Correction may be shallow

March 1, 2007

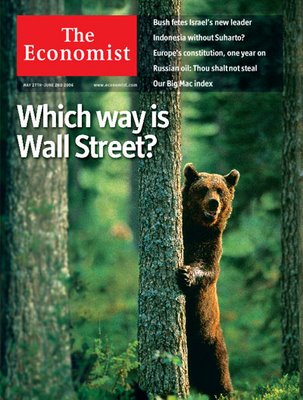

The Economist want people to be scared, given Economist covers reliability so far, this correction might be shallow.

How about this in first week of June 2006.

The S&P and Dow stopped going down and rallied within few days of the cover hitting stand. This British rag has amazing timing sense.

lots of conflicting interests: bernanke vs the economist vs greenspan vs roubini, etc etc etc

ReplyDeletewe'll just have to wait for new tickersense poll!

ReplyDeleteShorts have a big problem on hand with action like today. By the end of the day they need to decide whether to keep their position or cover. Shorting is never easy, even in a bear market.

ReplyDeleteagree, but many new longs under water dont want to wake up to dow futures -200 again...

ReplyDeletei agree regarding the shorts, though, its a different mechanism and method to extracting wealth from the market

Today printed a bullish candle for the day, but the tide has clearly turned bearish. Short term bounce anyone?

ReplyDeleteI think the shorts have to worry more about a 200 point gap up than down from here.

ReplyDeleteOn the market direction, I ask, where are the leaders?

ReplyDeleteAll bull markets are led by some sector leaders be it financial, technology or anything else. In the last 15 years, the bull market has mainly been led by technology.

At present, the financials look very weak (brokers and banks have been downgraded and hammered past week, on very high volume), with technology, the Dell announcement today and the vista sales announcement from Steve Balmer are not very encouraging.

So, to the bulls, I ask, where are the market leaders?

I am not a bear, not do I short, I am seeing a sideways to lower market until we can get some leadership from technology.

I meant near-term measured in hours to days. Longer term (years) I agree that technology will lead a superbull market.

ReplyDeleteGosu

ReplyDelete4 year bull market has been lead by 100 year old technology (steel and commodities), why is technology critical for rally?

Which sectors are leaders for 4 year plus.