4/25/2024

4/23/2024

4/10/2024

1/24/2024

1/23/2024

Miami Bootcamp May

Miami

- Price: $750 (cancellation fee $200) ( only for members)

- Date: May 24—26, 2024

- Time:Fri—Sat, 9:00 AM to 5:00 PM

Sun, 9:00 AM to 1:00 PM - Meals: Coffee, pastries and lunch

- Venue: Shalala Student Center

University of Miami

1/22/2024

1/15/2024

1/13/2024

Copenhagen Bootcamp in July

Dates and venue are confirmed for the Copenhagen Bootcamp

Date: July 5—7, 2024

Time: Fri—Sat, 9:00 AM to 5:00 PM, Sun, 9:00 AM to 1:00 PM

Seats: 40 ( Members only price $750)

Venue: Copenhagen Professional College - Sigurdsgade Campus (view on Google Maps)

1/11/2024

Examine your trading beliefs

You can only trade what you believe in.

Your beliefs drive your behavior. This is true not only of trading but also in real life. If you know a person's beliefs, you know how he will behave.

If you "believe " the markets are efficient and there is no way to make money by selecting stocks, you will go and buy ETF.

If you "believe" the only way to trade is using mechanical methods ( that is a belief) and discretionary trading is too vague (that is a belief), as a result, all your behavior will flow from it.

If you "believe," you should only trade triple ETF and not waste time on individual stocks (that is a belief), and as a result, all your behavior will flow from it.

If you "believe" that the only way to trade is with big risk and fully invested on margin, as a result, all your behavior will flow from it.

If you "believe" market will crash (it is a belief) you will spend time constantly shorting.

If you believe trading options is the path to big success (that is a belief), you will spend time trading options.

If you believe momentum stocks offer the best opportunities, you will trade them.

If you believe growth stocks offer biggest opportunities to profit from the growth you will build methods around your belief..

You will become a value investor if you believe growth investors are fools buying expensive companies.

If you believe stocks move in a momentum burst of 3 to 5 days, you will find ways to exploit that phenomenon.

If you "believe" barring liquid stocks, all other stocks are junk, you will only trade liquid stocks.

If you "believe" anticipation setup allows you to make money with the least amount of drawdowns, you will spend time trading them.

If you believe working people can not trade, then you will find a hundred reasons to justify your belief.

If you believe working people like you can still profitably trade, then you will find creative ways to find time for trading.

Every trade has deeply held beliefs like these.

The bundle of deeply held beliefs drives what kind of setup they will trade, what kind of timeframe they will trade, and also all elements of trade like entry, exit, risk, and number of positions held.

The beliefs determine where you will spend your efforts.

1/10/2024

How to deep dive daily

I am interested in trading the most explosive moves for the week or month. By studying these daily, you know the nature of moves in 5-day time frames.

If you want a hold period of one month, do this Deep dive for one month, six months, or a year, depending on your objective.

Just do one thing daily without fail.

Study stocks that are up 20% for a week and up 100% for a year

Everything you need to make money, you will learn from that.

You need to understand the nature of stock moves and how they start, progress, and reverse. Doing this daily will give you a working model of what works in the current market. Then, you can start designing the scans to find them.

This study will help you develop "your understanding " of market moves. Once you have sufficient experience of doing this, you can start discounting a lot of conventional wisdom or market speak. Because you can see what the Guru is telling you on Twitter in the book or in a blog, it is not in line with what actually happens in the market.

How can you do this

Run simple scans in Telechart

Study Bullish 20% c/c5>=1.2 and minv3.1>100000 and c>=5

Study Bearish 20% c/c5<.8 and minv3.1>100000 and c>=5

Study 20 Dollar plus Bullish c-c5>=20 and minv3.1>=100000

Study 20 Dollars plus bearish c5-c>=20 and minv3.1>=100000

If you are trading low-priced stocks, you can eliminate the last condition of c>=5

Do this daily, and you are guaranteed to be a better trader.

