Identifying a good short term swing trading setup is a skill developed through practice. Once you have a setup concept for discretionary traders trading it requires experience over several hundred trades.

Conditions in the market change continuously and setups need minor tweaks in real time trading.

If you go through 5000 to 10000 old setups and identify good from bad and see what worked and how it worked, you will gain expertise in identifying and trading these setups in real time. On Member site I have been posting daily exercise to identify good setups, entry, exit, profit targets and risk. These exercises help you train your brain to identify good setup from bad setup.

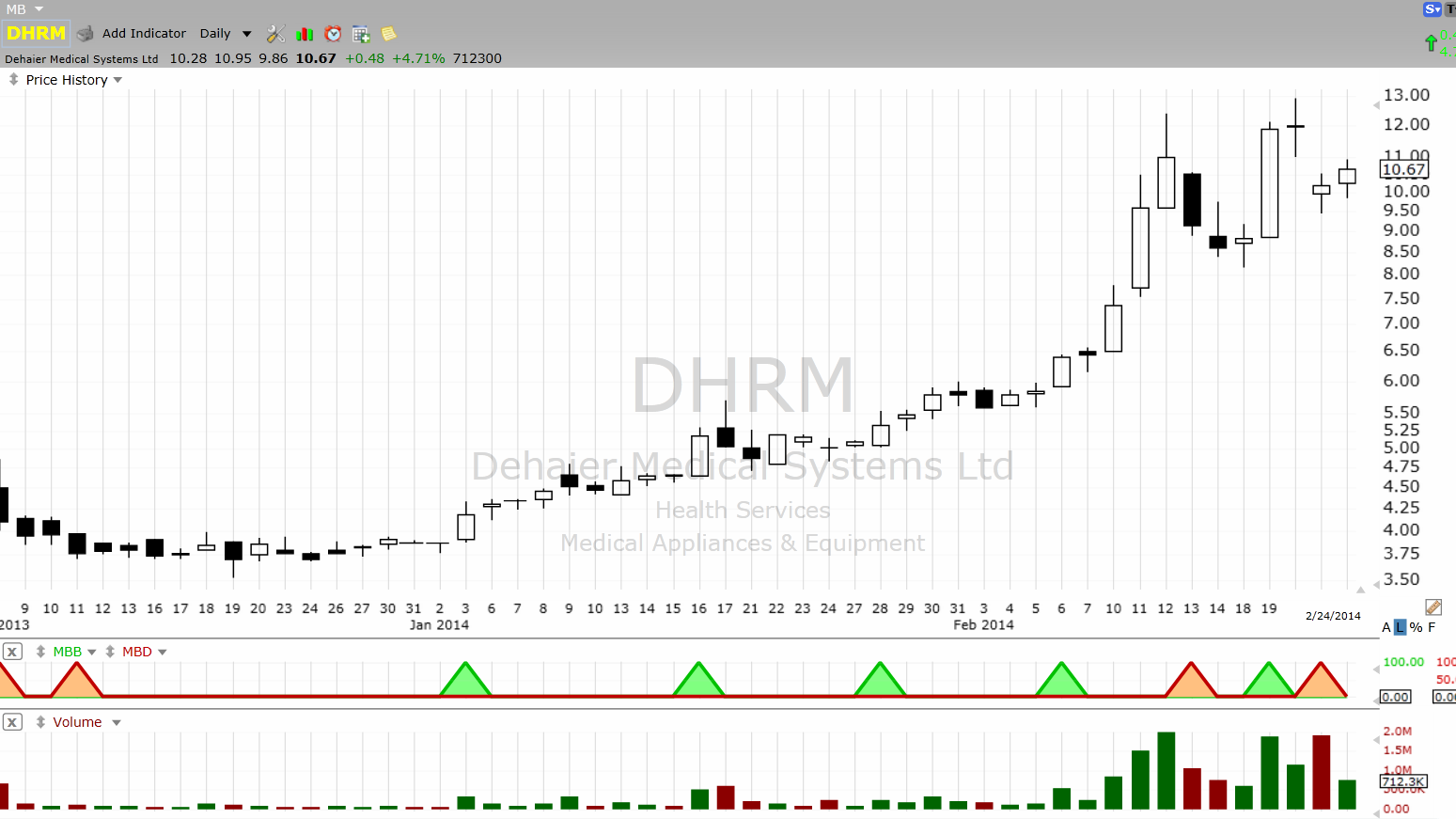

Look at the 5 charts below. I have been writing about momentum burst setup since beginning of the year , if you understood that concept , see if you can apply it to these examples. Try and identify good setups on them. Study what was the pre breakout situations. Study how it acted post breakout. Find out how much % move it made in 3 to 5 days post breakout. Study failed breakout.

Your objective should be to become an expert in this setup. If you do that you can make millions over your trading life time.

Example 1

Example 2

Example 3

Example 4

Example 5

The more you do this better you will become at identifying and trading them in real time. It will also help you identify pre breakout setup. Anticipation of breakout can help you get in to move earlier.

Going through 5000 plus examples of setups like this should be your 3 months goal. If you can do that you will have the setup permanently etched in your memory and you will be able to select good setup instantly.

It will also help you understand where you should exit and put stops.

More than that it will convince you that stocks indeed move in short term momentum bursts and there are 2 ways to trade them, either by anticipating the breakout or by buying on breakout day.

These exercises are posted daily on membership site.

No comments:

Post a Comment