about expertise development process has happened through research on training armies. The book Development of Professional Expertise By K. Anders Ericsson explores some of the latest research in this field and is one of the highly acclaimed book in the areas of expertise development. If you want to explore the area of expertise development in more detail you should read it.

Development of Professional Expertise by K. Anders Ericsson

Professionals such as medical doctors, airplane pilots, lawyers, and technical specialists find that some of their peers have reached high levels of achievement that are difficult to measure objectively. In order to understand to what extent it is possible to learn from these expert performers for the purpose of helping others improve their performance, we first need to reproduce and measure this performance. This book is designed to provide the first comprehensive overview of research on the acquisition and training of professional performance as measured by objective methods rather than by subjective ratings by supervisors. In this collection of articles, the world's foremost experts discuss methods for assessing the experts' knowledge and review our knowledge on how we can measure professional performance and design training environments that permit beginning and experienced professionals to develop and maintain their high levels of performance, using examples from a wide range of professional domains.

What does the US Army, Navy or Air force do. It takes raw recruits and through a extremely structured program it converts them in to exceptionally skilled warriors. It helps them develop procedural memory through a highly disciplined and structured program. If you want to understand how this is done watch the video Navy Seals Buds Class 234 Discovery Channel

US Army, Navy, and Air force have world's best training programs. If you study the history of training skills development in these institutions you will find that they were the first to recognize the concept of procedural memory. If you read book on expertise development, you will see that vast amount of learning about expertise development process has happened through research on training armies. The book Development of Professional Expertise By K. Anders Ericsson explores some of the latest research in this field and is one of the highly acclaimed book in the areas of expertise development. If you want to explore the area of expertise development in more detail you should read it.

Development of Professional Expertise by K. Anders Ericsson

Professionals such as medical doctors, airplane pilots, lawyers, and technical specialists find that some of their peers have reached high levels of achievement that are difficult to measure objectively. In order to understand to what extent it is possible to learn from these expert performers for the purpose of helping others improve their performance, we first need to reproduce and measure this performance. This book is designed to provide the first comprehensive overview of research on the acquisition and training of professional performance as measured by objective methods rather than by subjective ratings by supervisors. In this collection of articles, the world's foremost experts discuss methods for assessing the experts' knowledge and review our knowledge on how we can measure professional performance and design training environments that permit beginning and experienced professionals to develop and maintain their high levels of performance, using examples from a wide range of professional domains.

What does the US Army, Navy or Air force do. It takes raw recruits and through a extremely structured program it converts them in to exceptionally skilled warriors. It helps them develop procedural memory through a highly disciplined and structured program. If you want to understand how this is done watch the video Navy Seals Buds Class 234 Discovery Channel

If your objective is to become elite trader the training process would be similar. The only difference is you have to structure your own training and develop your own training material and then have the discipline to train yourself. Along the way there will be several setbacks and ability to persist under those circumstances is critical. Besides that you should survive the self training phase without blowing your account (which very few would do). That is the enormity of the task involved in becoming a successful trader. Which most novice have no idea about. Behind every successful self learned trader you will find similar story of extreme efforts and extreme frustration and then slowly discovery of profitable method. Unfortunately most people will not tell you that.

All the three examples above distill the essence of procedural memory development:

- structured environment

- supervised practice

- extensive practice

When you try to develop procedural memory on your own, you are your own supervisor, mentor, instructor, motivator and so on. Besides that you are developing your own syllabus. As against that in any structured environment they have studied procedural memory skills required for the job and have template to develop such skills in others.

That is the big challenge for trader who tries to learn trading on his own. And it is also the reason for high failure rate.

What can trader do to survive such learning process and become successful:

What can trader do to survive such learning process and become successful:

- Understand that learning to trade is about developing expertise. And specifically it is about training procedural memory.

- Understand that procedural memory is task specific. So specializing in a setup is extremely critical. Once you select a setup then you develop procedural memory specific to that setup. A trader who is good at trading say momentum stocks on 3-10 days has developed a procedural memory specific to that setup.

- Understand that selecting your trading time frame is critical. If you want to be day trader the kind of procedural memory development you will need is very different from if you decide to be swing trader.

- Understand that less number of setups you focus on better it is. The entire logic behind the procedural memory development process is that it allows you to overcome cognitive load. The more setups you try and trade simultaneously more is cognitive load. When your short term memory gets overloaded you tend to make mistake and get frustrated. First master one setup then you will find mastering other setup easier.

