Stop flirting from one setup to another.

Stop mixing setup ideas from two different sources.

Stop putting bunch of indicators on a setup.

A good setup is structural in nature.

It takes you months to become good at trading a setup. Unless you are willing to put in that much effort on one setup, you will go nowhere.

In a day or a week or a month if you read blogs or watch videos of traders you will be exposed to many new trading ideas and setups.

With proliferation of blogs, books, forums, Twitter and all kinds of media easily available there is constant temptation to flirt from one trading ideas to another.

You will see charts with different indicators and there you go running after it.

If someone highlights a trade then everyone runs to it.

If some new book comes in everyone gets excited about it.

In the process several things are cursorily tried but no expertise is developed in one type of trading style or setup.

If you see traders who have been around for 10 years plus, you will see that they trade same setup over and over again.

A trading idea or setup is just a idea and unless you think deeply about it and convert it in to process it does not become part of your procedural memory. Your task as a trader is to develop procedural memory. And to develop expertise to execute that setup without any help on your own

If you want to trade say breakout you need to develop procedural memory for trading it.

That would involve your ability to run the entire process involved in breakout trading like scanning, identifying good setup from scans, putting stop, determining position size, determining target, exiting, and so on. This is all part of procedural memory development challenge.

Procedural memory only develops after a considerable amount of doing same thing again and again using same step by step process. By doing that you develop procedural memory which becomes permanent part of your memory.

If you constantly flirt from ideas to ideas you will never develop procedural memory.

Individual trades do not matter. Learn process flows. If you learn process flow you will be able to replicate a trade or understand what is involved in finding a trade.

Once you understand process flow you will be able to build your own process template and make it efficient.

Process orientation is extremely important for developing procedural memory.

Procedural memory is a memory of a procedure. It is stored in your brain as one muscle sequence. In a flash the brain can then recall entire process.

Once you become process oriented the cognitive load will decrease.

Follow traders and people here or anywhere else only if they are transparent about their process flow.

If they can not explain step 1 step 2, step 3 and why it should be done that way you will not learn much.

Developing procedural memory is the key to becoming successful trader. Procedural memory is built through repeated practice.

But before you get to repeated practice you should have right process. Else you become good at wrong process and then you need to erase those procedural memories and rebuilt right procedural memory.

Procedural memories are enduring memories and we do not forget procedural things easily. If you learned to ride a bike as child it becomes permanent part of you.

Same way once you develop a setup specific memories they become permanent part of you.

If you understand that commit yourself to trading only one setup for next 6 month.

Most of the ideas you will see around you in trading are rehash of some few basic ideas like breakout, pullbacks, pivots, mean reversion, breadth, trend following, momentum, growth investing , value investing, contrarian investing .

Take any of these ideas and convert it in to process and trade it for months till it is part of your procedural memory. If you wake up in the middle of the night you should still be able to do the process blindly without thinking.

The way procedural memory works is by embedding a muscle or thinking sequence in your memory. A complex task involving say 25 steps is stored in procedural memory as one unit (schema) and when performing the task it is recalled in an instant.

If you want to make money trading stop chasing setup ideas and marry a setup and perfect it.

Stop flirting from one instrument to another.

Monday stocks

Tuesday Futures

Wednesday Option

Thursday ETF

Friday Forex

If you are constantly flirting from instrument to instrument you will be out of luck by Saturday.

Every instrument has its own characters , volatility, information sources, data sources, specialised brokers, margin requirement .

It will take you months to years to master one single instrument.

If you are constantly flirting from one thing to another thing it is like serial dating . The dinner , drinks, entertainment, and STD bills soon add up.

Commit yourself to one instrument like stocks, options, futures, etf , or forex and spend significant time and effort perfecting trading strategy on it and then put few years of profitable years behind you and then flirt with another instrument.

Stop flirting from one style to another

Monday Day trader using 5 minute charts

Tuesday Scalper

Wednesday Swing Trader

Thursday Position trader

Friday buy and hold

If you keep shifting from one style of trading to another soon you will have no style .

Each style of trading requires skills and can not be picked up on the fly.

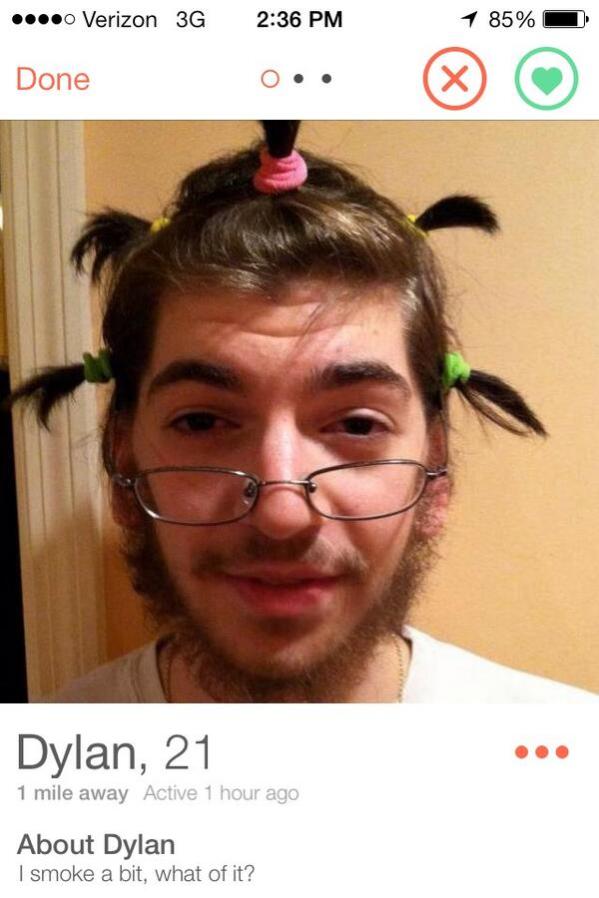

If you are looking for one night stand the stock market is not the place for it. Head to local bar for that or just fire up Tinder, you can find diffrent ass every night.

Significant amount of effort is required to master any style of trading and key decision you need to make before putting that effort is what instrument (stock, futures, options, etf, forex) you want to focus on , then what style you want to focus on.

Realistically speaking if you have full time job then you need to focus on swing trading and position trading .

No comments:

Post a Comment