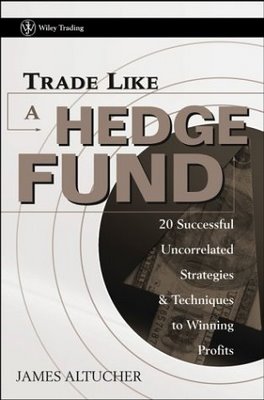

Baron had an article about The Little Book That Beats the Market sometime back. They attribute the superior returns to database selection. Even if you account for the database selection, you can still get market beating returns with the strategy in the book. The concept is still valid and there are number of value managers who show great returns following similar strategy.

The Little Book's Little Flaw

By BILL ALPERT

THE LITTLE BOOK THAT BEATS THE MARKET has become a bestseller since it appeared in November. In it, hedge-fund manager Joel Greenblatt describes a "magic formula" for picking stocks and shows how the formula identified winners when tested on an historical database. The awesome test results helped The Little Book win rave reviews. Stocks selected by Greenblatt's magic formula from 1988 to 2004 would have beaten the market by nearly 20 percentage points annually, he says, with yearly returns averaging almost 31%, versus 12% for the overall market. "It can't be this easy!" he writes."The results are just too good!"

But should you expect to nearly triple the market's performance, working just minutes every few months, if you apply his formula over the long haul? Greenblatt's strategy does make sense and probably would beat the market by some margin. But don't count on

30%-plus: Investment formulas that look great in a historical "back test" often prove less powerful in the real world. Trading commissions and other irksome frictions hurt performance, of course, but there are more fundamental limits to the predictive power of the kind of study The Little Book crows about. Simply put, the magic formula's jumbo returns were probably limited to the data Greenblatt used in his test.

To get a rough sense of how data-specific the magic formula might be, Barron's arranged to test it on a different financial database. From the beginning of 1997 through 2002, The Little Book reports 16% average returns on large-capitalization portfolios chosen from a Compustat database. But on data from Bloomberg,Barron's found, the strategy averaged 10% annual returns in that span. Readers should probably moderate their expectations, therefore, if they plan to use the magic formula on freely available databases -- like that offered at www.smartmoney.com1, the Website of Smart Money (the monthly magazine published by Hearst and Dow Jones, Barron's parent).