Sixty years ago, the bikini exploded onto the world, and a trip to the beach hasn't been the same since.

Anna Kournikova looking for good stocks to go long!

Anna Kournikova looking for good stocks to go long!

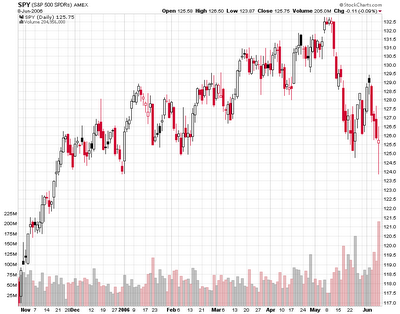

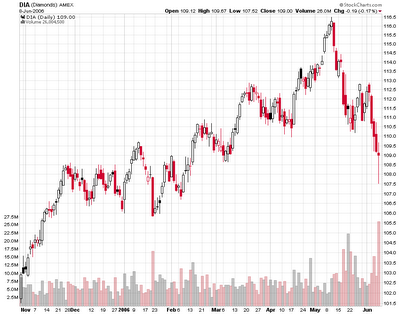

A much better example of the disaster of central planning is the recent monthÂ’s destruction of wealth set off by the coordinated set of plans to jawbone the economy and inflation down set off by the Fed Open Market Meeting of May 10, 2006. It started with an attempt to show that inflation was rampant, the public didnÂ’t get it, and the markets needed a dose of tightening to bring things back to proper order. The attempt was imposed from above based on the vision of a single personage, who coordinated a series of staged speeches about how vigilant the Fed was and how concerned about the failures of the knowledge of individuals they were. The loss of wealth that it set off was in the 3 to 4 trillion range as all emerging markets, Asia, Europe, and Latin America declined 10 to 20% in lockstep from a 45 trillion or so base. By June 29, 2006 it was all over. The last open market meeting emphasized how restrained inflation was, how the Fed would be guided by markets in the future, and how the tightening might be near its end. The world markets recovered an average of 5% from their most recent lows, and will undoubtedly move back to their former levels in the due course of reasonable time, like a few months. But what deadweight costs, what frictional costs, what individual hardship and poverty was created by it all.

What fools these central planners must think we are. What arrogance of power Khrushchev, Mao, Fred Lee and Ben Bernanke displayed in trying to consolidate power about them. What stooges the media and other bit players in the debacle were as they fanned the flames of total economic Armageddon as if puppets in a performance.

Let the story of this recent disaster in centralized planning, this superposition of the vision of a single leader for the wisdom of the market, this attempt to consolidate power behind a single voice (possibly engendered by the pretty woman transgression), serve as a vivid, and compact episode in the US of why market based solution, and pluralism, and suffering the consequences of failure are so necessary to the common good. And let us learn how to profit from such orchestrated forays in the future.

What are Expeditors’ expectations for stock option expense impact during 2006 and would you please discuss what you anticipate for the first quarter?

As an aid to our guesses as to who is going to reach the

semi-finals, we have calculated the following intriguing

probabilities.

We have combined official FIFA rankings and odds from

different bookmakers to create a probability model that

penalizes teams according to how tough their schedule is

on average.

Our model-probabilities are not too far from consensus.

Brazil is the undisputed favorite, with a 12% probability

of winning the Cup. England is the runner up, although

there seems to be a very close probability clustering

between positions 2 and 5, with England, Spain, France,

Holland and Argentina all with, broadly speaking, similar

chances of winning.

Germany, the host, is the 8th most likely team to win the

Cup, with a 5.5% probability. We did not award

Germany any bonus probability, despite some (debatable)

evidence that hosts do have an advantage. Portugal, Italy

and the Czech Republic all lie very close to Germany in

terms of probabilities. The USA, ranked 13th, has a slim,

but not negligible, probability (2.2%) of winning the

tournament. Asian and African countries generally rank

at the bottom end of the table.

All said, however, we look forward to another exciting

competition full of surprises and outstanding games from

outsiders and underdogs. That is, after all, what makes

football so popular.