1/09/2024

JBLU U NN URNM

NVDA Day vs Swing vs Position Trade

1/08/2024

APLS, AVGO, FNGU, TREE and a Market monitor tip

APLS

FNGU

AVGO

TREE

Does Overhead resistance matter? (Video 2 min)

1/05/2024

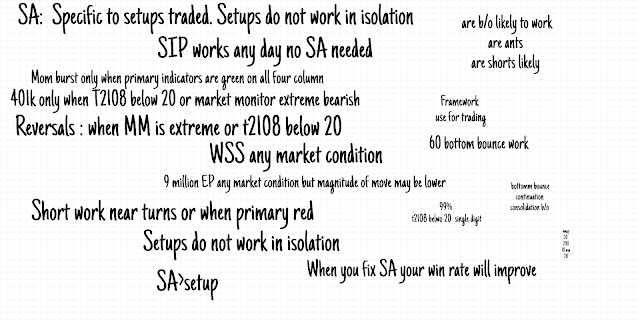

For high win rate fix Situational Awareness

Every day, we do this to answer whether our setup is likely to work and only trade when the probability is in our favor for that setup.

Over the years over 10000 traders have learned. Situational Awareness and Market Monitor-based framework for trading, and you will see thousands of them on Twitter doing similar things.

If your trading is not going anywhere fix your Situational Awareness and you will find instant difference.

1/04/2024

1/01/2024

12/31/2023

12/30/2023

12/23/2023

12/20/2023

2024 Bootcamp Dates

2024 Bootcamp dates for those asking about the schedule

Members Only Online 19 to 21 January New Jersey 9 to 11 February ( members only) Cyprus 8 to 10 March (members only) Copenhagen 5 to 7 July (members only)Next year bootcamp schedule if busy

Become a member and attend one of the Stockbee BootCamps in 2024.

We have boot camps planned online, in New Jersey, Florida, Cyprus, Copenhagen, Buda Pest, and Las Vegas for 2024

mflocastro238:30 AM Dec 20th 2023

Better late than never... my Bootcamp experience.

I've been a member since August 2021 and the North Brunswick Bootcamp is my first one. Since August 21 I've been in and out of trading, making every mistake on the book (yes, even flirting with different setups) but have been taking things pretty seriously this year. Being in the daily meetings, trying to develop my SA and so on. It has not been a great year for continuation setups, so I have not devoted 100% of my time to trading.

Going to a Bootcamp was quite an investment to me because I live in South America so the plane tickets are quite expensive. However, I pulled the trigger in November and bought the ticket for the NJ Bootcamp.

What I was looking for was quite clear to me: self-efficacy beliefs. I wanted to have the confidence to take larger size, being sure that I 'got' the setup right. I wanted to come back home excited to trade.

The experience was literally life-changing. I got everything I was looking for and more. Being someone that works form home and loves it, I had not considered the importance of social learning. EG is a great generous person that will go through your Deep Dive, answer questions and make sure that you don't go back home without understanding the setups. However, his commitment to everyone's success is crazy. The community that Pradeep has created is really a support system available to each and every member of the site. The incredible conversations I had at the Bootcamp had helped me clarify and re-clarify concepts that EG has been teaching us for years.

I'm back home and have daily conversations with people I met at the BC, constantly challenging our setup selection, exchanging opinions, and just basically lifting ourselves higher.

To finish my rant, if you're on the fence and you don't know whether the Bootcamp is worth it, make yourself a favor and go. I didn't know how alone I felt until I met other traders going through the same struggles.

And finally, a huge thanks to Pradeep for doing this, for challenging us but also for giving us the confidence we need to make this work. Trading is a journey (and a pretty long one for some of us) but having this community to lean on is what I think will make me successful in the long run.

Thank you to all the people I've met and exchanged opinions with, you've helped me tremendously. Social learning is the absolute best.

