How to use market breadth to avoid market crashes

August 8, 2011

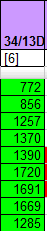

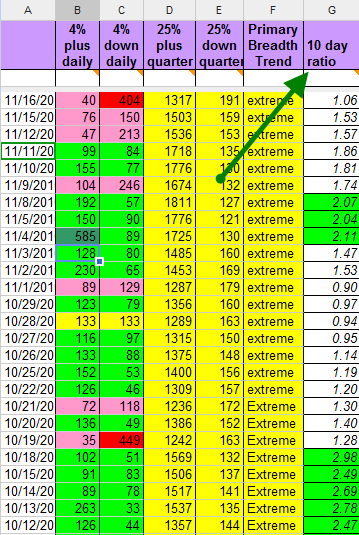

This is a chart prepared by one of the Stockbee member using the Stockbee Market Monitor data. It Plots the breadth of number of stocks up 25% in 65 days in the bottom two panes.

As you can see the breadth peaked in early November 2010. Since then rallies have been on lower breadth. Each successful bounce effort after that was not followed by significant breadth. This breadth divergence was clearly a sign of topping pattern.

Now breadth is at extreme negative level. Historically such low levels lead to tradable bounce in next 1 to 6 weeks time frame. Often such low readings also lead to new bull move.

If you see the left side of the above chart you will see that during the flash crash in June to August 2010 period the readings went below 200 to 130 , that resulted in a big rally starting September 2010. Readings below 200 indicate seller capitulation.

A detailed understanding of market breadth and how to use it can help you develop very effective market timing tools that will keep you out of bearish phases and will tell you when major rally is likely to develop. It is one time effort but it will save you hundreds of thousands and make you millions.

The Market Monitor is a breadth based risk management and market timing tool that I have been using for last 10 years. It has kept me out of every risky and bearish period.

Now the tool is used by number of trading bloggers (if you do search for Stockbee Market Monitor you will see lot of them using this tool ) you and many of them have done further refinement to the concept.

As I get many email messages from this blog readers about Market Monitor and how to interpret it the following Market Monitor post details the use of the tool and how to set it up in Telechart.

What is stockbee Market Monitor

What is market breadth

How is market breadth calculated

Primarily breadth is calculated by tracking advance decline and/ or new high new low and/or advancing volume and declining volume.

How is Stockbee Market Monitor different from other market breadth indicator

Market Monitor Scans

To get stockbee Market Monitor Daily data you need to setup following scans in Telechart. All stockbee Market Monitor scans use Common Stock as stock universe.

As you can see the breadth peaked in early November 2010. Since then rallies have been on lower breadth. Each successful bounce effort after that was not followed by significant breadth. This breadth divergence was clearly a sign of topping pattern.

Now breadth is at extreme negative level. Historically such low levels lead to tradable bounce in next 1 to 6 weeks time frame. Often such low readings also lead to new bull move.

If you see the left side of the above chart you will see that during the flash crash in June to August 2010 period the readings went below 200 to 130 , that resulted in a big rally starting September 2010. Readings below 200 indicate seller capitulation.

A detailed understanding of market breadth and how to use it can help you develop very effective market timing tools that will keep you out of bearish phases and will tell you when major rally is likely to develop. It is one time effort but it will save you hundreds of thousands and make you millions.

The Market Monitor is a breadth based risk management and market timing tool that I have been using for last 10 years. It has kept me out of every risky and bearish period.

Now the tool is used by number of trading bloggers (if you do search for Stockbee Market Monitor you will see lot of them using this tool ) you and many of them have done further refinement to the concept.

As I get many email messages from this blog readers about Market Monitor and how to interpret it the following Market Monitor post details the use of the tool and how to set it up in Telechart.

What is stockbee Market Monitor

stockbee Market Monitor is a market timing tool. It looks at the underlying breadth of big moves to determine market direction. The objective of Stockbee Market Monitor is to identify and anticipate market turns quickly and proactively. stockbee Market Monitor indicates bearish or bullish turns zones ahead of the actual turn. It is a overall filter for deciding when to use breakout methods, when to be aggressive in terms of margin and risk, and when to be defensive. I also use Market Monitor to time retirement account funds allocation.

Market Monitor has kept me out of every bearish move since 2002 and has helped me get in to every bullish move right at its beginning and get out before actual top.

Stockbee Market Monitor= Market Breadth of major moves+extreme zones+divergences+breadth thrust

What is market breadth

Market Breadth simply tells you how many stocks are going up, how many going down, and how many are unchanged. Market breadth tells you how many stocks are participating in the move. Market breadth uses market derived data to judge the health of a move.