Themistoklis Fiotakis

Country Model Probability

Brazil 12.4%

England 8.6%

Spain 8.3%

France 8.3%

Netherlands 8.0%

Argentina 7.4%

Portugal 5.8%

Germany 5.5%

Italy 5.3%

Czech Republic 5.0%

Mexico 4.2%

Sweden 3.6%

USA 2.2%

Croatia 1.8%

Poland 1.6%

Ivory Coast 1.2%

Switzerland 1.2%

Ukraine 1.1%

Paraguay 1.1%

South Korea 0.9%

Japan 0.9%

Tunisia 0.9%

Ecuador 0.8%

Serbia and Montenegro 0.6%

Australia 0.6%

Costa Rica 0.6%

Iran 0.5%

Ghana 0.4%

Saudi Arabia 0.4%

Togo 0.3%

Angola 0.3%

Trinidad and Tobago 0.2%

Who Will Win The World Cup?

GS Probabilities

Note: This table translates Fifa ranks into odds and combines

themw ith the average odds given by bookies to create an "initial

probability". Then, it penalizes the countries according to how

tough their schedule is and it spits out the final probability as per

the table above.

Finance professor Jeremy Siegel believes emerging market stocks have been in a bubble fueled in part by skyrocketing commodities prices, since many emerging economies supply the world with metals, fuels and other commodities. Also, trend-following investors have plowed more and more money into emerging markets as they chased past results, bidding stock prices ever higher. "I don't like markets that just follow trends," he says. "They attract trend followers who disregard fundamentals, and they all end this way eventually." Foreign stocks in developed markets "were not in quite as much of a bubble, but there are trend followers there, too," he adds.

If, as argued last Monday, the efficient market theory does not always work, when markets get over-heated, another, not quite academic, theory comes into play. Even after most participants have recognised that the prices are too high, that they have gone up too fast, and that, therefore, there is an increasing possibility of a sharp correction, they go on buying. (Indeed, most short-term players are trend followers).

The hope is that they would still be able to exit at a profit, because a "greater fool" will come along to buy the shares at an even higher price! This does work so long as the trend continues, but the risk is that the greater fool may turn out to be yourself!

Buffett said investors should focus on things that are important and knowable. One attendee asked Buffett and Munger a big-picture question involving currencies, interest rates and current account deficits.

I loved Buffett's answer and I think it helped illuminate some of the differences between his and Munger's approach (rooted in the old-school tradition of investing) and the more populous speculative arena: "We don't play big trends. That's a bit too macro for us," he said.

Buffett said, excluding agricultural products, they do see something of a bubble in metals (especially copper) and oil. He said, like most trends, the fundamentals drive it in the beginning. And what the wise man does at the beginning, the fool does at the end. As trends form and gather momentum, they attract a speculative element. Eventually, that element takes over, and then you are in the danger zone. "We are seeing that in the commodity area," Buffett opined.

We are coming to the end of the second quarter and in just a few short weeks we will be in the heart of earnings season. We have been starting to get a few early reports in (we define the second quarter as the fiscal period ending in May June or July) and the results have been extremely positive so far. Granted these firms are not a representative sample, but so far so good. The most noteworthy of the early reporters are four big investment banks, which blew earnings expectations out of the water.

However, as we enter the quarter, analysts are a bit on the cautious side with the median year-over-year growth rate expected in the S&P 500 at only 8.3%. That is a sharp slowdown from the 13.2% growth posted in the first quarter. Yet shortly before the first quarter reporting season started the analysts were only expecting 8.9% growth for that quarter. Positive surprises then simply overwhelmed disappointments by better than 3:1 and the actual growth was much higher than expected. It would not shock me at all to see that happen again in the second quarter. The three sectors with the highest expected growth for the quarter are Energy (38.3%), Industrials (16.0%) and Materials (14.3%). All three sectors are also continuing to see strong upward estimate revisions for both this year and next.

For all of 2006, earnings growth is expected to be very solid. The median expected growth rate among S&P 500 firms is 11.4%, and the strength is expected to continue into next year with 12.9% growth expected.

"Are there some good newsletters?" said John Markese, president of the American Association of Individual Investors. "Yes, but you still have to find one."

Deciding which newsletter fits your investing needs isn't easy. Perhaps 1,000 publications in the U.S. cover a gamut of investment styles. Many are buy-and-hold stock portfolios culled from old-fashioned gumshoe analysis. Others are disciples of share-price momentum and relative strength, while some rely on elaborate market-timing formulas or sophisticated futures, options and similar leveraged products.

Newsletters typically are delivered to subscribers weekly or monthly, with interim updates via e-mail alerts, Web site access and "hotline" telephone numbers. Such an insider's pass to authoritative, expert opinion certainly sounds appealing, but sometimes a newsletter's claims and tactics are difficult to understand, let alone justify.