12/04/2023

Members feedback

11/26/2023

How I calculate risk on a trade

11/11/2023

11/10/2023

11/07/2023

Stockbee North Brunswick Bootcamp December 8th to 10th.

Bootcamp North Brunswick, New Jersey ( only for members)

To be held at the Stockbee office in North Brunswick, NJ

Price: $750 (cancellation fee $200)

Date: December 8 - 10, 2023

Time: Fri—Sat, 9:00 am to 8:00 pm, SUN 9:00 am to 1:00 pm

Event size: Only 36 seats

Bootcamp Feedback Las Vegas

Tweet from CH

Posted on 4:07 PM Oct 22nd 2023Thanks to @eg and the Las Vegas members who helped make the BootCamp what it was. As many have already stated, I highly recommend attending one when you get the change. It was the last missing piece to this puzzle we call trading. I was asked by some members to post my Work and what I studied prior. I am in the process of gathering it all and will post a link when its complete. It will not be anything life changing, Just breaking each concept of Stockbee Methods down, using the search function and spending 2-3 days watching every video on that topic from the website.

Nice to meet everyone who shared email, phone numbers etc.

Gratitude and thanks to EG for sharing his knowledge.

Tweet from vdev

Posted on 1:57 PM Oct 22nd 2023Las Vegas Bootcamp

I am very new to trading, and this was very special for me. I had 3 Ah-Ah moments and the 4th one was something that the elderly gentleman Bill said.

First- EG's opening statement, Don't play casino at Vegas, play at the trading- the GONG, was I certainly don't want to play any casino, better follow EG to the T.

Second-- definitely Long Long Legs.

Third- KISS -visual only for 2lynch/ WSS. No thesis here.

4th - Bill commented to me- let the pattern hit you on the head(pop on the screen), don't chase it, only then trade.

I would like to thank EG, for choosing Las Vegas and sharing all his knowledge and wisdom. At the camp, EG gave us individual attention and time. We searched for patterns in a group setting as well as individually at the BC, and further more search at night. He commented on each ones work, each and every chart, starting early next day to do so.

I would like to thank the community here for encouraging us and sharing all their knowledge as well as all the attendees at the camp. It was a great experience.

I hope I will be able to implement the knowledge I gained. I started out by listening to few you-tubes, and reading an elementary book. Stumbled on trading accidentally! I chose Stockbee as I thought time and money spent on learning how to fish is more worthwhile than readymade fish. I took a platinum membership right at the start as I thought it would need time. I soon realized I am fortunate to be here. I purchased the Euro online BC, and found that is actually sums up all the guide and is much more concise and clear regarding buy point, exits etc. EP section was very well done.

I now look forward to participating in more deep dives. The homework assignment taught me a lot. Earlier I thought I had understood the pattern by reviewing the guide, python, Batra etc, but this made a huge difference and I will now search for more setups with a trained eye.

Tweet from AB

Posted on 7:14 AM Oct 22nd 2023Las Vegas Bootcamp

There is only one thing wrong with the boot camp - I wish I had done it earlier!

I joined the site sometime last year and studied a lot of material on the site, thinking I had grasped it all. However, during the boot camp, I learned many things I had been missing and hadn't paid attention to, which provided me with absolute mind clarity.

If you've just joined and you aren't profitable or your account balance is fluctuating, I would strongly recommend attending the boot camp as soon as possible.

Be first -attend the boot camp.

Be smart- and do it.

Don't cheat!

If you are a newbie.This will be the best investment, and you will never regret it. If you are an experienced trader, this is your opportunity to learn many details and tactics that EG is using because he has so many strategies at his disposal. Many successful traders have attended the boot camp in the past and achieved great results. Some of them made $100 million. Ask yourself why you would want to miss the opportunity to learn from such an experienced trader who has proven his success.

It was an amazing learning experience, and I am very confident and excited to put everything I learned into practice. It was nice to meet all of you at the boot camp, and thank you so much, EG, for this opportunity and for everything you do for this community.

