Behind every major move is a earnings acceleration.

The earning season provides you with the ability to identify such stocks.

Stocks react vigorously to earnings acceleration.

After a few quarters of earnings acceleration, every one notices it and the reaction is more muted as the earnings get discounted.

While there is a vast effort by many speculators to anticipate such earnings acceleration and take positions in anticipation, even if you react to earnings and enter after the earnings announcement, you still can catch bulk of the move.

Typically first earnings acceleration is followed by more earnings acceleration or the improved earnings continues.

The structural factors which contribute to earnings acceleration do not disappear in one quarter. That is why earnings trends persist and price trends persist.

When companies announce earnings, if the earnings are significantly better or worse than market/analyst expectations then the company stock goes up or goes down.

This is well documented phenomenon in the market and it is called PEAD or Post Earnings Announcement Drift.

Ball and Brown in 1968 first documented the PEAD anomaly.

As its name suggests, the PEAD is the tendency of stocks that beat earnings expectations to continue to drift upwards after the announcement, or likewise for stocks that miss earnings to continue to drift downwards.

What does the study show. it shows that if you form 10 portfolios of stocks ranked by their earnings surprize then the portfolio of stocks that are in top 10% by earnings surprise outperforms the 9 other portfolio and similarly the bottom decile portfolio under performs the nine other deciles.

This is the most researched topic in financial field. Every year at least 50 new papers are published on PEAD and is persistence.

1989 more research on PEAD

In 1989 a paper was published (Bernard, V. and J. Thomas, 1989, "Post-Earnings-Announcement Drift: Delayed Price Response or Risk Premium." Journal of Accounting Research. Vol 27 Supplement 1989, 1-36) which further enhanced the study of PEAD and demolished much of the objection of efficient market theorist to PEAD.

1989 more research on PEAD

In 1989 a paper was published (Bernard, V. and J. Thomas, 1989, "Post-Earnings-Announcement Drift: Delayed Price Response or Risk Premium." Journal of Accounting Research. Vol 27 Supplement 1989, 1-36) which further enhanced the study of PEAD and demolished much of the objection of efficient market theorist to PEAD.

Bearnard and Thomas work is considered one of the most definitive work in this field.

PEAD generates 6.3% abnormal return in 60 days

As is customary in all finance research designs, the author form deciles based on each event’s standardized unexpected earnings (SUE).

PEAD generates 6.3% abnormal return in 60 days

As is customary in all finance research designs, the author form deciles based on each event’s standardized unexpected earnings (SUE).

This means that the highest decile contains the stocks that beat expectations the most, while the lowest decile contains the stocks that missed estimates by the most.

The authors confirm the results of prior work, namely that going long the highest SUE decile and short the lowest SUE decile would yield abnormal returns of 6.3% in 60 days or 25% annualised.

They also confirm that there is an inverse relationship between firm size and resulting drift.

What you need to know about PEAD

PEAD phenomenon is more pronounced in thinly traded stocks.

What you need to know about PEAD

PEAD phenomenon is more pronounced in thinly traded stocks.

PEAD phenomenon is more pronounced in stocks with no analyst coverage.

PEAD returns persist even after one quarter.

PEAD is more pronounced on stocks with revenue surprise in addition to earnings surprise

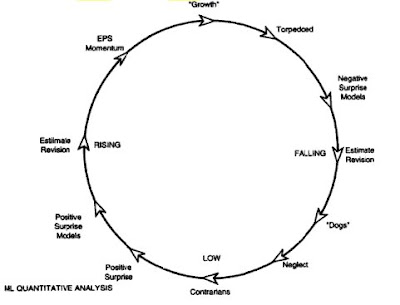

Earnings expectation cycle

Merrill Lynch quantitative strategist Richard Bernstein in his book Style Investing: Unique Insight Into Equity Management

Bernstein's earnings expectations model compares earnings expectations of a typical company on a clock face.

When a company is at its pinnacle in growth term it is at 12.00 midnight. In his book he offers a strategy to identify stocks early enough in their growth cycle.

The idea is to find growth stocks early enough but not to overstay the party.

That is why the name Cinderella strategy- you should not overstay the growth party and must leave the party before midnight.

The strategy basically offers a choice of value investing or growth investing based on how early you identify earnings potential of a stock.

12 to 3

12 o’clock: The company’s earnings are high and expectations are also very high

1 o’clock: Torpedo is a negative earning surprise

3 o’clock: Analysts revise earnings estimates downward. Growth investors abandon the stock.\

This is where short selling strategies work.

3 to 6

4 o’clock: Earnings expectations continue to fall dramatically.

6 o’clock: At some stage earnings expectations reach their low point. At this point most of the bad news is priced in. Expectations are at lowest level. Contrarian investors focus here.

6 to 9

6 o'clock:This is where value investors focus. Value investors want to buy stocks neglected by market but which have the potential to surprise on earnings front. They want to buy it before the earning surprise. One of the risk of value approach is if you buy too early, you have to wait a long time.

7 o’clock: Stock has a positive earnings surprise. If it is a genuine turnaround there will be more surprises down the line.

9 o’clock: Market starts to recognize the stock and its earning potential.

9 to 12

This is where primarily growth investors focus. They want companies that have exhibited consistent earnings growth over several quarters. They pay premium for such stocks as the stock has already moved from low expectations to high. The value investors pass on these stocks to growth investors during this transition phase. The risk of growth investing is overstaying the party beyond midnight.

11 o’clock: Everyone becomes aware of the company.

12 o’clock: Earnings and earnings expectations reach peak.

The CANSLIM strategy primarily operates in the 9 to 12 quadrant.

That is one of the reason many of the stocks on IBD 100 can break down also after appearing in the list.

Earnings lead breakouts operates primarily in the 6 to 9 quadrant.

Building a mix of earnings based strategies in the 6 to 12'o clock time frame gives you best of both worlds.

Mark Minervini's SEPA

If you go to Mark Minervini's site and look at his SEPA model, he illustrates this fact with a picture. This model is very similar to Bernstein's model.

![[minervini.jpg]](http://4.bp.blogspot.com/_xHfnIRO0T_Y/RpY29BNnbOI/AAAAAAAAAgM/vhGtnOZbihM/s1600/minervini.jpg)

Mark Minervini's SEPA model

Earnings surprise and neglect are two essential elements to finding the big movers.

Every earnings season these two things come together to create mispriced opportunities.

If you want to profit from that then look for big earnings surprises.

If you want to profit from that then look for big earnings surprises.

2 comments:

how do you calculate "earnings acceleration"?

When earnings growth rate increases above the normal growth rate it is earnings acceleration. For example a company which was growing EPS at say 20% rate q over q has earnings growth of 60% then the earnings has accelerated.

Post a Comment