Why I look at float for every stock

For the new traders confused by the float discussion this post might answer some questions.

Float is the number of shares actually available for trading in the open market. To understand float you need to understand authorised shares, treasury shares, outstanding shares and restricted shares.

Authorized shares are total number of shares authorized by shareholders. Companies do not issue all authorized shares and retain some in treasury. Which are called treasury shares. The issued shares constitutes outstanding shares. The shares issued to insiders, favored parties, employees are typical the restricted shares, which have certain restriction in terms of ownership and when and how they can be sold. Float is the number of shares after restricted shares are removed from the outstanding shares.

e.g

Let up take a hypothetical company Trader Mike Inc. which derives its income from trading, advertising, sponsorships and strategic investments in start ups.

Authorized shares= 25 million

Treasury shares= 5 million

Outstanding shares= 20 million

Restricted shares= 10 million

Float= 10 million

Why is float important, because it impacts supply and demand. As a general rule low float companies are more volatile and make extreme moves in either direction on good or bad news.

If you want to gun for high returns, looking at low float companies with excellent earnings is one way. As more institutional players want to own them, a small float makes them difficult to accumulate. This is what leads to them making significant moves. e.g. GROW which was one of the best performer stock last year has a float of only 6 million. That also after a 2:1 split in beginning of year.AXR another stock which made 500% plus move last year has a float of 1.8 million. MWRK which was another 400% plus mover had 5.6 million float.

Similarly if you study stocks which have made major moves, you will typically find stocks with low float dominating the list. Now there was an aberration during the dot com boom where new IPO's came out with higher floats and sometime went up many fold, but as we all know that was irrational exuberance.

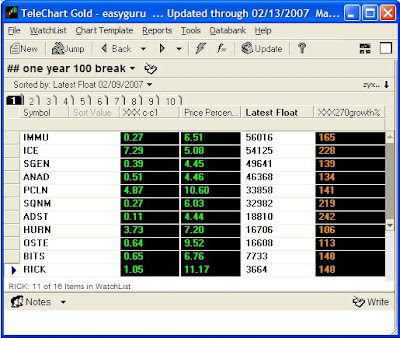

Lets look at some recent data from my trading universe and scans:

Out of 80 Stocks up 200% plus from low in 260 days there is only 1 stock which has 100 million plus float, CHTR, Charter Communications Inc.

Out of 338 stocks up 100% plus in 260 days from low there are only 16 stocks with 100 million plus float.

Out of 81 stocks up 25% plus in a month there are only 3 stocks with 100 million plus float.

Only 73 stocks out of 862 stocks up 25% or more in this quarter has 100 million plus float.

Now I have this data for number of years and has studied it in great details. My findings are no different from anyone else who has studied the data, in most periods low float stocks significantly outperform high float stocks if they have a catalyst like earnings. Now that is another advantage for average speculators against the big speculators who by virtue of their size cannot focus on low float stocks.

Obviously if you are very short term trader all that matters to you is liquidity and range. So for day traders stocks with high float and large range like GOOG are very good and you can make lots of money just trading day in and day out that one stock. But as a general rule if you are long or intermediate term trader and if you want to improve your returns significantly , pay close attention to float.

21 comments:

I like the headline today "Daktronics Decimated". I like it because I don't own it. I just feel bad for people that bought this stock on IBD hype. After missing the numbers 2 quarters ago and then today I don't think I would own this stock again.. Some people will probably buy today because they think it's cheap here but it's still way to expensive!

I was wondering about market cap and how it relates to float. For example , ABC might be priced at $100 a share with a 1 million float. XYZ might be priced at $10 with 5 million float, but it's market cap would be half of the size in terms of market cap. Have you compared market cap to float to see which is more volatile or successful?

Market cap is arrived at by taking the stock price and multiplying it by the total number of shares outstanding not float.

65 Trader

There are circumstances where oustanding shares are high but float is low like in many IPO's.Or the practice of stock options creates more shares outstanding but float remains same, till the restricted shares get released for trading which in many cases might be after months or years. So float is more relevant information in my opinion.

Does that answer your question.

Hi

Would you know what the float is on TKO and would you post it?

Thank you!

TKO float 50 million.

Thanks Pradeep!

Thank you!

Are you saying just the float is 50M for TKO?

Authorized shares= ? million

Treasury shares= ? million

Outstanding shares= ? million

Restricted shares= ? million

Float= 50 million

According to my data provider Telechart the float is 50 million.

Yahoo Finance says

Shares Outstanding:56.85M

Float:46.07M

Now if you see different data sources you will get different figures for example Reuters says:

Shares Outstanding (Mil)56.85

Float (Mil)50.1

Why this happens is because of frequency with which data is updated.

As to finding out authorized shares, you have to look at SEC or EDGAR filings or company web sites. Most of the time compay websites also do not show authorized shares they just give outstanding shares figures.

Wow, thank you!

It would be fascinating to see how the number of 100 & 200% plus gainers varies with the float. Could you get the figures you were giving over/under a 100 mil float (260 day time frame) for over/under dividing lines of say 50 mil, 25 mil, and 10 or less mil also? You could then plot a rough chart of these large gainers' behavior versus float - it would probably go hyperbolic as you approached a zero float.

397 stocks with 100% plus move float distribution.

Total Stocks= 397

100 million += 20

50 to 100= 48

25 to 50= 73

25 to 10= 120

less than 10= 135

Pradeep

Can you tell me if the amount of shares short or % of float consisting of short shares has any significant effect on stock performance?

thx Mike

It is bullish.

Pradeep

can you see the float of the UK equities on Yahoo finance? Or do you know of any other source?

Thank you

KN

http://money.uk.msn.com/investing/

Has float information for UK companies.

Have you done any research on shares outstanding and volume traded for the last month or quarter?

Pradeep I apologize for getting back to this subject, ( I also admire your patience..)

I went to http://money.uk.msn.com/investing/ and a share I own is GKN so the no of shares outstanding is 704.19 mil, where does one go to see the float on this?

I appreciate your time and effort

All the best

KN

697.20 million is the float on GKN. Try Reuters UK, it has better data.

As to your earlier question, the float study is not monthly. Float influencing supply demand is known fact. So monthly studies are not going to help much.

Ahh thank you very much.

Post a Comment