- Understand that there are no secrets in this business. The real secret is your ability to develop procedural memory. Procedural memory can only be developed through "How to " kind of knowledge. If someone gives you a secret way to put stops as a software plugin. It is perfectly useless. Because it does not allow you to develop your own procedural memory skill. Similarly someone gives you 3 picks daily and does not tel you in significant detail how that person actually arrived at those picks, what scans he used, what analytical methods he used to arrive at those 3 picks, you will learn nothing. It will not help you in anyway to develop procedural memory.

- Understand that many profitable traders are not conscious of how they develop their own trading skill and how procedural memory work. in fact most would not have even heard of procedural memory unless they had background in psychology or are involved in training. If you want to understand more about procedural memory ask Reaper Trader . His Masters Thesis was on that subject.

- Understand that profitable traders can not verbalize the process they follow. Procedural memories are implicit memories they can not be easily verbalized. A person who possess a skill in particular kind of trading may not be aware of steps he or she is following. Psychologist and those who study procedural memory use special techniques to build procedural maps to understand such skills. Often you will read a interview or watch a interview of famous trader and you will see that the person does not tell you much about his process. Often they give you generalities , why because they are not aware of their own procedural skills. I recently read a book by a trader who is pretty well known amongst prop traders and day traders and recently wrote a book about it. Now the book is extremely disappointing to many highly skilled traders because it fails to explain the process. It has tall stories but when it comes to actually the meat of explaining the process the author fails miserably. Why because it is difficult to verbalize a skill like tape reading.

- Understand that once you develop procedural memory it is on auto pilot and it is lifetime skill. The bodies mechanism for handling procedural memories is for survival reason. If we did not have way to develop procedural memory we would not be able to perform any skilled task. In the absence of procedural memory you would be trying to remember steps of a skill and the method involved in performing task every time you perform it. Think of how your life would be if you were to drive like you were driving for first time every time you drive a car. Procedural memory primarily allows you to avoid short term memory overload.

- Understand that most activities which make you money in your life involve procedural memory. Your procedural memories earn you your leaving. If you are a doctor, nurse, dentist, lawyer, teacher, firefighter, marine, actor, singer, dancer, software programmer and so on, what makes you money is your procedural memory. It is not knowledge that makes you money, it the "ability" to convert that knowledge in to some "professional skills" that makes you money. There are many people with superior knowledge but they can not make a living. In any field you will see that the people who earn higher amount of money have more refined procedural memory. Procedural memory is not specific to trading.

- Understand that procedural memory is not developed through hardwork. There are many hardworking traders but they do not necessarily make lot of money. Why because they may not be having right procedural memory. In fact once you develop procedural memory you don't really need to work hard. that is the essential role of procedural memory.

9/21/2010

Top Rated Exchange Traded Funds

DRN: Direxional Daily Real Estate Bull 3X shares is up 31% in last one month. AGQ is up 26%. and URE is up 19% in one month. Some big movers in the Exchange Traded funds universe.

DRN: Direxional Daily Real Estate Bull 3X shares

Top ranked ETF by momentum

AGQ,Proshares Ultra Silver

CHIQ,Global X China Consumer ETF

DRN,Direxion Daily Real Estate Bull 3X Shares

EPI,WisdomTree India Earnings Fund ETF

EWH,iShares MSCI Hong Kong Index Fund ETF

EZA,iShares MSCI South Africa Index Fund ETF

FDN,First Trust Dow Jones Internet Index Fund ETF

GDXJ,Market Vectors Junior Gold Miners ETF

HAO,Claymore/Alphashrs 2 Sm Cap

ICF,iShares Cohen & Steers Realty Majors Index Fund ETF

IDX,Market Vectors Indonesia Index

INP,iPath MSCI India Index ETN

IYR,iShares Dow Jones US Real Estate Index Fund ETF

PIE,PowerShares DWA Emerging Markets Technical Leaders Portfolio ETF

PIN,PowerShares India Portfolio ETF

RWR,SPDR Dow Jones REIT ETF

TUR,iShares MSCI Turkey Investable Market Index Fund ETF

URE,ProShares Ultra Real Estate ETF

VNQ,Vanguard Reit Etf

Subscribe to:

Posts (Atom)