"We've seen just about everything," marquees said. "Newsletter writers writing something, then claiming it means something else, or writing things that could not be deciphered. Short of 'My dog ate the newsletter,' we've read it all."

The investment newsletter business is itself no dog. By some estimates the industry takes in several hundred million dollars a year in revenue, but it's essentially unregulated. A 1985 Supreme Court ruling determined that financial newsletter publishers are not investment advisers under Securities and Exchange Commission regulations; all anyone really needs to pontificate on stocks is a printer and a mailing list.

Despite continuing doubts about whether ethanol provides a genuine energy saving, much of the nation's heartland is in the middle of an explosion of the modern-day alchemy of turning corn into fuel. At least 39 new ethanol plants are expected to be completed over the next 9 to 12 months, projects that will push the United States past Brazil as the world's largest ethanol producer.

"This is a bit like a gold rush," warned Warren R. Staley, the chief executive of Cargill, the multinational agricultural company based in Minnesota. "There are unintended consequences of this euphoria to expand ethanol production at this pace that people are not considering."

Two years of maneuvering to enhance shareholder value at Kerr-McGee (KMG:NYSE - news - research - Cramer's Take) found the bull's-eye Friday when the company agreed to be acquired by Anadarko (APC:NYSE - news - research - Cramer's Take) at a 40% premium to its market value.

Anadarko will pay $70.50 a share in cash for Kerr-McGee, or about $16 billion. Kerr-McGee's stock closed Thursday at $50.30 and surged $18.68, or 37%, to $68.98 in premarket trading Friday. As of Thursday's close, Kerr-McGee's market capitalization was about $11.4 billion, while Anadarko's was $22.2 billion.

Anadarko also announced an agreement Friday to acquire Western Gas Resources (WGR:NYSE - news - research - Cramer's Take) for $61 a share cash, or $4.7 billion. Western Gas closed at $40.91 Thursday and was up $18.09, or 44.2%, to $59 early Friday.

In the past few months, MedifastÂ’s CEO/Chairman and his wife, the MacDonalds, have sold a total of $3.7 million in stock, which represents close to 25% of their total holdings. While we do not fault a CEO for taking money off the table, we must note that his stock sales exceeded the entire growth in shareholders value over the course of the quarter. http://finance.yahoo.com/q/it?s=MED

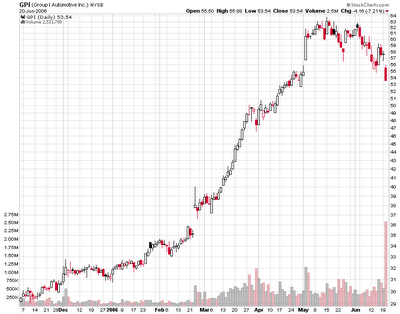

Automotive retailer Group 1 Automotive Inc. (GPI.N: Quote, Profile, Research) said on Tuesday that it had priced $250 million of 2.25 percent convertible senior notes due 2036 in a private offering to institutional buyers.

The notes will be convertible into cash and, if applicable, shares of Group 1 common stock, based on an initial conversion price of approximately $59.43 per share. Group 1 has granted to the initial purchasers a 13-day over-allotment option to purchase an additional $37.5 million of the notes.

The May selloff in stocks couldn't have come at a worse time for hedge fund manager Victor Niederhoffer, who's been working hard to put his infamous 1990s boom-to-bust story behind him.

In May, Niederhoffer's four-year-old Matador Fund posted one of its worst months ever, industry sources say. The fund, which specializes in trading stock futures and stock index futures, lost nearly 29% as the U.S. markets began to unravel, reducing the value of Matador's holdings to about $247 million.

As of the end of May, the so-called commodity trading adviser fund, which was once up 31% for the year, was 6% in the red since the end of December. Results for June, which is shaping up as another harsh month for investors, could not be determined.

The markets saw a big reversal and shot up on account of heavy buying in scrips across sectors. The Sensex closed with a gain of 616 points. The Nifty closed with hefty gains of 166 points. It was the biggest ever intra day gain for the Nifty and the Sensex.

