mrstrader said...

I would like to clarify how YOU handle gaps and I will use MBLX purely as an example. I bought on Monday at about 21. Lucky for me some guy on CNBC hawked it and it gapped up as high as 25.9 yesterday. Stopped out today using the 5% loss rule. Prior to coming to your sight I would have held because the chart still looks good to me but I figured I'd give your system a go. At what point would you reenter, a new high or a 2% move? Thanks

Apr 26, 2007 9:29:00 PM

Mrstrader please see my earlier post Why you should not trade any of the ideas discussed here

I do not know what stops you used and why. My stops are at 2 days low before entry day. So here is MBLX chart with entry and stops, as I see them and trade them. Current trailing stop is 22.43 as it made 20% plus move post entry.

JS said...

VDSI surged some 27% today. It is up 153% in 1 year. Would you consider today's surge (due to earnings) a EP, and trade the stock even though it has gone up considerably? Or would you wait for a pull back? Was this stock picked up on an earlier date by your scan and if so, would that scan have been a better entry point?

Apr 26, 2007 9:04:00 PM

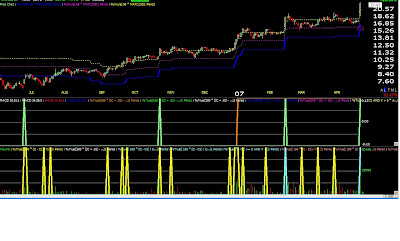

VDSI is up 225% in 260 days. The yellow spikes show 4% plus signal. Green and Light Blue show Episodic Pivots. Earlier entry points were better. It was an earnings trade 3-4 quarters ago when it doubled its earning and has gone up since then.VDSI was on IBD 200 for long periods of time in last one year and offered entry points then. IBD 200 stocks have lower price growth than 100% plus universe. So some of the good earnings candidates come from it.

3 comments:

Got it. Thanks. You just reinforced my confidence. Great site keep up the good work. I was in on DBTK yesterday and will try and handle that correctly

re MBLX, what do you mean exactly with 'signal day'?

thanks

Signal day is based on my scan

( 100 * (C - C1) / C1) >= 4 AND V >= 1000 AND V > V1

Now in case of MBLX it also came in on the same day in my other Episodic Scan (EP)

EP has 5 bullish scans it came in one of them by afternoon

( 100 * (C - C1) / C1) >= 10 AND V > 1000 AND C >= 5

Plus it had 16 million float, was a recent IPO (which tend to do well post EP break)

So I bought on the same day in afternoon.

The yellow spike indicates the stock satisfied the first condition, green indicates it satisfied EP scan conditions.

Post a Comment