There are variations of the basic breadth idea like measuring number of new highs and new lows, or measuring the up volume and down volume. But ultimately all breadth indicators mathematically are derivatives of :

A D and U

A= number of advancing stocks

D= number of declining stocks

U= unchanged

Different people have massaged this data in various ways by using variety of mathematical techniques like moving average, exponential moving average, ratio analysis, standard deviation and so on to develop number of breadth based indicators.

Because it is internally driven information, it tells you objectively the participation of stocks in a market move. Sometime one of the indexes can be positive as the index are calculated by price weightage or capitalisation weight age, but breadth does not lie. Breadth treats all issues equal.

So because Dow Jones is price weighted , if say the 10 highest priced stocks are up big , it can be positive, even if remaining 20 stocks are down for the day. In such a case the breadth will tell you real story. The breadth will be 10/20.

Breadth tells you immediately the strength and direction of a move in the market. A market in which more stocks are going up compared to going down and more stocks making new high compared to new low is a good bull market. Extreme breadth is often indicator of exhaustion and such zones lead to reversal. Tops and bottoms are also formed due to breadth divergence. If a move keeps going up but breadth does not increase then that is divergence. Such divergences typically result in failure of the move.

How is market breadth calculated

Primarily breadth is calculated by tracking advance decline and/ or new high new low and/or advancing volume and declining volume.

To calculate advance decline you need:

- Total stocks available for trading in the market (T)

- Advancing stocks or advances (A)

- Declining stocks or decliners (D)

- Unchanged (U)

To calculate advance/decline volume

- Advancing Volume or Up volume (UV)= total volume of (A)

- Declining volume or Down volume (DV)= total volume of (D)

- Total volume = total of all volume traded for the day for all stocks

To calculate new high/new low

- New high (h)= number of stocks making 52 week high

- New Low (l)= number of stocks making 52 week low

All market breadth based commonly available indicators in the market are derived using this basic data. After taking this basic data people massage it in different way to create their own "proprietary " indicators.

Market Breadth simply tells you how many stocks are going up, how many going down, and how many are unchanged. There are variations of the basic breadth idea like measuring number of new highs and new lows, or measuring the up volume and down volume. But ultimately all breadth indicators mathematically are derivatives of :

A D and U

A= number of advancing stocks

D= number of declining stocks

U= unchanged

Different people have massaged this data in various ways by using variety of mathematical techniques like moving average, exponential moving average, ratio analysis, standard deviation and so on to develop number of breadth based indicators.

How is Stockbee Market Monitor different from other market breadth indicator

Most market breadth indicators tend to be noisy as they use very few filters.

stockbee Market Monitor is different from most commonly used breadth indicator. It only looks at breadth of major moves. Stockbee Market Monitor uses minimum liquidity to calculate breadth. All market breadth indicators take any up or down move to calculate breadth. So if a stock goes up on 100 share volume it is still calculated . In stockbee Market Monitor such stocks are not used for market calculations. Only stock with Dollar volume above 250000 USD or 100000 shares traded are used in all stockbee Market Monitor calculation. stockbee Market Monitor uses price cut offs to eliminate low priced stocks. Fourth difference in use of only Common Stocks to calculate breadth. This ensures you are looking at breadth of only tradable stocks.

These changes in ways to calculate market breadth significantly improves the breadth indicators.

Market monitor looks at breadth of significant moves in the market instead of small moves. By doing that it reduces the noise in breadth data. Say if you use just advancing , declining, and unchanged issues to look at breadth on a daily basis, a stock going up or down 1 cent also gets represented in the data.

Same way if you use up volume and down volume , even a stock trading single share more than yesterday gets reflected in the data. That makes breadth data very noisy. So if you look at breadth chart they tend to be very noisy.

If you look at the US stock market over many many years, you will see that the average daily move in the market is less than 1% (2008 and 2009 are exceptions). It is a very mature market. Unlike that developing markets and frontier markets have average daily moves of 4% plus So in a market where the daily moves are below 1%, if it makes say 2% move that is significant (that is the concept behind IBD distribution and accumulation days where they look for 1.5% plus day on high volume). Similarly if you study the average daily move in stocks as aggregate over say 10 or 40 years, you will see average move in a stocks are below 2%.(the year 2008 and 2009 are anomalies where big moves are daily phenomenon).

So stockbee Market Monitor uses only certain magnitude moves for calculating breadth.

- Daily time frame=4% plus

- Monthly move=25% plus

- Monthly move=50% plus

- Quarterly move= 25% plus

By using such big moves to measure breadth you are reducing the noise in data.

Stockbee Market Monitor measures breadth on various time frame. That allows you to create slow and fast indicators or strategic or tactical indicators. So market monitor measures the breadth of the market on various time frames.

There is also a variation in how the % moves are calculated. In some cases the reference point for percent change is price number of days ago. In some cases it is lowest price for the period of calculation. The logic is to track both kinds of trends. Some trends start from low points. some start from mid way point. So if you use just new high or new low it can be misleading. This is very critical at turns where up or down moves start from 52 week high or low.