Your life, your choice - do what you can't.

Tweet from MSN123

Posted on 6:16 AM Oct 22nd 2023I joined this community around June this year. I had watched guide section videos and have been attending SA calls in the morning but not other calls during the day as it conflicts with work timing. Attending the Vegas Bootcamp was one of the good things I did, as it gave good understanding of different set ups especially 2LYNCH. The individual assignments and feedback definitely helps build that conviction. Find those good first leg moves, find them early! Don’t overstay the party! Now it’s time to perfect my SA and execute the setups well. Thank you EG for the Bootcamp, and everyone who attended for making it such a productive session.

Tweet from abimrk

Posted on 12:43 AM Oct 22nd 2023I recently attended my second Stockbee bootcamp, having previously participated in one back in June. After my first experience, I noticed a decline in my setup selection quality, influenced by the current market conditions to make breakouts work. This latest bootcamp helped me realign myself on setups and achieve mind clarity. Thank you EG for your teaching and feedback!

Tweet from pokemon

Posted on 8:14 PM Oct 21st 2023I also joined stockbee 3 months ago. In the BootCamp, EG pointed out a few mistakes I had for the MB 2lynch pattern in the continuation setup. I had to fix them and did the 2nd round of the homework. This learning process helped me to understand what would be a qualified continuation setup clearly. Hopefully, I can apply that in my actual trading when SA becomes healthy. I also got some ideas on managing my risk and peeling my positions. I will keep experimenting to see what would work better for me. Thanks, EG, and other traders. Seeing you all in person has made this community come alive.

Tweet from Jail

Posted on 6:55 PM Oct 21st 2023The Las Vegas Bootcamp Experience

I had joined Stockbee 3 months ago, and it didn't take long for me to realize that this is by far the best trading community that I've come across. After joining, I binged hundreds of videos and found incredible value in them, so much so that I booked the Las Vegas bootcamp less than 3 weeks after joining.

My number one goal for this bootcamp was to obtain Mind Clarity on all setups, and I'm happy to report that the experience had exceeded my expectations. As I said, I watched many videos already (some multiple times) and also did deep dives, but there were still gaps I did not know existed that were only discovered during the bootcamp. I had at least two big epiphanies, and countless other smaller realizations that I did not learn from watching videos. EG explained each setup in great detail and also covered a lot of the nuances (especially if specific questions were asked) that helped a ton in my understanding of the setups. Also, having each of the setups explained in a methodological fashion in its entirety helped a lot in obtaining MC. Although the online videos are valuable, they can sometimes be hard to piece together due to fragmentation.

The assignment given for the night was instrumental in developing MC as well, the fact that you get to present your deep dive to EG in person, and he'll ruthlessly point out any gaps or misunderstandings you have is exactly what one needs to develop 100% MC. Deep dives without expert feedback can be detrimental as you could be reinforcing an ever so slightly incorrect understanding of the setup (which was exactly what I was doing pre-bootcamp), or in the worst case, a completely incorrect one.

Lastly, on what makes a good trader, EG mentions self efficacy belief (https://stockbee.biz/tweet/620036) to be the most important factor. While obtaining better MC definitely helps one on their path to mastery experience, I think there are other benefits of an in person bootcamp for building self efficacy belief as well. There's something about EG pouring decades of trading wisdom and experience onto you in person that watching videos on a screen just can't compete with. It's like having a master craftsman passing down their decade-long legacy to you, and you have a sense of duty to put the wisdom into practice to master the craft and continue their legacy. There's something special about the personal touch that definitely increased my self efficacy belief and confidence in becoming a successful trader. In addition, being in a roomful of other traders builds vicarious experience as well. I've never met a single trader in person prior to this bootcamp, let alone a roomful. Having this experience definitely made me think that becoming a professional trader can very much be a reality that's within reach.

