Stocks on the move

June 30, 2006

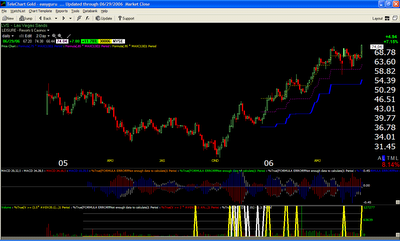

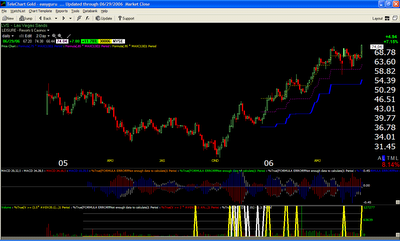

LVS, Las Vegas Sands

Good times bad times people like to gamble. The casino sector is witnessing some renewed strength and LVS, Las Vegas Sands has good earnings. Also keep an eye on PENN, Penn National Gaming which is within 15% of its all time high.

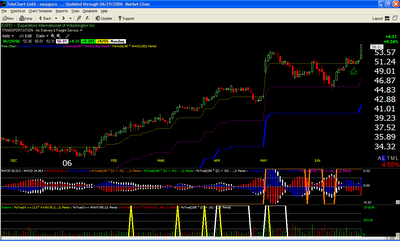

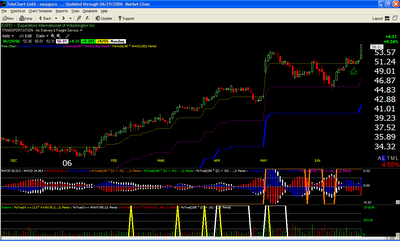

CME, Chicago Mercantile Exchange

Like the casinos who always make money, the exchanges always make money. This one is near all time high,probably headed to 600. It also has low float. Keep an eye on other exchanges also like BOT, Cbot Holdings Inc. and NYX, New York Stock Exchange.

EXPD, Expeditors International Of Washington Inc.

This is the only company whose filings I read regularly. The company has great sense of humor. Sample this answer to an analyst question.

What caused your first quarter 2006 depreciation and amortization expense to decline sequentially?

While it is true that depreciation and amortization expense recorded in the first quarter of 2006 was down some $53,000 from the amount recorded for the fourth quarter of 2005, we have a tough time considering this to be very significant.

During the fourth quarter of 2005, we increased the amount we recorded in Australia as depreciation expense in accordance with GAAP in anticipation of paying what is known as “dilapidations” on the ultimate termination of a leasehold. We also fully depreciated a forklift in one location (hey, you are asking us to explain a $53,000 difference). We also had a couple of locations in the United States where we had slightly extended our lease term after we had nearly finished amortizing tenant financed lease hold improvements.

Perhaps the concept of paying dilapidations needs a bit of additional explanation. Any college student likely understands that in order to get a damage deposit back, it is advisable to put some toothpaste in the nail holes, clean the fridge and shampoo the carpet. Commercial rental agreements in certain backward locations have a similar concept. These are places where they likely drive on the left hand side of the road. They also spell funny, but we digress.

Rather than having a clause that allows for normal wear and tear, these leases require the tenant to “return the premises to original status” or pay the landlord the cost. Just as the carpet is always dirty in a landlord’s opinion, no matter how hard you worked on it, a freight forwarder cannot escape a lease without making a substantial payment to these lords of the realm.

GAAP requires that we anticipate these dilapidation accruals by “capitalizing” our best estimate of what this dilapidation amount will be at the inception of a lease and booking a related liability that will be paid at the conclusion of the lease. We then systematically write this asset off over the life of the lease as additional depreciation expense leaving only the liability.

As we approach the end of a lease, we sometimes realize that we are going to need a couple of extra toothpaste tubes. Having reached this conclusion, we book an increase to the “dilapidation accrual” and make a cumulative “catch up” adjustment to depreciation expense. In this manner, we will have expensed all of our toothpaste obligation.

You must also read answer to this analyst question to understand employee stock options acounting.

Good times bad times people like to gamble. The casino sector is witnessing some renewed strength and LVS, Las Vegas Sands has good earnings. Also keep an eye on PENN, Penn National Gaming which is within 15% of its all time high.

CME, Chicago Mercantile Exchange

Like the casinos who always make money, the exchanges always make money. This one is near all time high,probably headed to 600. It also has low float. Keep an eye on other exchanges also like BOT, Cbot Holdings Inc. and NYX, New York Stock Exchange.

EXPD, Expeditors International Of Washington Inc.

This is the only company whose filings I read regularly. The company has great sense of humor. Sample this answer to an analyst question.

What caused your first quarter 2006 depreciation and amortization expense to decline sequentially?

While it is true that depreciation and amortization expense recorded in the first quarter of 2006 was down some $53,000 from the amount recorded for the fourth quarter of 2005, we have a tough time considering this to be very significant.

During the fourth quarter of 2005, we increased the amount we recorded in Australia as depreciation expense in accordance with GAAP in anticipation of paying what is known as “dilapidations” on the ultimate termination of a leasehold. We also fully depreciated a forklift in one location (hey, you are asking us to explain a $53,000 difference). We also had a couple of locations in the United States where we had slightly extended our lease term after we had nearly finished amortizing tenant financed lease hold improvements.

Perhaps the concept of paying dilapidations needs a bit of additional explanation. Any college student likely understands that in order to get a damage deposit back, it is advisable to put some toothpaste in the nail holes, clean the fridge and shampoo the carpet. Commercial rental agreements in certain backward locations have a similar concept. These are places where they likely drive on the left hand side of the road. They also spell funny, but we digress.

Rather than having a clause that allows for normal wear and tear, these leases require the tenant to “return the premises to original status” or pay the landlord the cost. Just as the carpet is always dirty in a landlord’s opinion, no matter how hard you worked on it, a freight forwarder cannot escape a lease without making a substantial payment to these lords of the realm.

GAAP requires that we anticipate these dilapidation accruals by “capitalizing” our best estimate of what this dilapidation amount will be at the inception of a lease and booking a related liability that will be paid at the conclusion of the lease. We then systematically write this asset off over the life of the lease as additional depreciation expense leaving only the liability.

As we approach the end of a lease, we sometimes realize that we are going to need a couple of extra toothpaste tubes. Having reached this conclusion, we book an increase to the “dilapidation accrual” and make a cumulative “catch up” adjustment to depreciation expense. In this manner, we will have expensed all of our toothpaste obligation.

You must also read answer to this analyst question to understand employee stock options acounting.

What are Expeditors’ expectations for stock option expense impact during 2006 and would you please discuss what you anticipate for the first quarter?

No comments :

Post a Comment