One of the problems with many breadth indicators is that they are 2nd or 3rd derivatives of breadth. This creates a lag in these indicators. The stockbee Market Monitor uses 1st derivative data to eliminate such problems.

Market Monitor Scans

To get stockbee Market Monitor Daily data you need to setup following scans in Telechart. All stockbee Market Monitor scans use Common Stock as stock universe.

4% plus daily

Number of stocks up 4% for the day on high volume.

(100 * (C - C1) / C1) >= 4 AND V >= 1000 AND V > V1

4% down daily

Number of stocks down 4% plus in a day on high volume.

( 100 * (C - C1) / C1) <= ( - 4) AND V >= 1000 AND V > V1

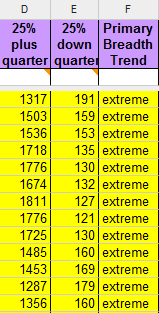

25% plus Quarter

Number of stocks up 25% plus in a quarter

100 * ((C + .01) - ( MINC65 + .01)) / (MINC65 + .01) >= 25 and AVGC20 * AVGV20 >= 2500

25% down quarter

Number of stocks down 25% plus in a quarter.

(100 * ((C + .01) - (MAXC65 + .01)) / (MAXC65 + .01)) <= ( - 25) and AVGC20 * AVGV20 >= 2500

25% plus month

Number of stocks up 25% plus in a month

C20 >= 5 AND (AVGC20 * AVGV20) >= 2500 AND 100 * (C - C20) / C20 >= 25

25% down month

Number of stocks down 25% plus in a month

C20 >= 5 AND (AVGC20 * AVGV20) >= 2500 AND 100 * (C - C20) / C20 <= ( - 25)

50% plus month

Number of stocks up 50% plus in a month

C20 >= 5 AND (AVGC20 * AVGV20) >= 2500 AND 100 * (C - C20) / C20 >= 50

50% down month

Number of stocks down 50% plus in a month.

C20 >= 5 AND (AVGC20 * AVGV20) >= 2500 AND 100 * (C - C20) / C20 <= ( - 50)

34/13 Bull

Number of stocks up 13% in 34 days.

100 * ((C + .01) - ( MINC34 + .01)) / (MINC34 + .01) >= 13 and AVGC20 * AVGV20 >= 2500

34/13 Bear

Number of stocks down 13% in 34 days.

(100 * ((C + .01) - (MAXC34 + .01)) / (MAXC34 + .01)) <= ( - 13) and AVGC20 * AVGV20 >= 2500

10 Day Ratio

This is not calculated using Telechart. This is calculated by using last 10 days of 4% plus and down breakouts.

10 day breadth ratio= number of 4% plus daily breakouts in 10 days/number of 4% down daily in last 10 days.

34/13D

This is not calculated using Telechart. This is calculated using the 34/13bull and 34/13 bear data

34/13D= 34/13bull-34/13bear

Total (No ETF)

This is the number of "Common Stocks" from Telechart component lists.

How to interpret Market Monitor

4% plus Daily

up to 300 normal buying pressure

300 to 500 high buying pressure money flowing in to market

500 to1000 very high buying pressure (normally seen at beginning of a bullish turn from bearish phase)

1000 plus extreme buying pressure

300 plus day are common in bear markets.

At beginning of a bull move you will see a cluster of 3 to 5 big buying days of 300 plus.

Most turns in major trend start with 1000 plus buying day.

4% Down daily

up to 300 normal selling pressure

500 to 1000 very high selling pressure

1000 plus extreme selling pressure

Bear markets rallies typically start after such extreme 1000 plus selling days.

So a 1000 plus days after a 5 to 10 days of selling pressure is short term bullish.

10 Day cumulative breadth ratio

When market is in bearish phase first time ratio is 2 plus signals start of a bull move.

Bull markets start with a bullish thrust.

Bear markets often end with a bearish thrust.

Ratio below .50 signals start of a bearish move after a bull move has been in progress.

2 plus readings are good for swing trading on long side.

.5 or less readings are good for swing trading on short side.

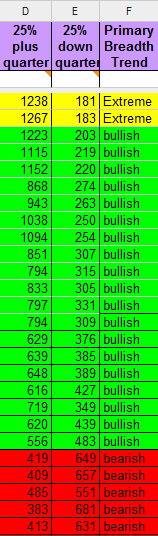

25% plus quarter

This is a primary indicator

Market is in bullish phase if 25% plus quarter>25% down quarter.

Market is in bearish phase if 25% plus quarter<25% down quarter.

Numbers below 200 are considered extreme.

When 25% plus quarter number goes below 200 it is extremely bullish. It indicates extreme bearishness.