Parlux Fragrances, Inc. engages in the creation, design, manufacture, distribution, and sale of fragrances and beauty related products. The company holds licenses to manufacture, distribute, and sell fragrances and grooming items of PERRY ELLIS, PARIS HILTON, OCEAN PACIFIC, XOXO, FRED HAYMAN BEVERLY HILLS ‘273 Indigo’, and JOCKEY. It also has license agreements with Paris Hilton Entertainment, Inc. to develop, manufacture, and distribute cosmetics, watches and other time pieces, handbags, purses, wallets, and other small leather goods under the Paris Hilton name; and GUND, Inc. to develop, manufacture, and distribute children’s fragrances and related products on a worldwide basis under the babyGund trademark.

Simclar, Inc. is a contract manufacturer of electronic and electro-mechanical products. The company's products are manufactured to customer specifications and designed for original equipment manufacturers (OEMs) in the data processing, telecommunications, instrumentation and food preparation equipment industries. The company's principal custom-designed products include complex printed circuit boards (PCBs), conventional and molded cables, wire harnesses and electro-mechanical assemblies. In addition, Simclar provides OEMs with value-added, turnkey contract manufacturing services and total systems assembly and integration. The company also delivers manufacturing and test engineering services and materials management, with flexible and service-oriented manufacturing and assembly services. Simclar manufactures approximately 850 products for over 100 OEM customers.

If a U.S. slowdown is not the issue (but rather the extent of it), the next most crucial and important issue becomes whether the rest of the world will de-couple from the U.S. slowdown or not, i.e. whether Europe, China, Japan and other emerging market economies will be able to continue to grow at a sustained rate if the U.S. economy slows down or whether the U.S. slowdown will drag the rest of the world into a sharp global growth deceleration.

The current consensus in financial markets – as expressed in the analysis of many leading investment banks – is that the U.S. slowdown will lead to a de-coupling of the rest of the world from the U.S. slowdown, i.e. the rest of the world will maintain its high growth rate. The de-coupling view is based is based on the following arguments:

1. There is a very strong growth momentum in four major Asian economies – China, India, Japan and South Korea – and this momentum is supported by rapid and resilient growth of domestic demand. Thus, while a U.S slowdown would not be a positive, its impact on Asian growth will be very modest. And if these four major Asian economies keep on growing fast, the rest of Asia will also weather a US slowdown.

2. Many economic indicators from Europe – especially but not only Germany – suggest that economic growth in Europe and especially the Eurozone – is recovering; initially the recovery in confidence and activity was limited to the corporate sector but the recovery is now extending to the household sector. Also, since exports from Europe to the U.S. represent only 3% of European GDP, a US slowdown will have only a very limited effect on European aggregate demand via the trade channel.

3. Various private sector leading indicators measure of the global economy – such as the Goldman Sachs Global Leading Indicator index – suggest a clear leading slowdown in the U.S. but still a strong leading momentum in the rest of the world.

Do these de-coupling arguments make sense? Will thus de-coupling occur if the US slows down? My view is again very much out-of-consensus: I believe that the world will not decouple from a U.S. slowdown and that a sharp U.S. slowdown will lead and be associated with a global slowdown.

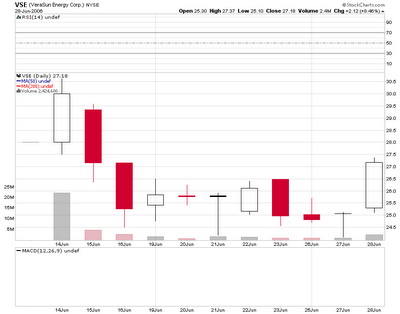

On Tuesday night, VeraSun Energy, the second largest ethanol producer in the US, priced its highly anticipated IPO of 18.25 million shares at $23, above the company's upwardly revised range of $21 to $22. The original deal structure was 17.25 million shares at $18 to $20 before the range was raised and insiders offered an additional 1 million shares (bringing the secondary share total to 7.25 million). VeraSun plans to use the proceeds to signficantly expand its production of ethanol, which is needed to meet federal mandates as a gasoline additive. Morgan Stanley and Lehman Brothers were the lead managers on the deal. The stock is expected to begin trading on the NYSE under the ticker VSE on Wednesday.

You're the world's most famous investor -- do some of them want stock tips?

Interestingly enough, nobody has asked for stock tips. We've always talked about varied things. Most talk about their personal lives. The younger people like David Einhorn (who is 37) talk about raising kids and other such worldly things. They think because I'm 75 I know something -- which is not necessarily the truth.