What's special about EG is the fact that he's not only an amazing trader, but also an amazing teacher, two rare qualities for someone to possess at the same time. It's clear to me that EG understands how one can become a successful trader at a fundamental level, I've never seen any other trading coaches talk about things like self-leadership, self efficacy belief, visualization, creativity, serendipity, deep dive, procedural memory, social learning, etc. EG knows trading is a performance sport and thus train us like peak performance athletes. This is why I view EG as a performance coach just as much as I view him as a trading coach, because I believe we can use the same concepts taught by EG in any other area in life we want to develop an expertise in and get top-level results. It was my pleasure to have experienced EG's teachings in person and I can't recommend it enough to everyone, thank you EG for this amazing bootcamp experience!

Tweet from ibby_950

Posted on 5:48 PM Oct 21st 2023Amazing bootcamp. EG proves once again how kind he is to share what is required to make it in this game. There are little to no people who would do that. Dont hesistate. Do a bootcamp.

Thank you for everything uncle!

Tweet from paragrj

Posted on 4:22 PM Oct 21st 2023Las Vegas Boot Camp-

As I leave this morning from Airport ,I looked back on what I learnt from the bootcamp and the perspective of trading using simple ,strategic effective methods of StockBee Trading sets up have given me a mind clarity as to which directions I should lean on . As a NewBee in trading and attending my first ever Trading bootcamp with several veteran attending several times, sometimes is overwhelming and nervous. However right from day one ,Easyguru given every confidence with details of set up, during workshop .His In-depth Technical analysis and his simple logical methods, strategies and techniques has given me exponential confidence and a change of attitude to begin trading.

Anyone who is a new to Trading and wants to learn simple , easy yet constructure mechanism of trading , should go to Stockbee boothcamp. Not just once but multiple times to keep engaging with community that Easy has created.

Thank you all for amazing time and thank you Easyguru for helping us.

May the Markets be us all time !!

Tweet from arung

Posted on 2:48 PM Oct 21st 2023Las Vegas Boot Camp

Please read @Sketch comment below. He has comprehensively put the what many of us wanted to say about the bootcamp and how essential it is.

In addition I would say don't even hesitate or think twice about attending. The Boot Camp along with the home work assignment and corrections and the classroom teaching by EG would bring the mind clarity that would be elusive for a long time which is completely unnecessary.

GO FOR IT.

Tweet from Sketch

Posted on 1:13 PM Oct 21st 2023Las Vegas Boot Camp - If you've never been to a bootcamp do yourself a favor and GO!!!

I had the pleasure of attending the Las Vegas Stockbee Bootcamp, and I can't express enough how great the entire experience was. If you think EG is great on zoon calls... well he is exceptional in person but watch out his paddle/whip arm is super strong now. His ability to make the world of stock trading not only accessible but genuinely exciting is unmatched.

Having attended several other seminars in the past, I can confidently say that the Las Vegas Stockbee Bootcamp stands out in a league of its own. Each bootcamp I've attended, now three, had its unique charm, but this one was an absolute game-changer. It was refreshingly straightforward, delivering clear and concise strategies on how to make money in the stock market with ease by focusing on a clear methodology and process.

One of the aspects that I appreciated the most was the focus on simplicity. EG emphasized the easiest and most effective ways to make money in the stock market. This pragmatic approach was a breath of fresh air, especially for someone like me who had struggled with thinking complex strategies were the way to find success. It’s clear EG genuinely cares about his student's success and is committed to providing US with the tools and knowledge needed to make money.

I've been to the fancy well known seminars and they are filled with hours of fluff for the perception of value but offer little substance. In a world where the pursuit of financial knowledge often comes with an exorbitant price tag, it’s always been refreshing that Stockbee offers the best value for knowledge in this business.

If you're looking for a stock trading bootcamp that's not just informative but also engaging, I wholeheartedly recommend attending a Bootcamp, you won't be disappointed!

.png)