Rallies which start from readings below 200 are extremely powerful. (I make my IRA/Roth IRA buys on such days)

End of day readings of below 200 on 25% plus quarter are rare, most of the time 200 readings are reached intra day for few hours or minutes and market rebounds.

So when readings drop to below 500 be on watch out for a reversal of the bearish trend.

25% down quarter

This is a primary indicator

Market is in bullish phase till 25% plus quarter>25% down quarter.

Market is in bearish phase till 25% plus quarter<25% down quarter.

When this number goes below 200 it is bearish. It indicates extreme bullishness.

Readings below 200 are considered extreme readings.

Unlike end of bear market in bull market, markets do not turn immediately after such high readings.

There is a delay of 2 to 6 weeks before real selling might start and a top is formed after readings reach extreme levels

25% plus month and 25% down month

These are secondary indicator.

Readings above 200 tend to be rare.

50% plus month and 50% down month

This is a secondary indicator.

This indicator tells you intermediate term extreme bullish phases and likely pullback/correction points

Readings on 50% plus month above 20 are bearish.

They indicate high bullishness and tend to lead to correction.

Market resumes its bullish move once such high readings drop below 10.

Readings of below 3 are bullish on 50% plus month.

They indicate extreme bearishness.

50% down month indicator tells you intermediate term extreme bearish phases and likely counter trend rally points during bear market.

50% down month readings above 20 indicate high bearishness and tend to lead to reflex rallies.

34/13 bull and 34/13 bear

34/13 is a faster version of 25% plus or down in a quarter.

34/13 bull looks for half of that move in half the time frame.

So it gives buy and sell signal faster compared to Primary indicator.

But it tends to be noisy.

thank you very much for your long and detailed post. I'll study it. Have a nice day

ReplyDeleteThanks a lot for the detailed explanation! Breadth is definitely underrated and your tool is such a great example how to use it!

ReplyDeleteHi Pradeep,

ReplyDeleteWould the code notation C20 be equivalent to Ref(C, -20) for ami i.e the value of C 20 days back from the present day?! TIA n Regards,

Hi Pradeep,

ReplyDeleteWould the code notation C20 be equivalent to Ref(C, -20) for ami i.e the value of C 20 days back from the present day?! TIA n Regards,

Not very familiar with Amibroker. But yes c20 is closing price 20 days ago.

ReplyDeleteThanks Pradeep. You are a very generous person. Can you provide the excel formulas for the Primary Breadth Trend and Second Trend columns please or do you do this manually?

ReplyDeleteit is manually done

ReplyDeleteAre the thresholds for Bull & Bear 3413 same as 25% +/- Quarterly, e.g. 200 and 500?

ReplyDeleteWhat is to be done with the 3413 Diff?

There are no thresholds for them. The 34/13 just adds additional info. I do not really rely on it

ReplyDeleteHow is the Primary Breadth Trend column calculated?

ReplyDeletehttps://stockbee.blogspot.com/2011/08/how-to-use-market-breadth-to-avoid.html

ReplyDeleteWhat is the reason for the +.01 in the quarter calculations? (e.g. MINC65 + .01)

ReplyDeleteit is just a constant added to avoid maths error due to tc2007 bug. now not required

ReplyDeleteAre columns B and C still using the same formulas shown in the "How to use market breadth to avoid market crashes" blog post?

ReplyDeleteFor example, on 11/05/2021 your spreadsheet column B shows 370

When I scan with the formula (100 * (C - C1) / C1) >= 4 AND V >= 1000 AND V > V1

TC2000 returns 504 tickers

Regards,

John

In new versions of tc2000 v>=1000 is 100000 that is why

ReplyDeleteWhat a beauty of data this is...thank you very much for your kindness in sharing this...i began to follow you in twitter and saw one of your twits about this, have come to your blog to read this, amazing...

ReplyDeletethank you...very much.

Dear Pradeep,

ReplyDeleteIs this a typo in your post “When 25% plus quarter number goes below 200 it is extremely bullish. It indicates extreme bearishness.”

Count below 200 should be bearish sign, unlike as stated in this blog. Please advise if my understanding is incorrect

It is bullish as extreme bearishness attracts buyers

ReplyDeletehi Pradeep, thank you for such a wonderful information. A quick question - is the data calculated at the end of the day or during market hours?

ReplyDeleteHi Pradeep, thank you for such a wonderful post. A quick question - is this data calculated at the end of the day or during market hours?

ReplyDeleteHi Pradeep, you mentioned that 'numbers below 200 are considered extreme.' In the case of 5100 odd stocks in the U.S., this comes to about 3.92%. Since there are around 2100 stocks in India, would 4% be a good threshold for identifying extreme bearishness in the Indian market as well?

ReplyDeleteThanks. The pictures in the thread are no longer available. But even without them, it was explained very well.

ReplyDeleteThanks. The pictures in the thread are no longer available. But even without them, it was explained very well.

ReplyDelete