I hope its clear to everybody that my goal is to find as many low risk, high reward trades as possible. I generally won't enter a trade if I don't think it has the potential to return 3 times my risk. So in R-multiple terms, I'm looking for trades that I think will be at least 3R.

When the newly installed Federal Reserve Chairman Ben S. Bernanke sent stocks plunging 200 points Monday with his latest inflationary warning, this was not another case of the rookie central banker shooting off his mouth. Rather, this was a carefully calculated message to lessen inflationary expectations in markets and the real economy.

''This is theater,'' said one longtime Fed-watcher, meaning that Bernanke is playing a role in hopes that words will make action unnecessary. A more apt metaphor might be that Bernanke is the aviator flying the Federal Reserve monetary airplane, seeking a soft landing from the growth economy without crashing into a recession.

This is the test for America's central banker, at the controls of the global as well as the U.S. economy. Monetary aviation is difficult and risky. Alan Greenspan, Bernanke's predecessor at the Fed for more than 18 years, was renowned for his mastery there. In fact, the man now referred to on Wall Street as ''The Legend,'' out of three attempted soft landings, crashed and burned two times -- a poor average for central bankers. One such crash in 1992 contributed to the defeat for re-election of President George H.W. Bush.

GOLDMAN SACHS, the Wall Street investment bank, is to start raising billions of dollars for a new private equity fund within weeks, despite the recent furore over conflicts of interest between the bankÂ’s private equity division and its corporate clients, The Times has learnt.

It is expected that Goldman is seeking to raise at least $10 billion.

Market commentators expect 2006 to be another record year for fundraising. The biggest firms — including Texas Pacific, KKR, Blackstone, Permira and Apollo — are are on target to raise more than $50 billion.

Oil states armed with an estimated current account surplus of $480bn in 2006 are thought to be feeding the "stealth demand" for bullion, led by Russia.

President Vladimir Putin, a frequent critic of dollar hegemony, has ordered the Russian central bank to raise the gold share of foreign reserves from 5pc to 10pc.

Russia's reserves have surged to $237bn - the world's fourth biggest - after rising 61pc in 2004 and 40pc in 2005. With a current account surplus of 10pc of GDP, it must sweep up a big chunk of global gold output just to stop its bullion share of reserves from falling.

In China, monetary committee member Yu Yongding last week issued the most explicit call to date for Beijing to diversify its $875bn reserves into gold to protect against a tumbling dollar. "We need to use some of the reserves to buy other assets such as gold and strategic resources such as oil," he said.

How many engineers did it take to produce Google spreadsheet? Two? Three? And how many other people did it take to launch? 3 more? What'’s the result of 6 peoples efforts for 6 months?

The press is falling over themselves trying to figure out “"the implications of this announcement". Microsoft has to spend marketing and PR cycles trying to explain to everyone why “"this isn'’t as powerful as Excel"” in the same article which offers a “"balance opinion" from analysts say that it is.

So, for 3 staff-years, Eric Schmidt gets to make Microsoft look like its standing still again and wastes more of their C-Level execs time reacting instead of acting. Pay back is a bitch.

Interviews with nearly a dozen economists and market analysts turned up widely varying views on whether this particular market correction will develop fur and claws. That's partly because each one looks at different signals to determine where the equity markets are going.

Ben S. Bernanke rattled world financial markets Monday with his tough talk about combating inflation, but he also buffed up his image as a strong Federal Reserve chairman committed to the fight, analysts said yesterday.

"He reintroduced testosterone to the inflation-fighting resolve of the Fed," said Diane Swonk, chief economist of Mesirow Financial Inc., an investment management firm. "This is a pure male thing. He said to the markets, 'You think I'm a wimp? Take me on.' "

IN the matchup between the print and online versions of newspapers, signs of the Internet's ascendancy are growing stronger. As Colby Atwood, a newspaper analyst and a vice president at Borrell Associates, put it, "The tail is beginning to wag the dog."

According to estimates released on Friday by the Newspaper Association of America, newspaper print ad spending in the first three months of 2006 increased only 0.3 percent, to $10.5 billion, over the corresponding period last year. At the same time, spending for online advertising surged 35 percent.

"I think the handwriting is kind of on the wall that there is a large migration to the Web," Mr. Atwood said. "Increasing amounts of revenue and focus should be on the online properties. This is a transition that's taking place over several years here. It's not happening overnight, but it's definitely happening."